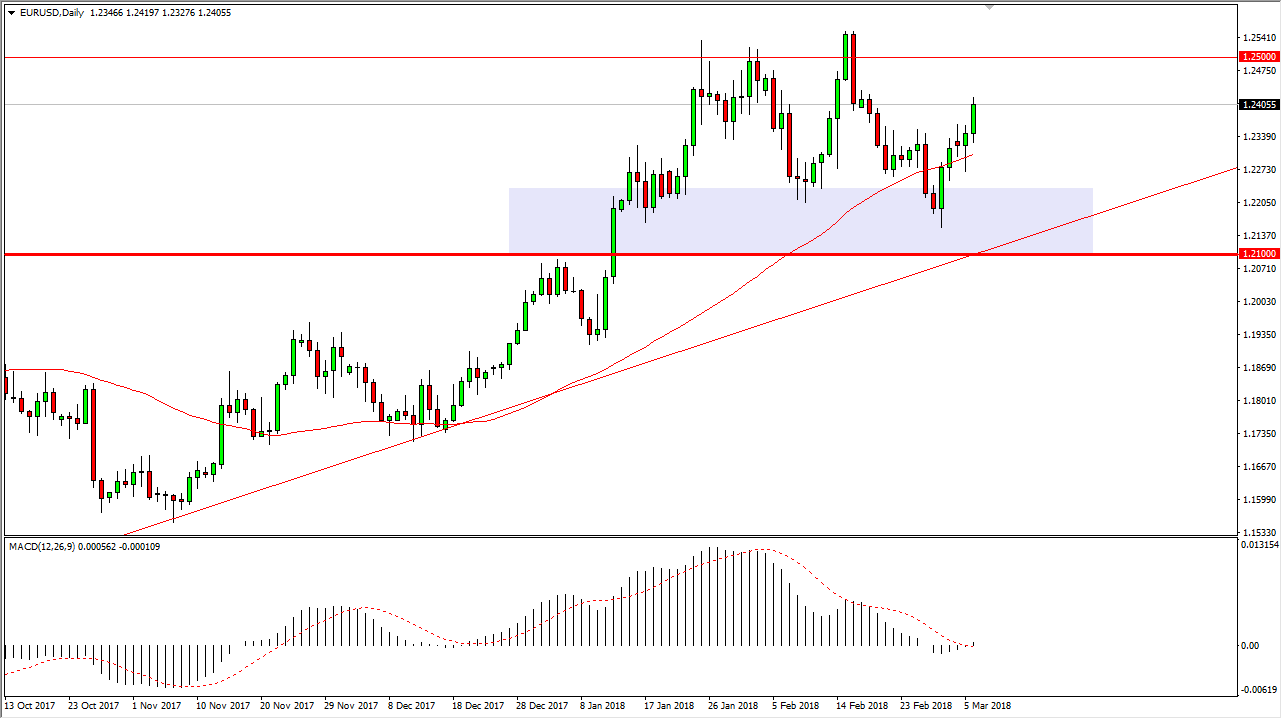

EUR/USD

The Euro rallied during the day on Tuesday after initially pulling back, but the hammer that formed on Monday had already given us an idea that we are ready to break out to the upside. The 50-day exponential moving average underneath should continue to offer dynamic support as well as it seems all but a given that we are going to reach towards the 1.25 handle above. That’s an area where we have seen a bit of resistance, but I think eventually we do break above there. I like the idea of buying short-term pullbacks in this market, as it appears that we had formed a significant base in the market, and I believe that the buyers are coming back overall. However, a lot of this will depend on whether trade war talk escalates or not, right now it doesn’t look as if it well, so traders are willing to get involved and serve buying.

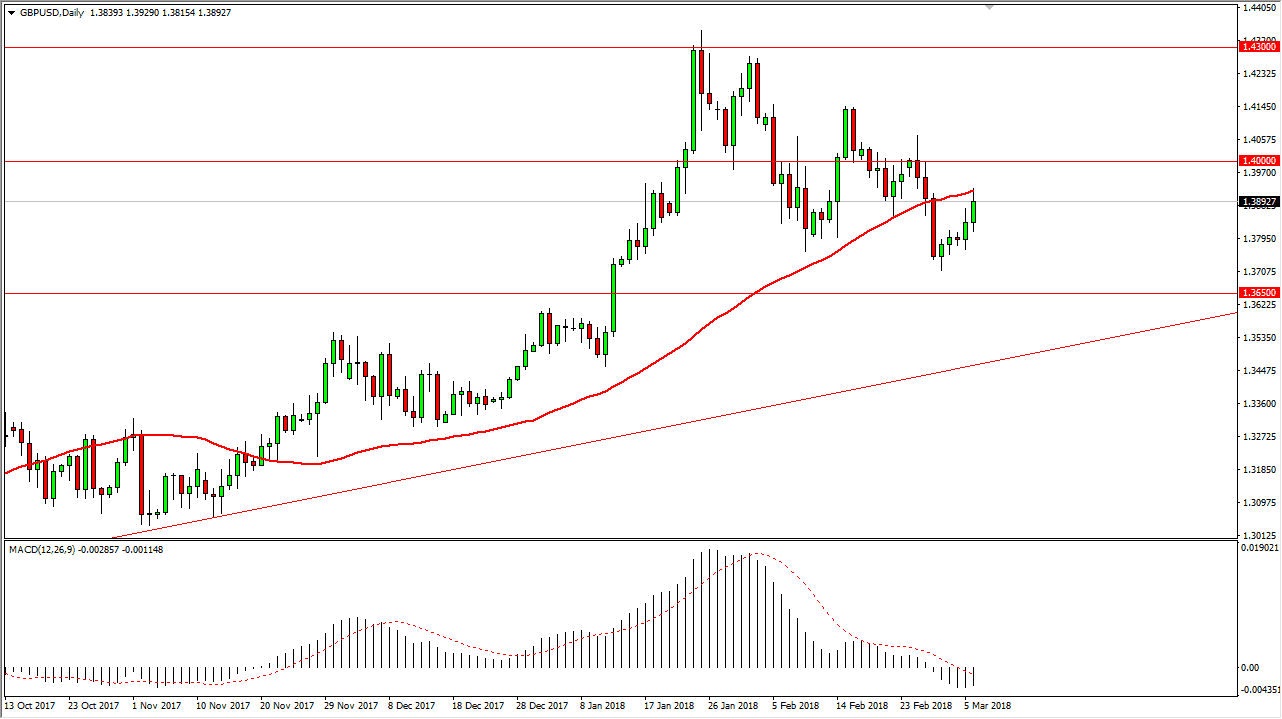

GBP/USD

The British pound initially pulled back a bit during the Tuesday session, but rallied to reach towards the 50-day EMA. That’s a good sign, but we also pulled back from there, so I think we may get a little bit of a pullback in the short term, only to reach towards the 1.40 level above. If we can clear that area on a daily close, then the market continues to go higher, reaching towards the 1.43 level above which was the most recent high. A break above that level census market much higher, perhaps even the 1.45 level. The 1.3650 level underneath is massive support, and I think that the market is a “buy only” situation until we break down below that level. Remember, there’s a bit of risk sensitivity in this currency pair, so if we can continue to get good news coming out of the geopolitical situation, that should drive this pair higher.