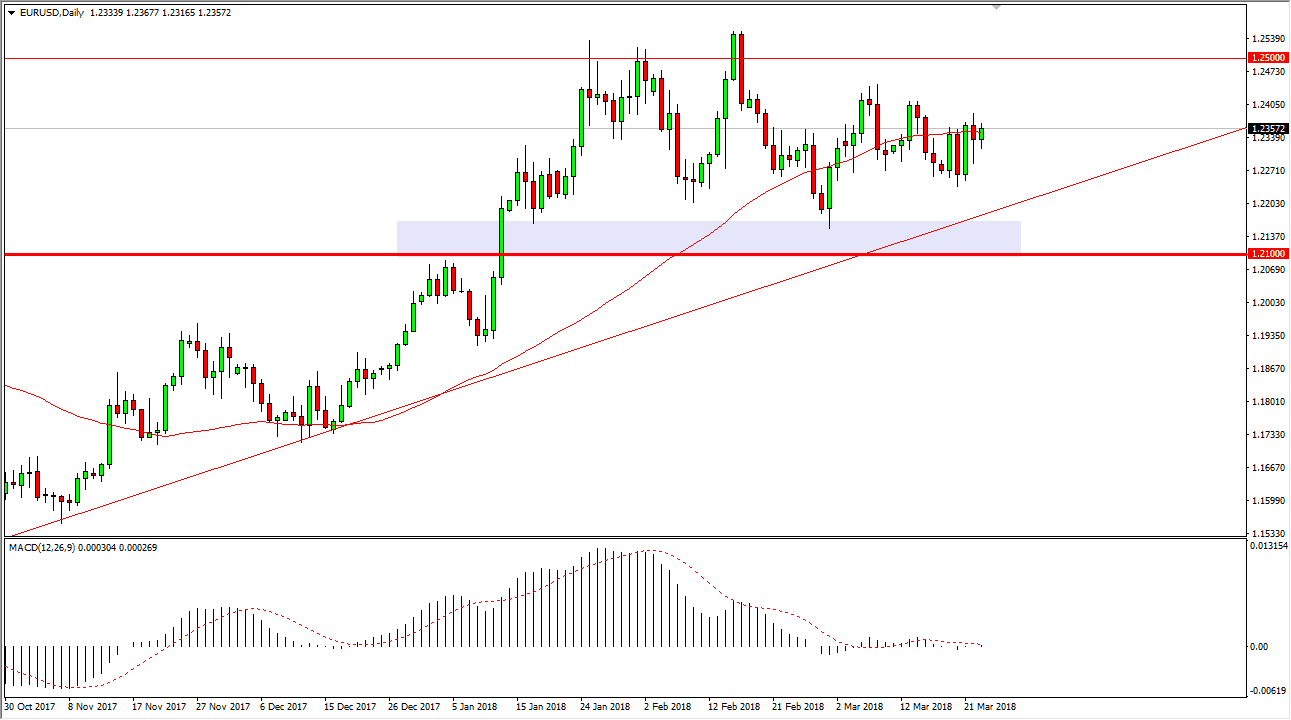

EUR/USD

The EUR/USD pair pulled back slightly at the beginning of the session on Friday but turned around to show signs of support again. Ultimately, this is a market that I think continues to grind sideways in general, as there are a lot of concerns around the world. The German economic numbers recently haven’t been that strong, but at the same time we have a concern about trade wars coming out of both the United States and China, and with that being the case there is a lot of fear in general. I believe that ultimately, the pair will continue to go higher, if we can stay above the uptrend line that I have marked on the daily chart, as well as the 1.21 level underneath. The 1.25 level is the target, and then eventually breaking above there would open the door to the 1.32 handle based upon longer-term charts.

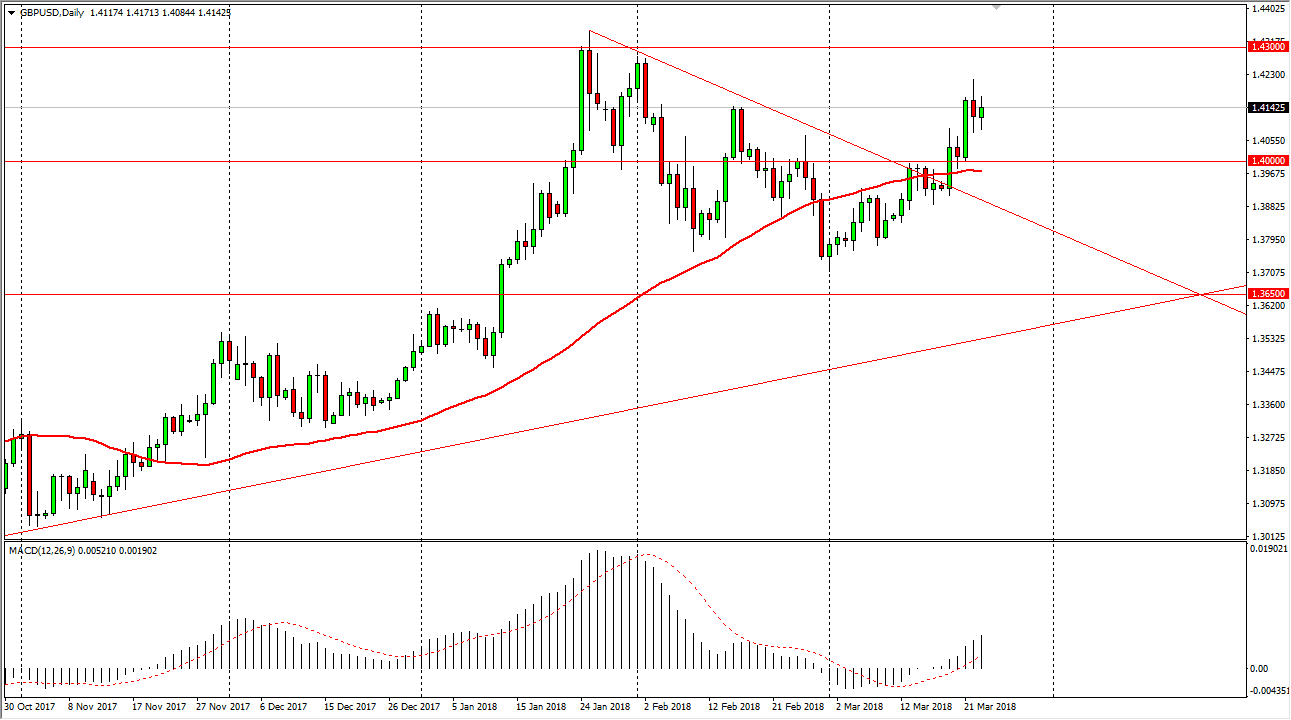

GBP/USD

The British pound went back and forth during the trading session on Friday, but still looks reasonably supported, and I think that the 1.40 level continues to offer significant support. I think that given enough time, we will go to the 1.43 level again. The 50-day EMA underneath continues to offer support as well, so I think that buying the dips continues to be the best way to play the British pound. The Bank of England have suggested that they were going to start raising interest rates this summer, and that has people trying to front run that move. Although it might be volatile, I think that continues to be a market that offers value occasionally, and those who are prudent will patiently await signs of support underneath.