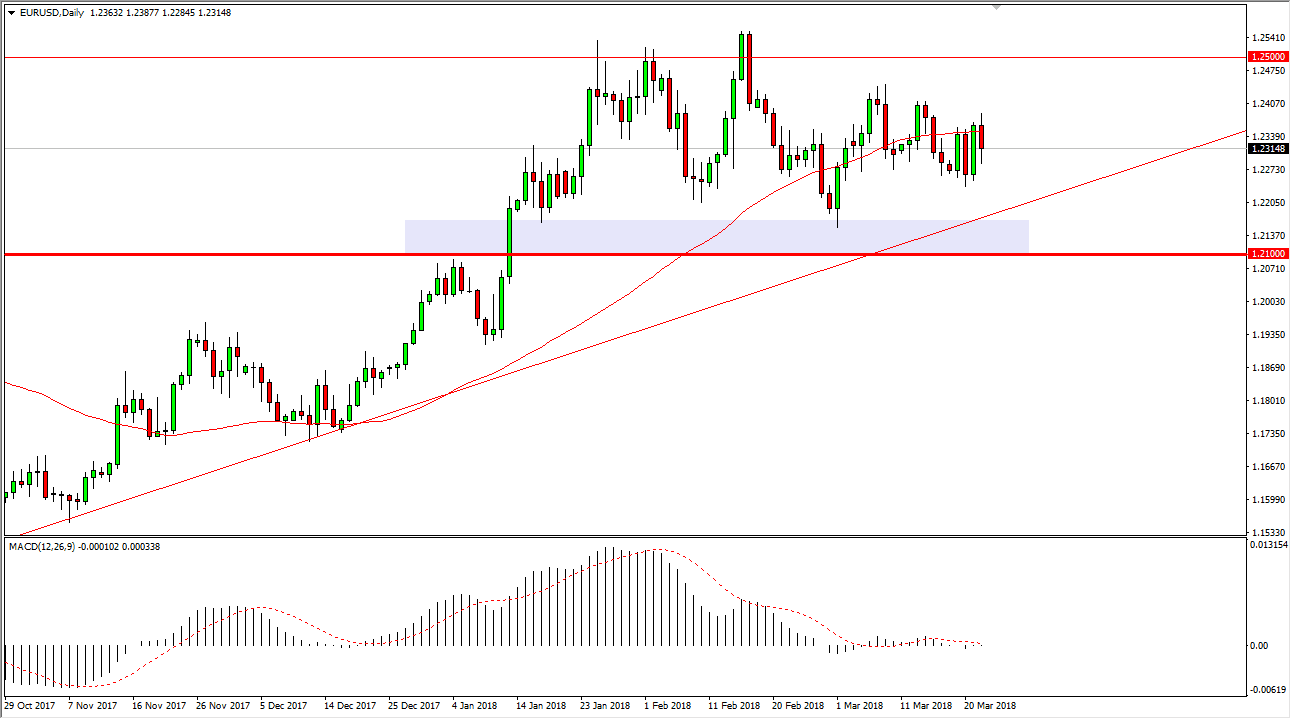

EUR/USD

The EUR/USD pair fell initially during trading on Thursday, reaching down towards the 1.2275 level, but then bounced later. The market has been very choppy, as there are a lot of concerns about trade wars flaring up between the United States and China, which of course has a “knock on effect” around the world. The market in the EUR/USD pair seems to be sideways more than anything else, and I think at this point short-term pullback should offer buying opportunities. The uptrend line is still very much in effect, just as the massive support level at the 1.21 handle. I believe that the 1.25 level will be targeted eventually, and we can break above there the market should be free to go much higher. However, right now looks like we have more sideways trading than anything else, with perhaps a slightly upward proclivity.

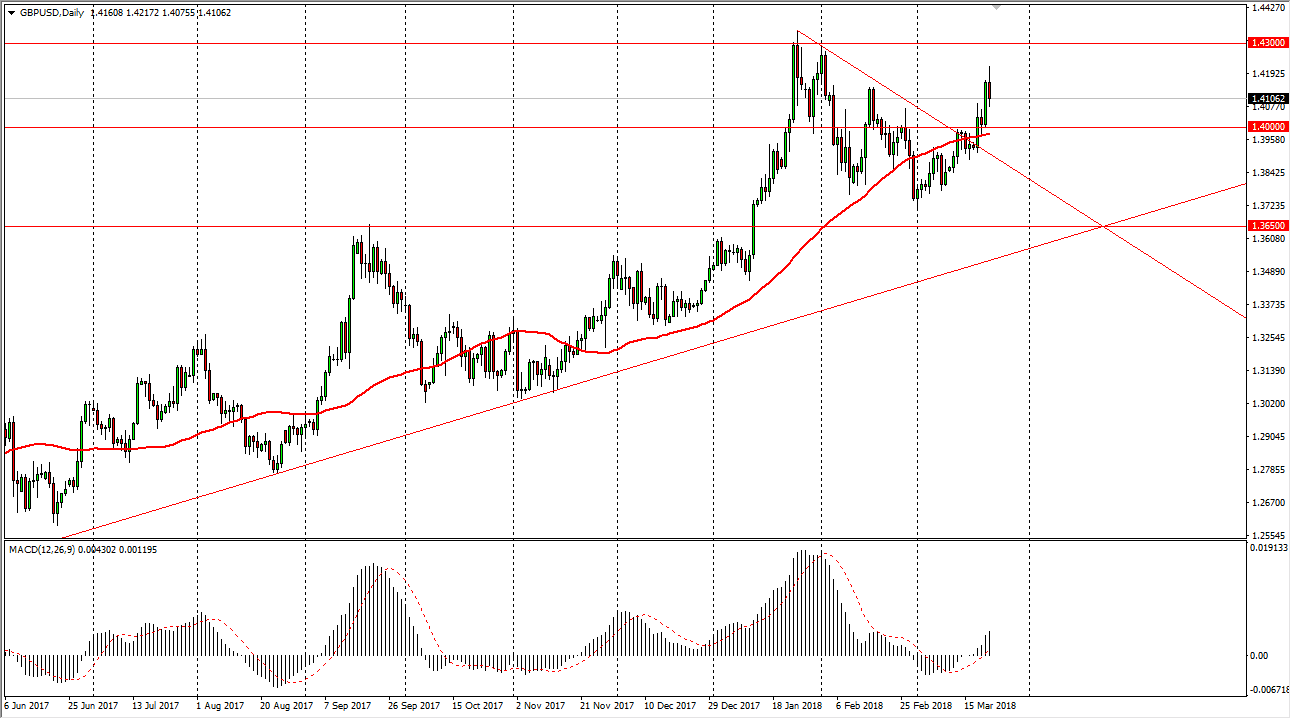

GBP/USD

The British pound initially tried to rally during the session on Thursday, but then rolled over to reach back towards the 1.41 level. The 1.40 level underneath is even more supportive though, so I think that a short-term pullback could offer an opportunity to go long. I think that the market would then extend to the 1.43 level after that. I also recognize the previous downtrend line as being potential support, just as the 50-day EMA is just below. In fact, I don’t have any interest in shorting the British pound as the Bank of England suggested that an interest rate hike is still in the cards in May, and I think that traders will continue to look to the British pound to go higher. If we can break above the 1.43 level, the market then goes to the 1.45 handle.