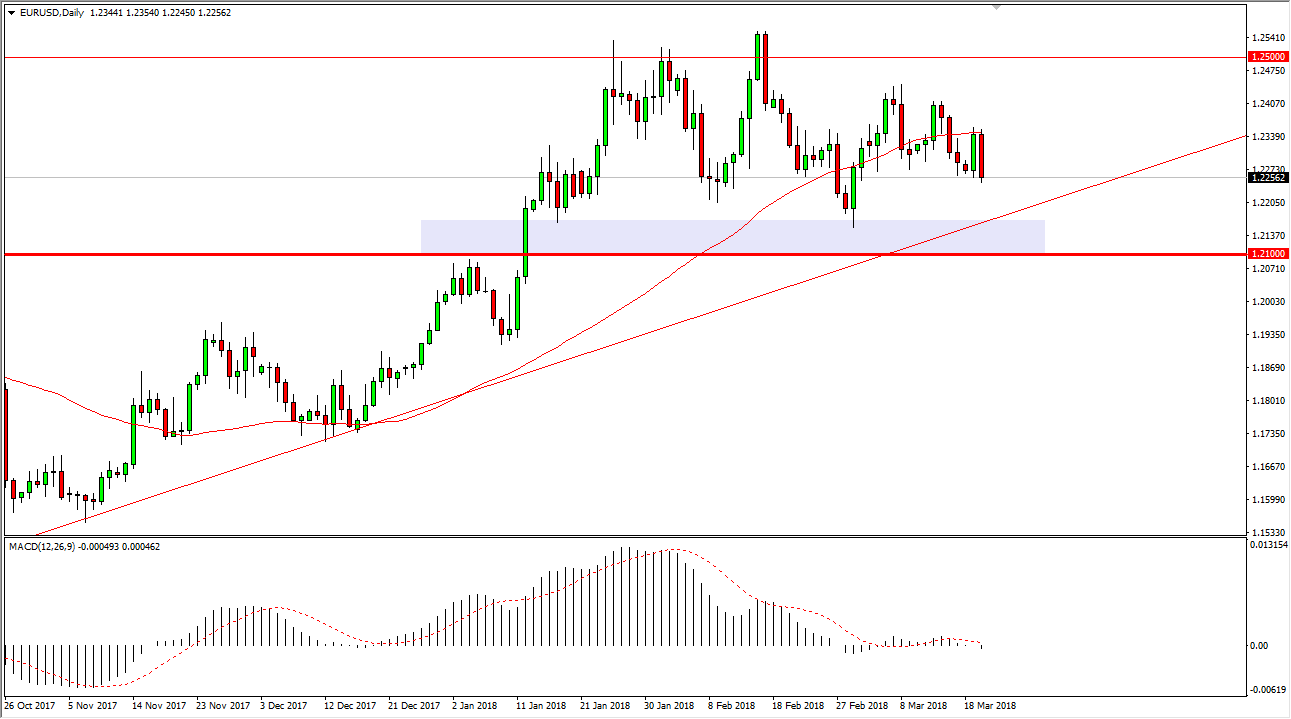

EUR/USD

The EUR/USD pair has fallen during the trading session on Tuesday, as we continue to bounce around and just above the 1.2250 level. There is an obvious uptrend line underneath it should continue to get the market somewhat buoyant, and of course the purple box on the chart at the 1.21 level also highlights a significant support level. I think that we will find buyers underneath, but with today being the day that the Federal Reserve has a news conference after the statement, you can bet the traders are starting to look at whether the Federal Reserve is going to raise interest rates 3 or 4 times this year. If they look likely to only raise 3 times, then the market should continue to go higher. If it’s 4, we will more than likely see some type of pullback and test of that support underneath.

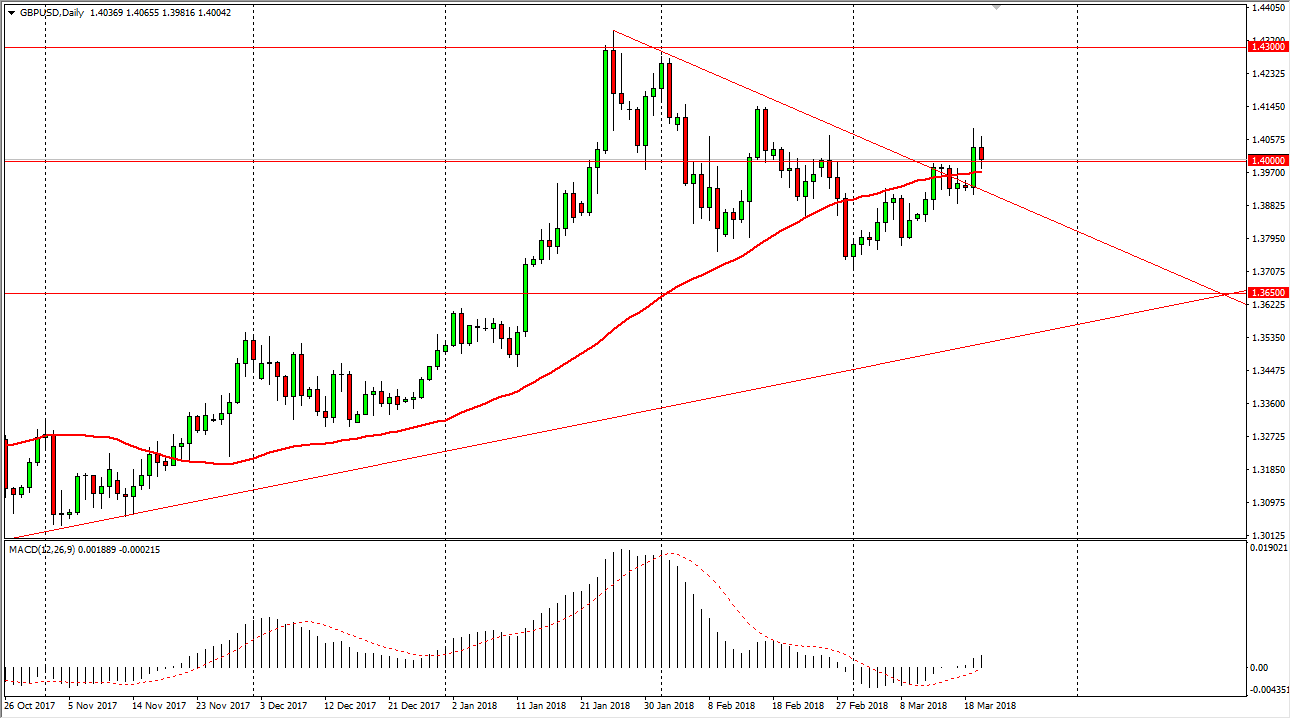

GBP/USD

The British pound has gone back and forth during the trading session on Tuesday, bouncing around the 1.40 level. The market found support underneath, not only under the 1.40 level, but also the 50-day EMA. I think that the market should continue to go higher, but until we get the Federal Reserve news conference out of the way, it might be rather choppy and quiet. Ultimately, I think that the market then goes to the 1.43 level, perhaps even higher than that. If we pull back from here, the previous downtrend line should offer support, as it was previous resistance. If we do break down below there, the market could unwind towards the 1.38 level, and then perhaps the 1.3650 level after that. I anticipate seeing a lot of noise in this market, but the uptrend is still in effect at this point.