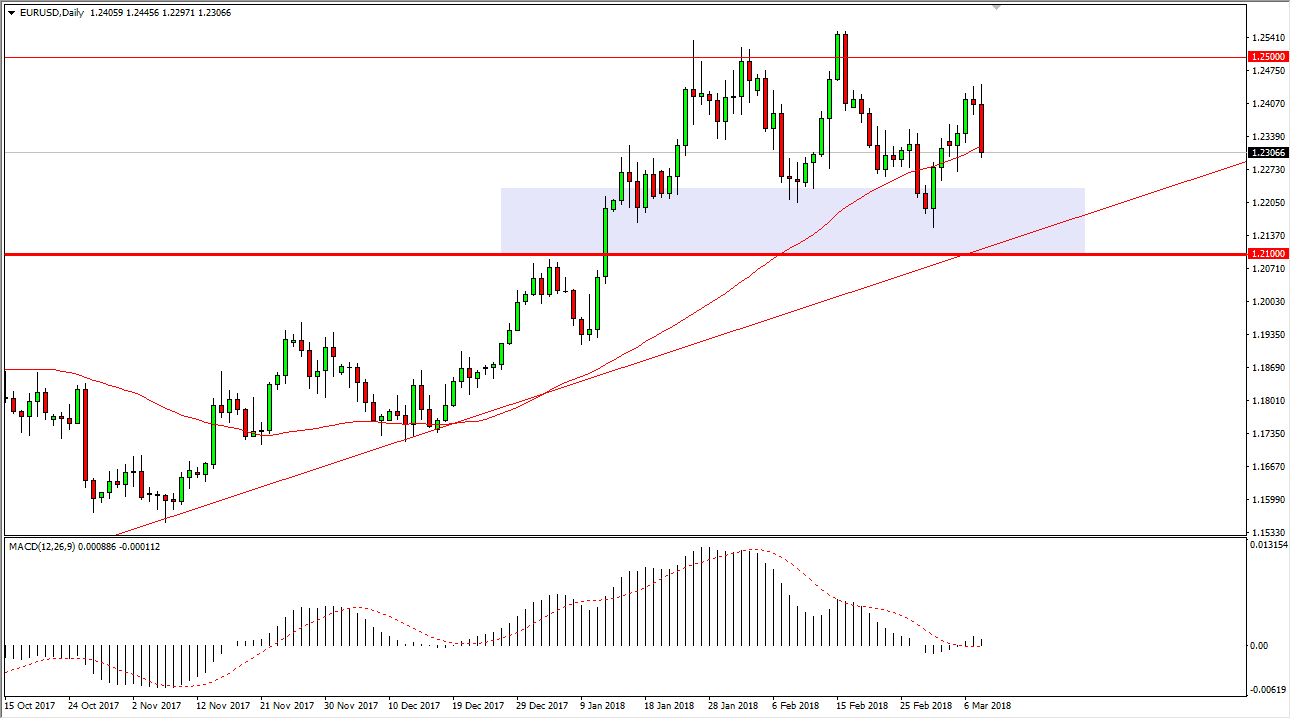

EUR/USD

The EUR/USD pair initially rally during the trading session on Thursday, but then rolled over rather drastically as the ECB policy statement suggested that perhaps we may see less quantitative easing, but that isn’t coming soon. The market had anticipated that the ECB was going to start tightening relatively soon, and this has put that into down. As we roll over into the Friday session, we now start to pay attention to jobs numbers in the United States, so we may get a complete reversal if those numbers get more of a “risk on” attitude going in the market. You’ll notice that there is an uptrend line underneath that the 1.21 handle, as well as significant horizontal support. I believe that eventually, the buyers will come back into this market place, picking up value. However, if we were to break down below that level, it would change everything and send this market much lower.

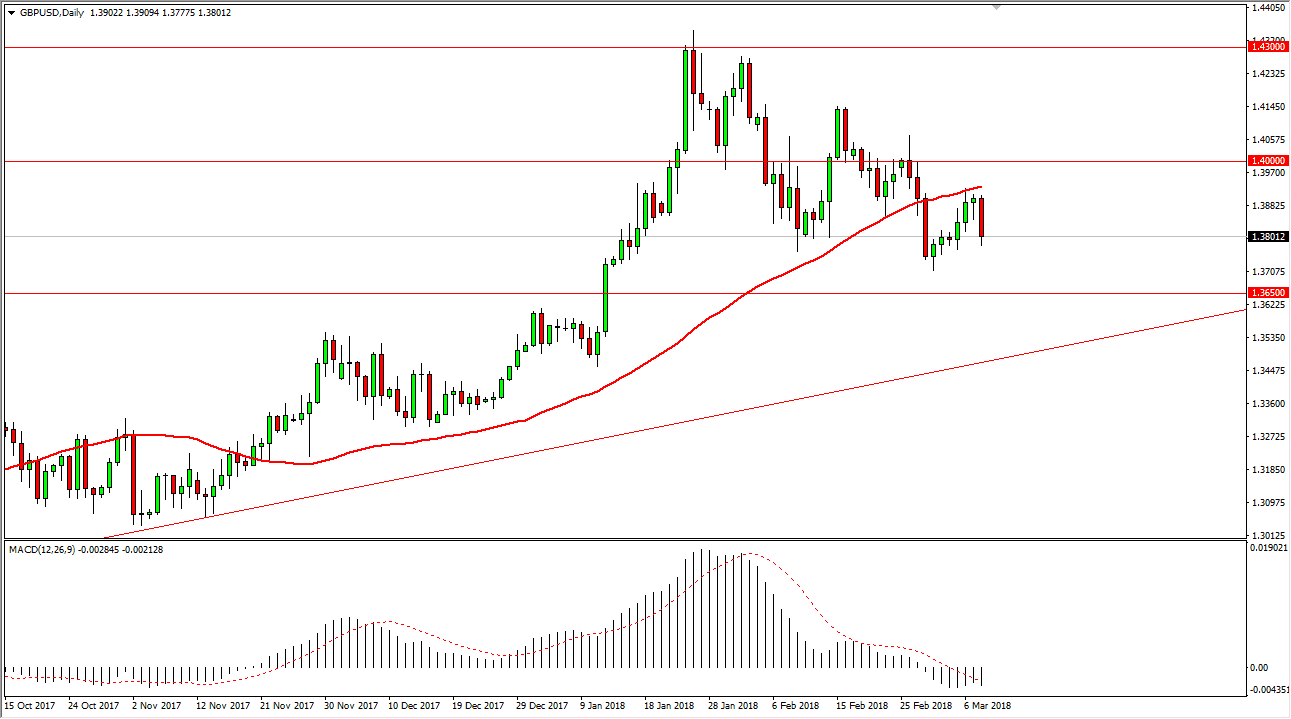

GBP/USD

The British pound also rolled over, breaking the back of the hammer from the previous session, causing it to turn into a “hanging man.” That of course is a very negative sign, and it’s likely that we will drop from here, perhaps reaching down to the 1.3750 level next, and then testing the 1.3650 level after that. You’ll notice that I have a significant uptrend line on the daily chart that’s far below there, so I think it’s only a matter of time before the buyers come back, but we may see some weakness over the next several sessions. However, the jobs number comes out today and that of course can change everything. Longer-term, I still think that the buyers are in control, but we certainly are struggling to pick up upward momentum.