BTC/USD

Bitcoin fell significantly during trading during the session on Wednesday, slicing through the $10,000 level. There have been reports of multiple hacks, especially in third-party tools that are used on certain exchanges. Because of this, fear ruled the day and we felt as quickly as we possibly could. It looks likely that the markets are going to test the $9300 level, and if we break down below that level I believe that Bitcoin may make a round-trip, perhaps to the $8000 level, and with a little bit of momentum down to the $6600 level. As far as buying is concerned, I would need to see a certain amount of bullish pressure or at the very least some type of stability on the daily chart. Currently, I don’t think it’s worth the risk.

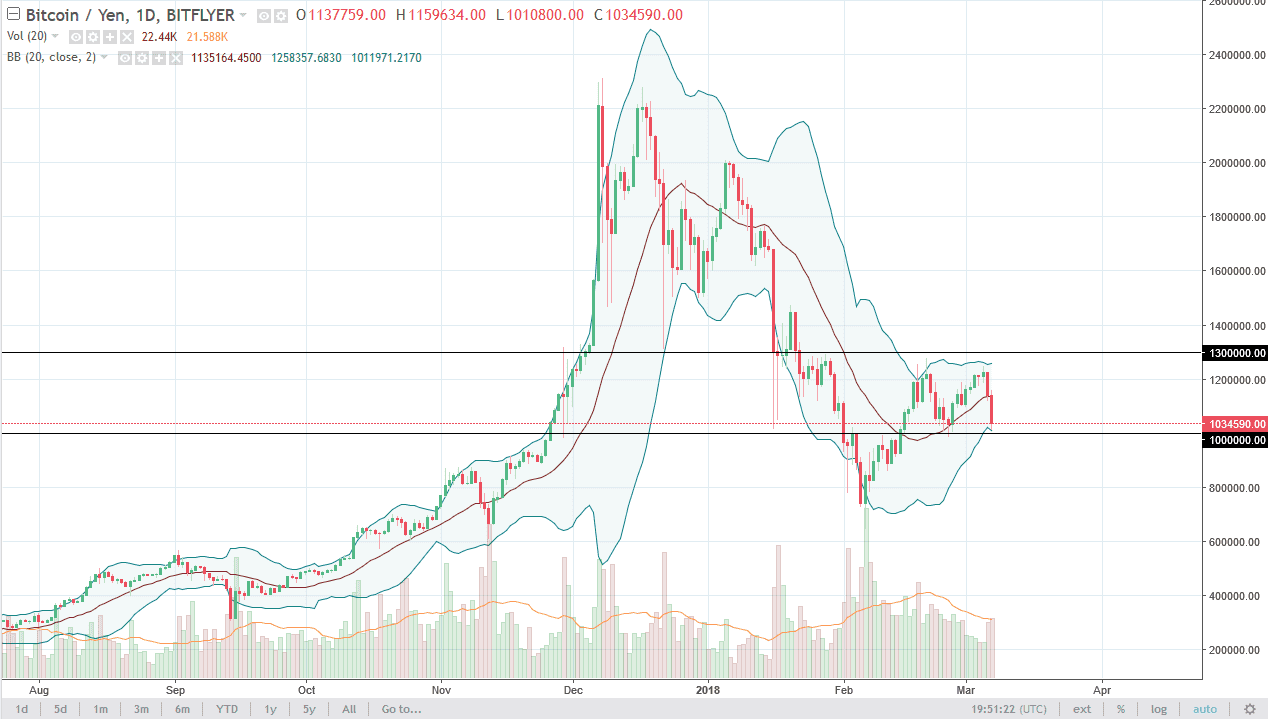

BTC/JPY

Bitcoin traders also sold off against the Japanese yen, testing the ¥1 million level. This is an area that is going to be very supportive based upon not only structural support, but also the psychological significance of the level. If we were to break down below the ¥1 million level, I think the market unwinds to the ¥800,000 level, and the fact that we are closing so close to the bottom of the candle suggests to me that we will see a bit of continuation. Even if we bounce from here, we are still at the best in consolidation, at least not until we break above the ¥1.3 million level, which has been very resistive. I believe that longer-term traders are starting to get a little bit nervous, as quite frankly they should be as we do not have the confidence in this market to continue to go higher in the long term, at least not yet.