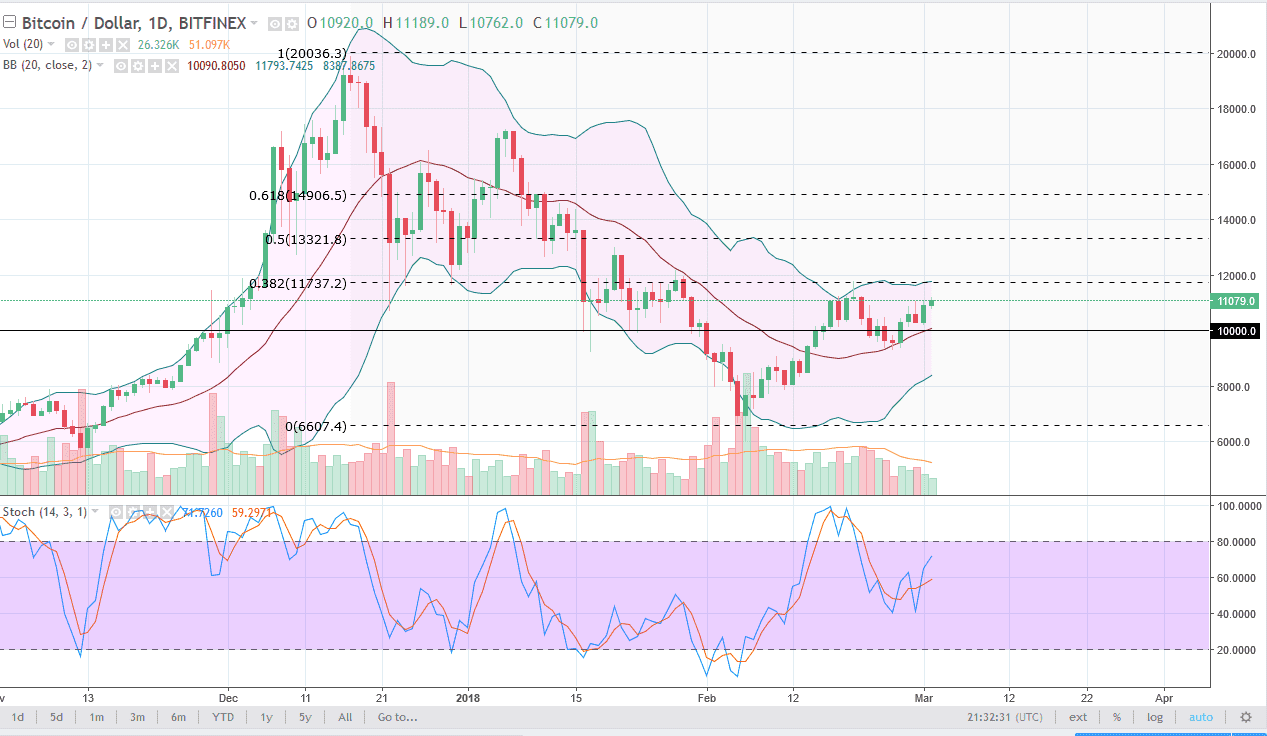

BTC/USD

Bitcoin markets when higher on Friday, reaching towards the $11,050 level. The market has rallied a little over 1.2%, and I believe that the market still has a lot of noise to chew through between here and $12,000 at the least, so it’s not until we break above there that I am comfortable buying. I do believe that a break above there should send the market looking towards the $14,000 level though, and ultimately, I think that the market would go even higher from a longer-term perspective. The meantime, I think we are susceptible to short-term pullbacks, as we consolidate between $9400 and $12,000 overall. I believe that the market will eventually make a move to the upside, but right now with the lack of volume it would not surprise me at all to see the market continue to base a bit.

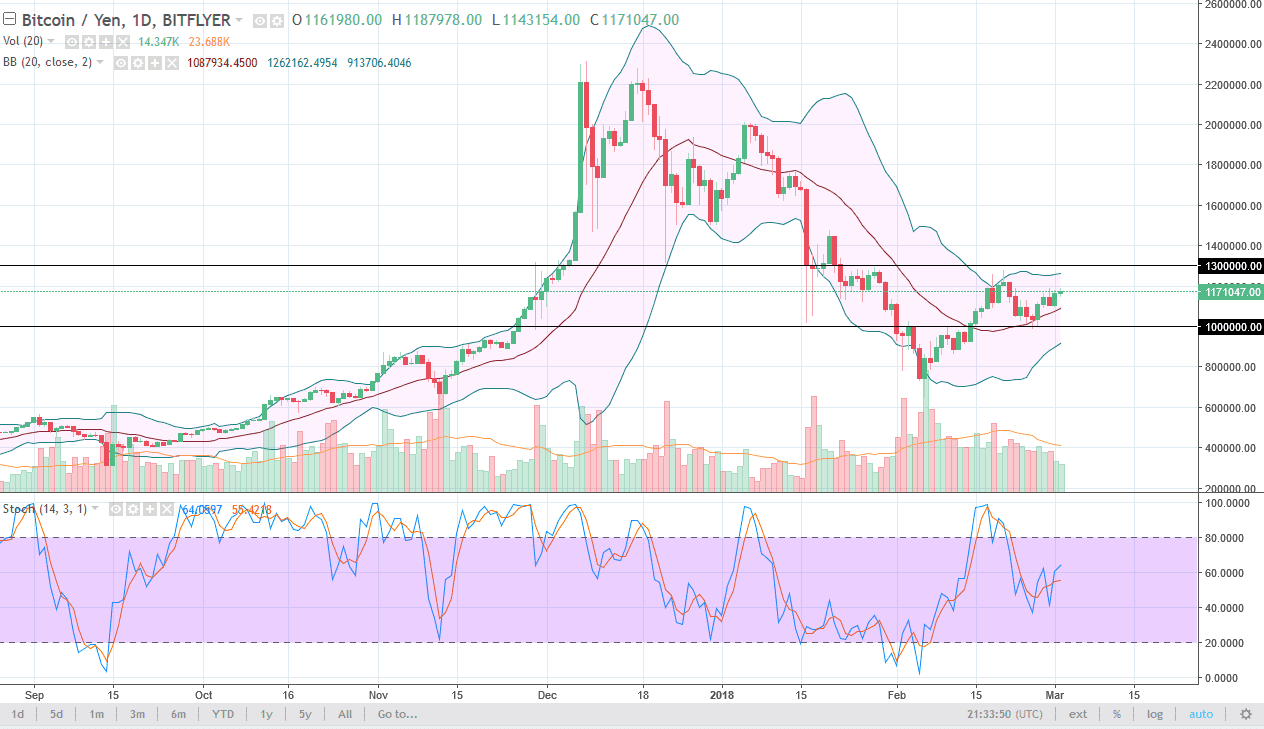

BTC/JPY

Bitcoin also rallied against the Japanese yen during the day on Friday, as we continue to hang about. The ¥1 million level underneath is the support base, while the ¥1.3 million level above is resistance. If we can break above the ¥1.3 million level, the market could continue to go much higher, perhaps reaching towards the ¥1.5 million level and beyond. However, I think in the short term we will probably continue to see a lot of noise, so don’t be surprised at all that the market simply grinds away over the next several sessions. I think if we break below the ¥1 million level, that would be very negative, just as the move above the ¥1.3 million would be very positive. I believe we are trying to make a decision for the longer-term move, but currently I think it favors the upside, the question is now when can we do it?