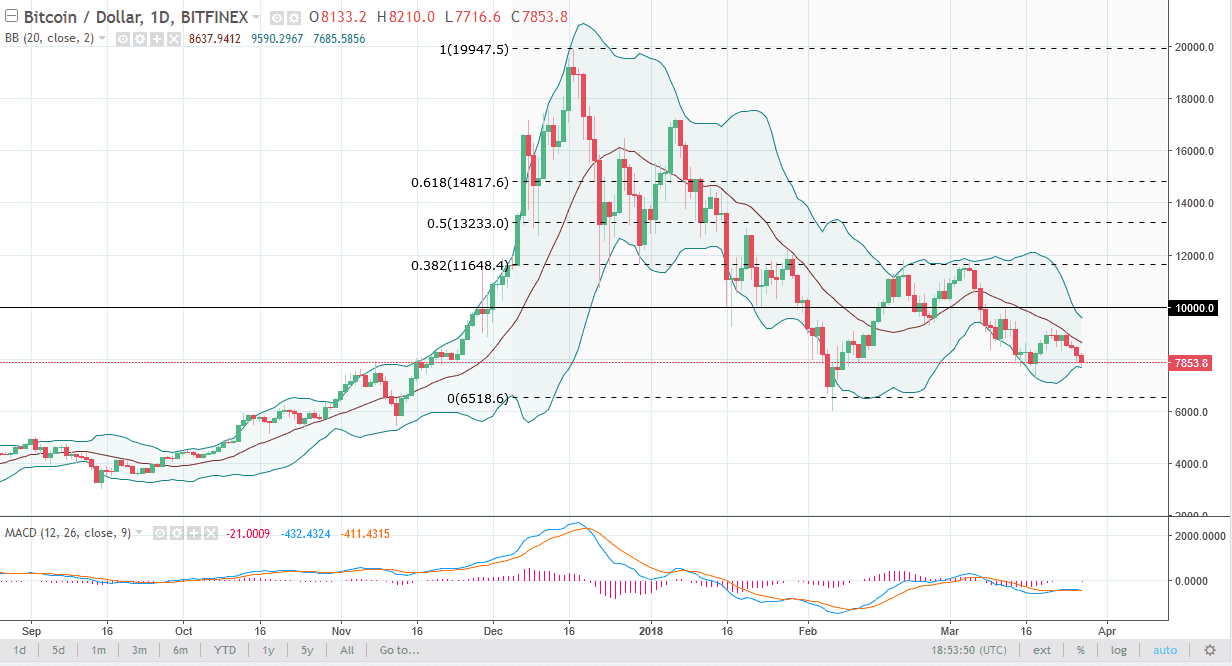

BTC/USD

Bitcoin fell again against the US dollar, losing 3% during the trading session on the Tuesday, it looks as if the market is trying to find some type of bottom, but clearly has not yet. I believe that the market is probably going to continue to find sellers on rallies, so that is probably going to be the best way to trade Bitcoin, selling any signs of exhaustion’s after a bounce. I believe that there is much more significant support closer to the $6500 level and would not be surprised to see this market test that area. So far, the $7000 level has offered a bit of support, but I think it’s only a matter of time before we break down through there. As far as buying is concerned, we would need to close above $10,000 on a daily chart for me to be convinced of even attempting that move.

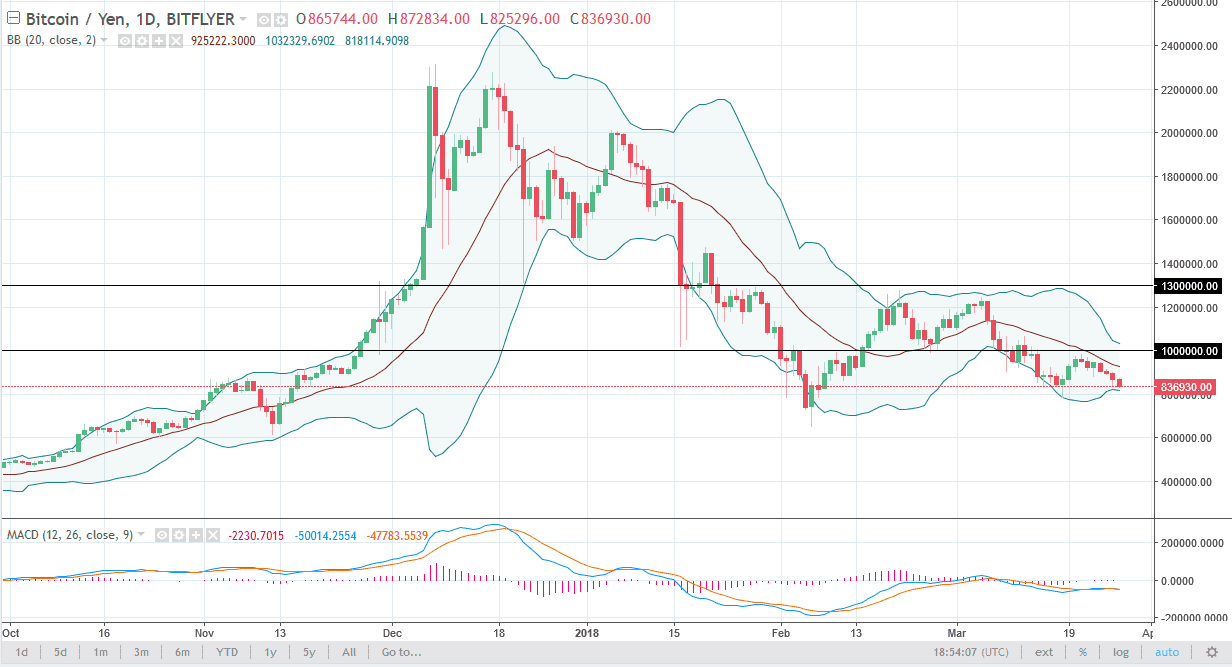

BTC/JPY

Bitcoin also fell against the Japanese yen, which isn’t much of a surprise considering how much strength there was in the Japanese yen during late trading in New York. The ¥800,000 level is going to be targeted next, followed by the ¥650,000 level and so on. Rallies at this point should continue to be selling opportunities, at least until we break above the ¥1.1 million level, which I see as the top of the resistance barrier above. If we did break there, I think that the market would probably go looking towards the ¥1.3 million level after that. Ultimately, this is a market that continues to show signs of negativity every time we rally, and therefore I think exhaustion is to be taken advantage of as Bitcoin is clearly very negative. If we can break down below the ¥650,000 level, we probably go down to ¥500,000 next.