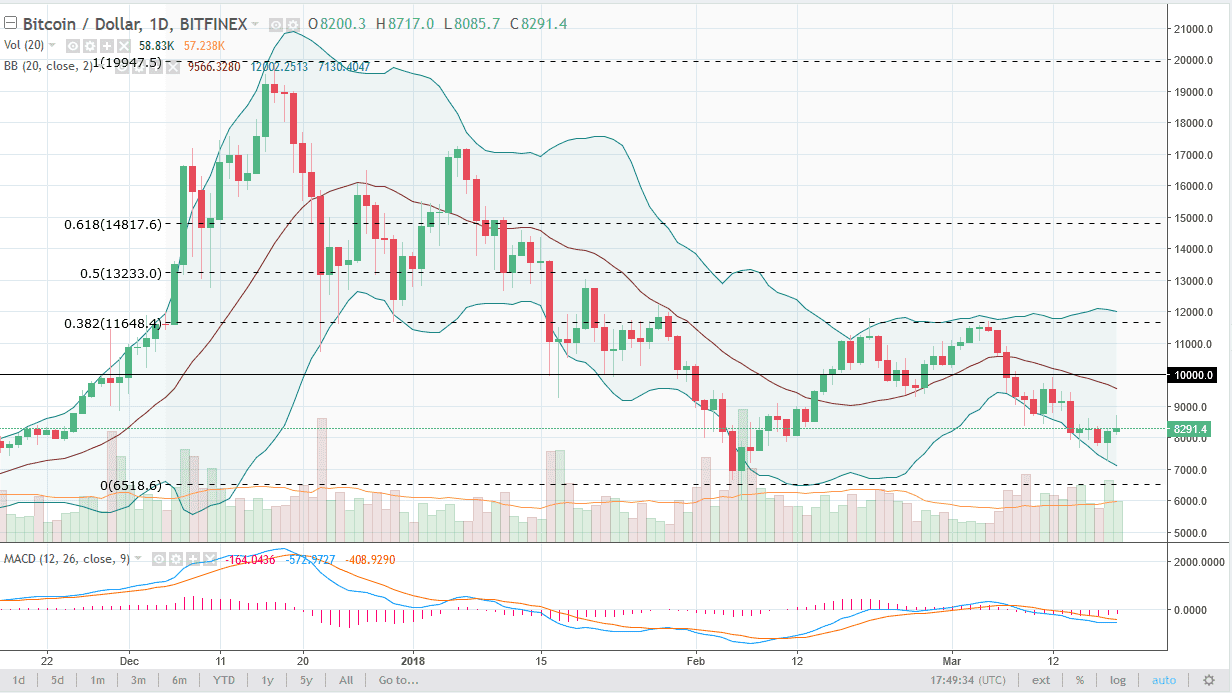

BTC/USD

Well, Bitcoin tried to rally during the day on Monday, but as you can see is starting to roll over already. At some point, it looks as if we will continue to see selling pressure every time we rally, so I think that the market will eventually try to break down to a fresh, new low, perhaps reaching towards the February level near the $7000 level. If we break down below there, we could eventually wipe out the lows from February and continue to go much lower, reaching towards the thousand dollars first, and then eventually $4000. At this point, Bitcoin looks dead in the water, especially considering that the US dollar has been strengthening. Crypto currency markets are losing a lot of interest, as the retail traders have left. The question now is whether the institutional traders will stay. If they do, this will become just another currency market, as the 20% moves in just a few hours will be a thing of the past, unless of course we melt down.

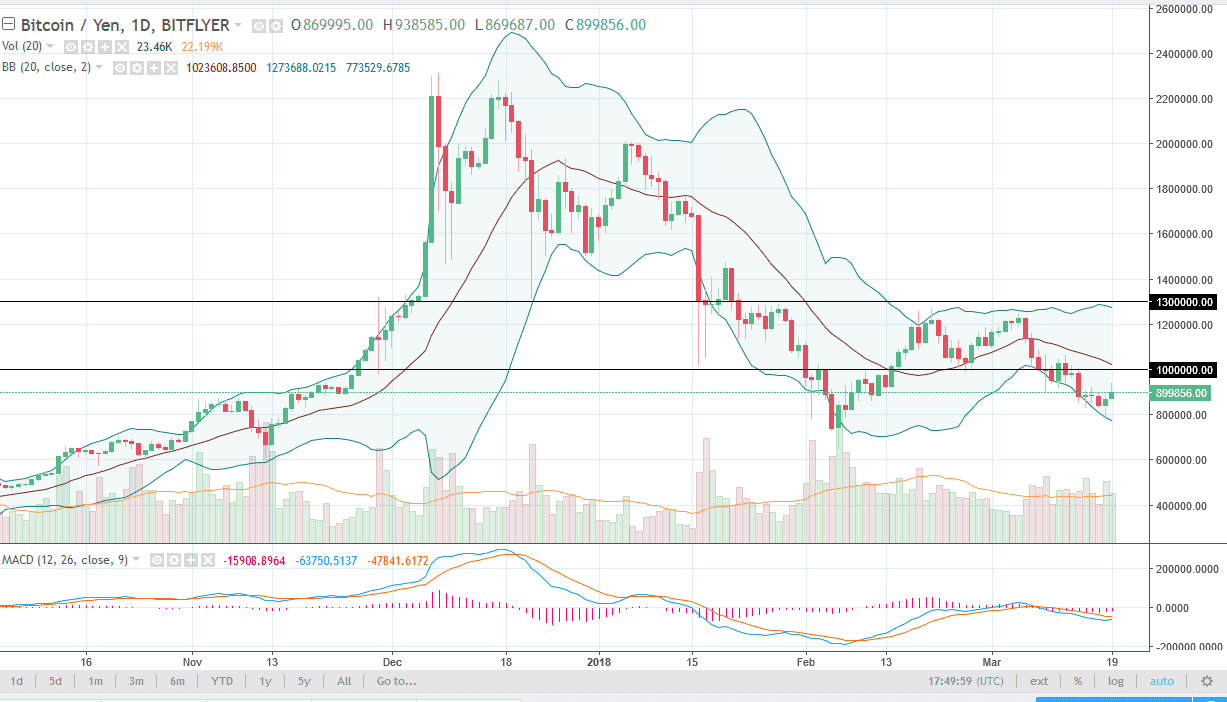

BTC/JPY

Bitcoin tried to rally against the Japanese yen during the day and did keep some of the gains over here. However, the most important thing on this chart to pay attention to in my estimation as the ¥1.1 million level. If the ¥1.1 million level gets broken to the upside, then I think we go looking towards the ¥1.3 million level beyond that. Alternately, if we break down below the ¥800,000 level, I think we will test the lows from February again, and then break down significantly to reach towards ¥600,000 and below. At this point, if we break above the ¥1.3 million level, then it will change the trend to the upside, but I don’t think it’s going to happen anytime soon, and I suspect that we will continue to see Bitcoin weakness in both pairs.