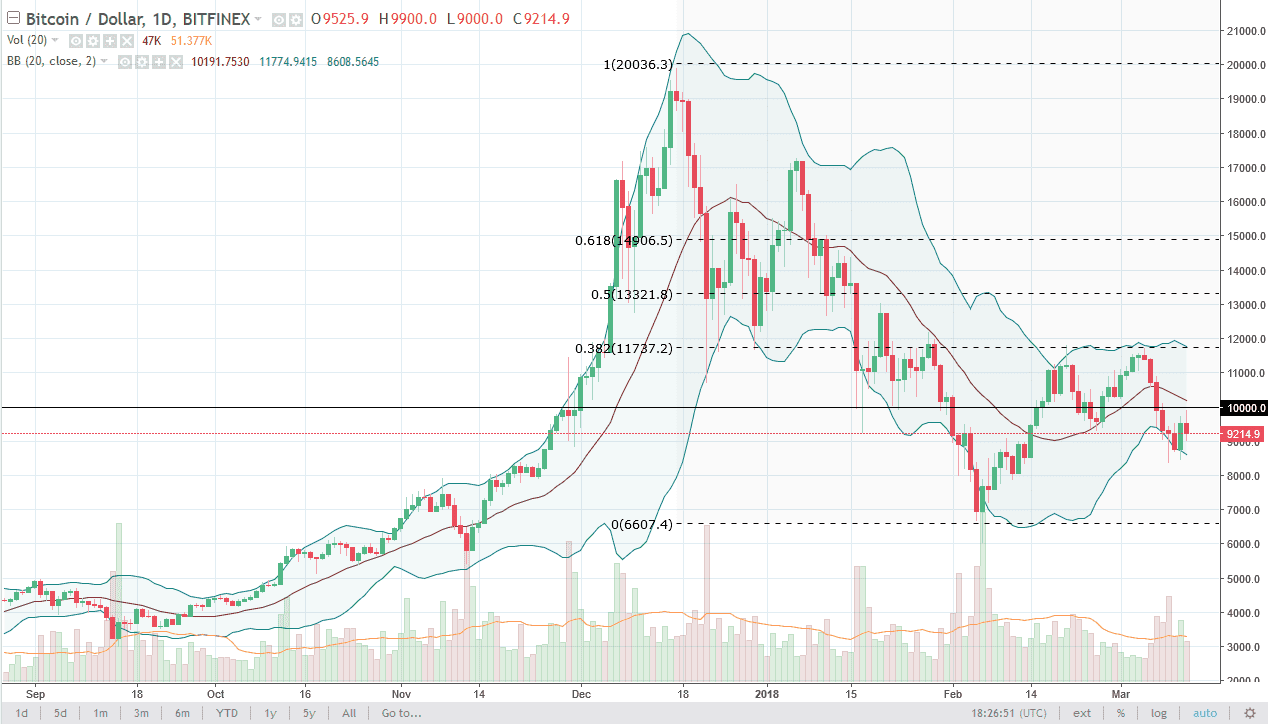

BTC/USD

Bitcoin initially tried to rally during the trading session on Monday but found the $10,000 level to be far too resistive to continue going higher. Because of this, it looks as if the market is ready to roll over as we are forming a bit of a shooting star. I believe that given enough time, the market probably goes down to the $8500 level again, an area that has been supportive recently. Otherwise, if we break above the $10,000 level, it is possible that we will continue to go higher, perhaps reaching towards the $12,000 level again. Expect volatility, but the fact that we have rolled over leads even more negative validity to the market before the sellers return. Ultimately, I would not be surprised at all to see this market break down below $8500 and go even lower, perhaps down to the $7000 handle.

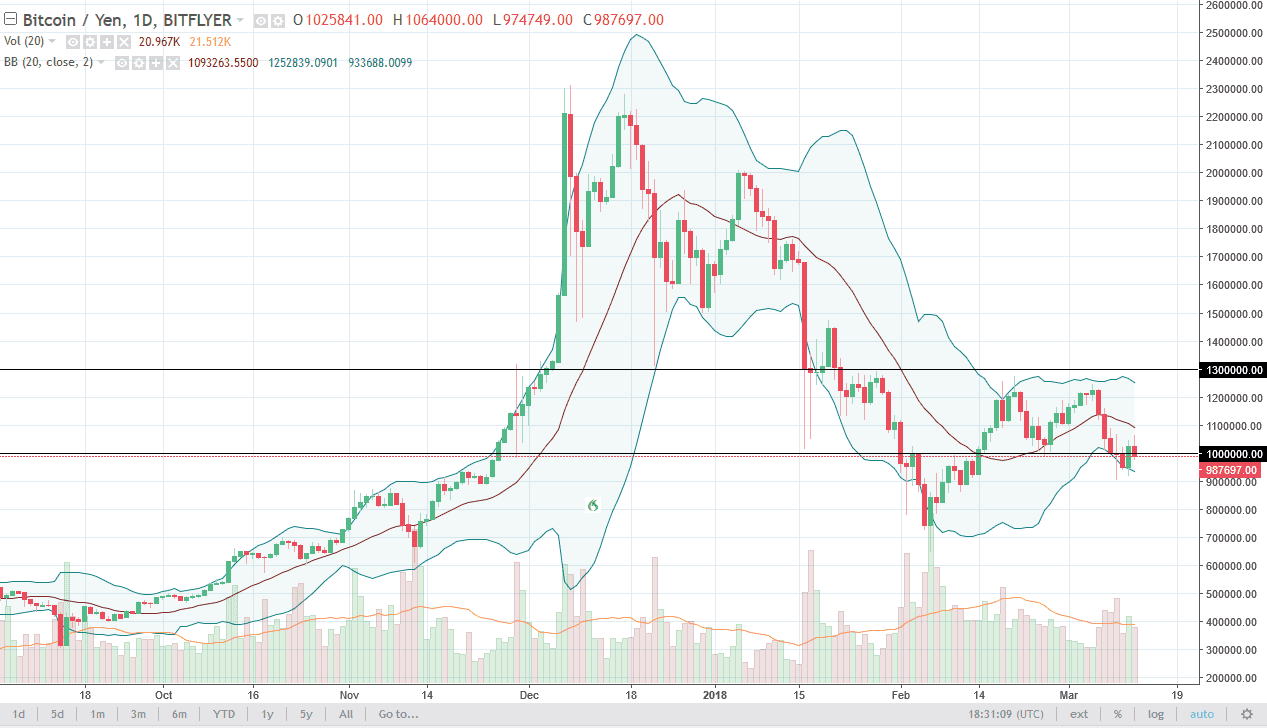

BTC/JPY

Bitcoin initially tried to rally against the Japanese yen during the trading session on Monday but turned around to show signs of exhaustion. The ¥1 million level is of course an area that will attract a lot of attention, but I think that if we can break above the ¥1.1 million level, the market should continue to go much higher. If we break down below the ¥900,000 level, then I think the market continues to go lower, perhaps reaching down to the ¥700,000 level. Either way, the market should continue to be very noisy, and very difficult to deal with. I don’t see how Bitcoin goes higher over the longer term, at least not in the present circumstances. I think that we are more likely to see some type of selloff than anything else. Small position sizes are recommended.