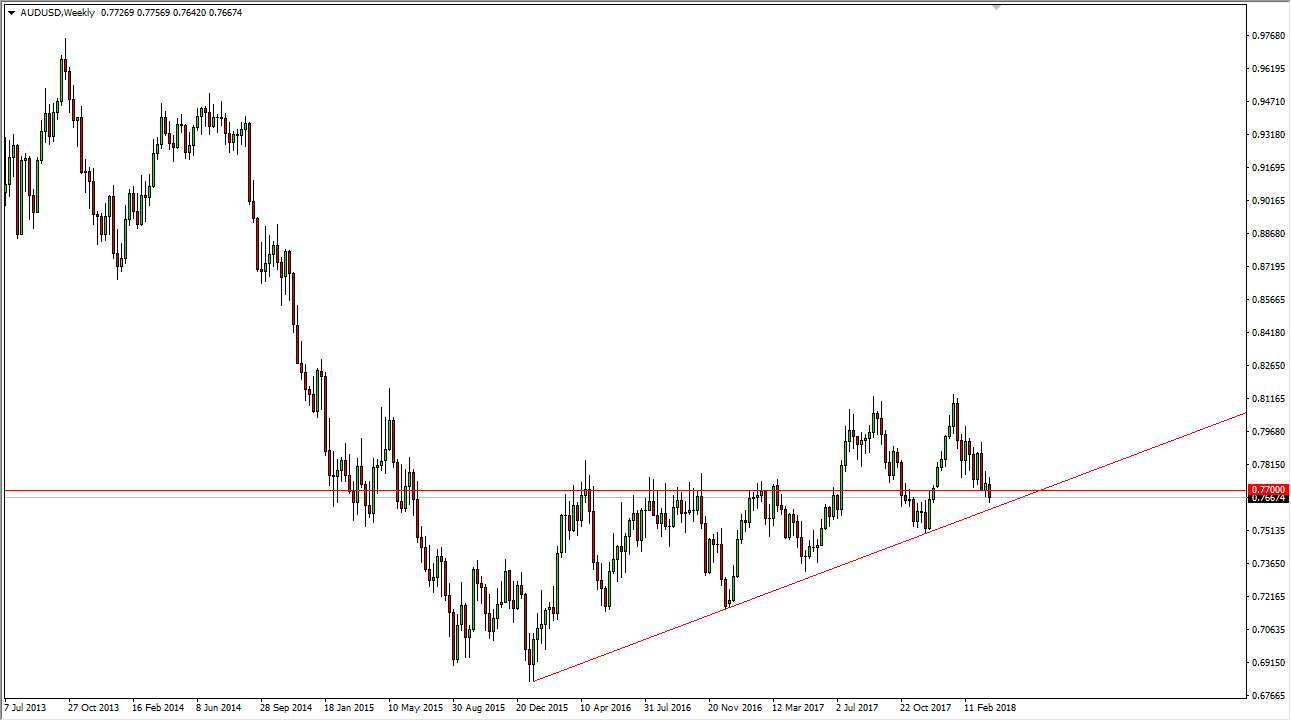

The Australian dollar has been negative during most of the month of March but is approaching a significant uptrend line that I think will continue to hold this market afloat. Obviously, gold will have its influence as well, but it looks to me as if the 0.77 level is a significant level, lease based upon the last couple of years, and I think that the buyers are willing to pick up a bit of value here. Once we can break above the 0.77 handle again, I think that will instill a bit more confidence, and if we can break above the 0.78 level, that will probably move things even further.

At this point, I anticipate that the market will go looking towards the 0.80 level again, as it has been important on charts going back decades. Anticipate that this should be a decent month for the Australian dollar, but if we get some type of trade war, that could change everything.

The alternate scenario of course is that we break down below the uptrend line, perhaps sending the market down to the 0.75 level. At that level gives way to selling, I think at that point the market unwinds rather rapidly. Currently though, I think that there are more reasons to be optimistic and pessimistic, and that should continue to be the way things pan out. After all, there were a lot of nervous and shaky traders as soon as it was announced that tariffs were going to be brought to market, and I think that essentially flushed out the “weak hands” in most of the currency pairs around the world, this one being no different. It might be choppy, but I believe that by the time the month ends, we should see higher pricing for the Australian dollar.