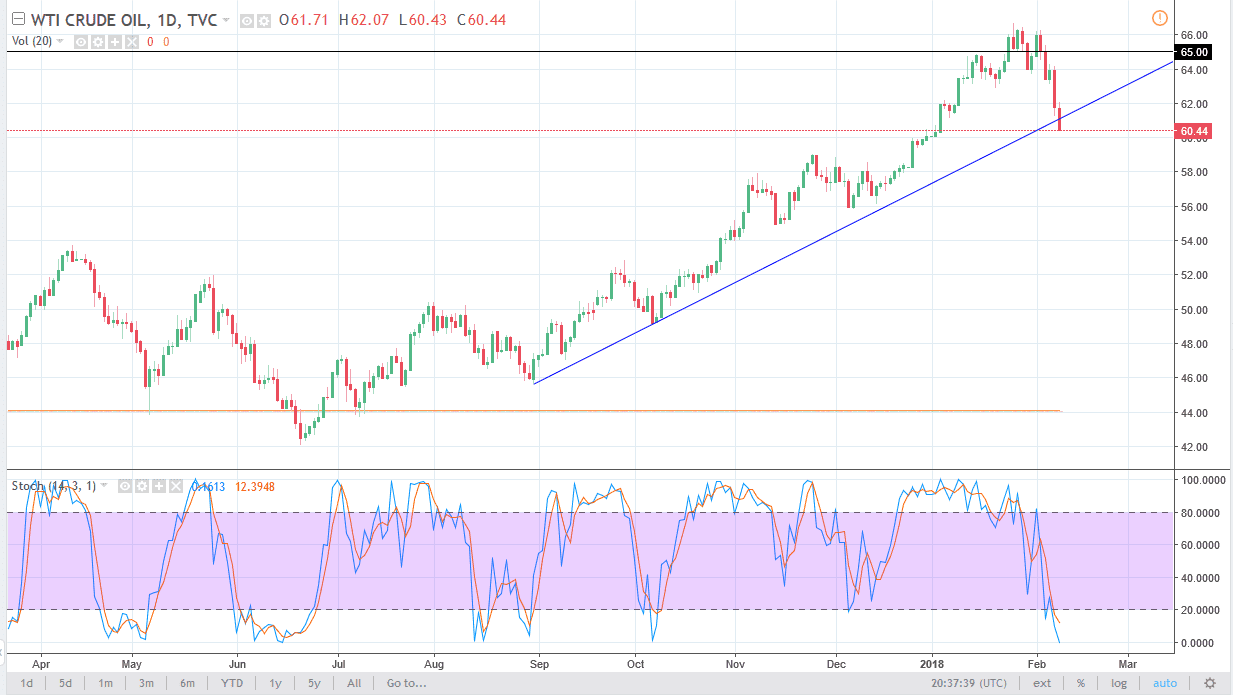

WTI Crude Oil

The WTI Crude Oil market fell over during the trading session on Thursday, slicing through an uptrend line that has been keeping this market higher for months. Now that we have sliced through this line, it’s likely that we will continue to go towards the $60 handle, and then eventually below there. Supply continues to build in the United States, so having said that it’s likely that the oil markets will continue to go lower. A strengthening US dollar will exacerbate this if that continues as well. $60 will offer a bit of support, but I think we break down below there and go towards the $56 level over the next several sessions. If we break above the $62 level, then I think the uptrend could continue, but right now it certainly looks as if the sellers are starting to take control again.

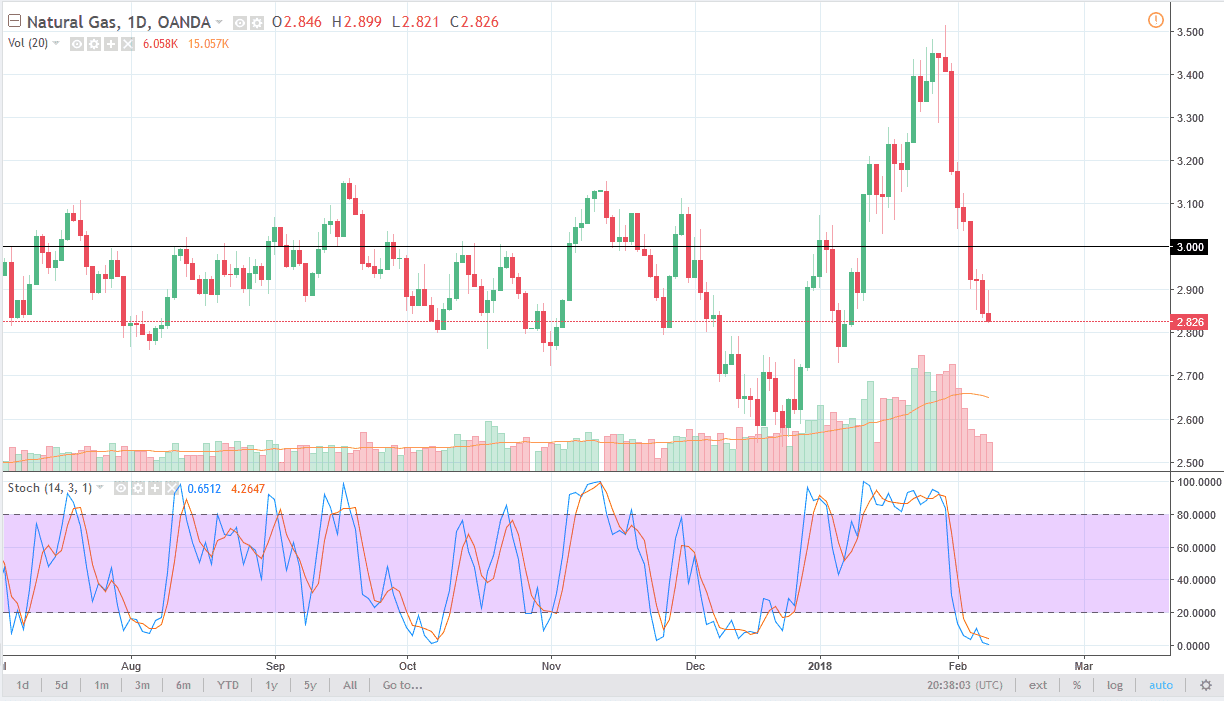

Natural Gas

Natural gas did something that was quite impressive today: continue to fall. The market initially tried to rally, but then rolled over and ended up forming a shooting star, and that is of course a negative sign. It looks as if the sellers are going to continue to pressure this market, but if you are not already short of natural gas, is can be difficult to get involved at these low levels. You would be “chasing the trade”, which is a great way to lose money. However, if we get some type of rally I am more than willing to start selling it. I would love to see this market tried to rally towards the $3 handle, but we may not even get that opportunity. Eventually, buyers will return, or at least short covering will happen, but in the meantime, I think that the market is one that has only one direction.