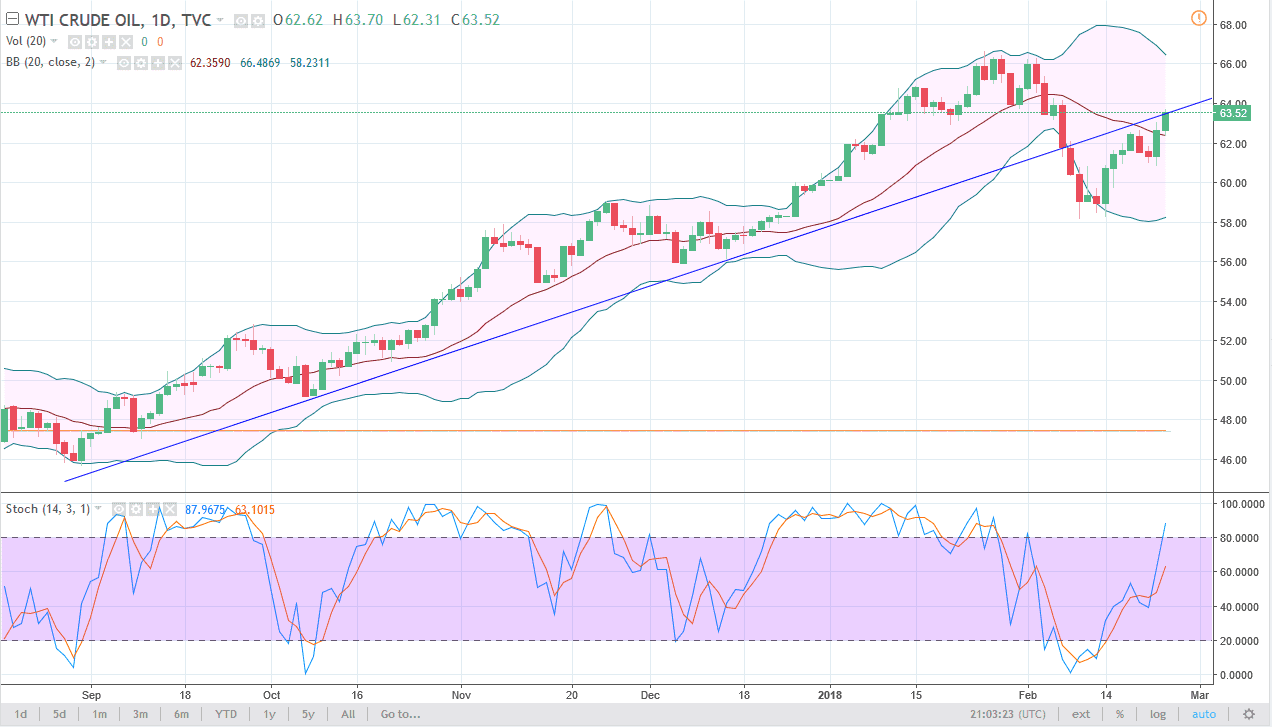

WTI Crude Oil

The WTI Crude Oil market rallied on Friday, as the EIA numbers have come out a bit surprising. However, we are testing the bottom of the previous uptrend, and I think that we could see some sellers in this area. Even if we don’t get that selling, I think that exhaustive candle’s just above will give me an opportunity to short again. I don’t like buying this market, because a lot of the things that are driving it higher are short-term based. There have been disruptions in the Libyan markets, but until we make a “higher high”, we have not proven ourselves overly bullish. I wouldn’t short here, but I need to see some type of exhaustive daily candle to start putting that money to work. If we made a fresh new high, then of course it’s a buy signal.

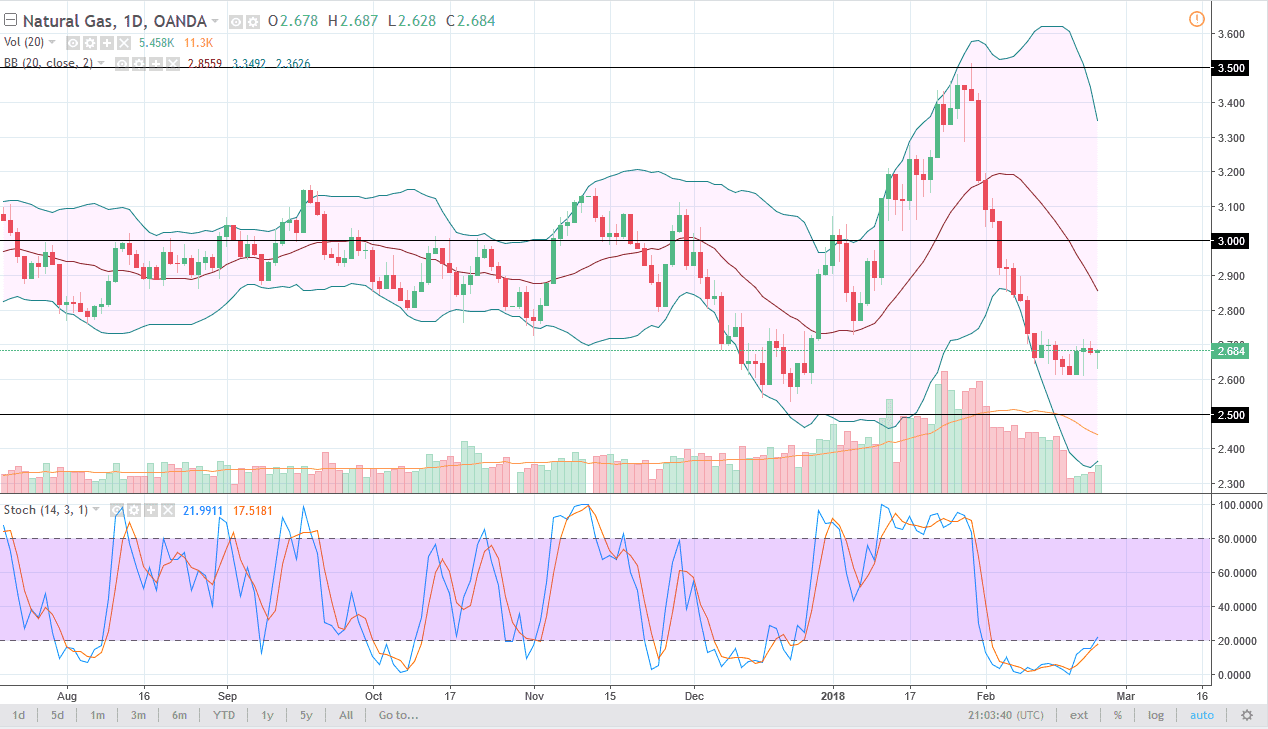

Natural Gas

Natural gas markets initially fell during the trading session on Friday but turned around to form a massive hammer. The hammer looks very bullish, and I think at this point we will see buyers come back into this market place. You could buy here, as it is the bottom of the larger consolidation area, but I believe that there are plenty of reasons to think that this market will drop. The $3 level above will be massive resistance, and of course exiting the colder winter months of the northeastern United States will drive down demand as well. I think at this point although we are oversold, and the sellers will probably start cutting their position, I’m not interested in trying to jump on this dead cat bounce. I think given enough time, I will see an exhaustive candle in higher levels that I would throw money at.