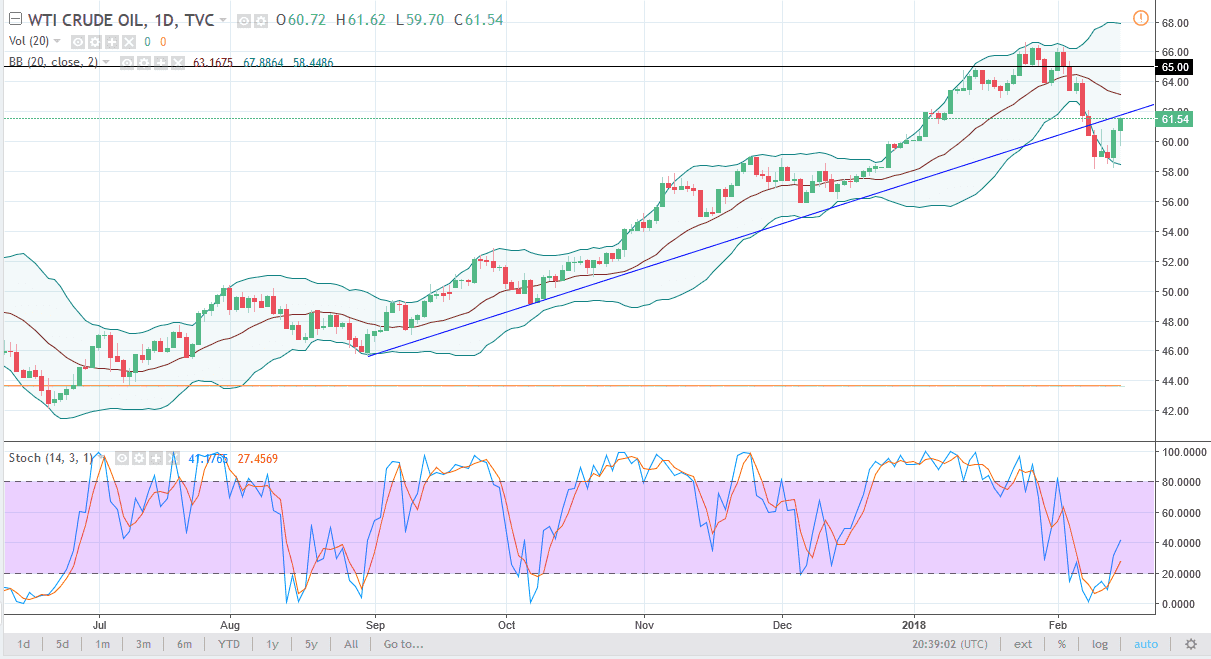

WTI Crude Oil

The WTI Crude Oil market has been very noisy during the trading session on Thursday, initially falling towards the $60 level, but the buyers came back in to push the market higher and close strong. Ultimately, the previous uptrend line has offered quite a bit of support, and it should offer resistance now that we are approaching it. However, if we break above that uptrend line, that would be a very bullish sign. Longer-term, I think that oil markets will continue to struggle, and I’d be surprised if we broke above the $65 level. At this point, I’m looking for an opportunity to start selling, and exhaustive daily candle would be a good way to get involved. Otherwise, if we break down below the bottom of the hammer for the session on Thursday, I would be a seller then as well, perhaps reaching down towards the $56 level.

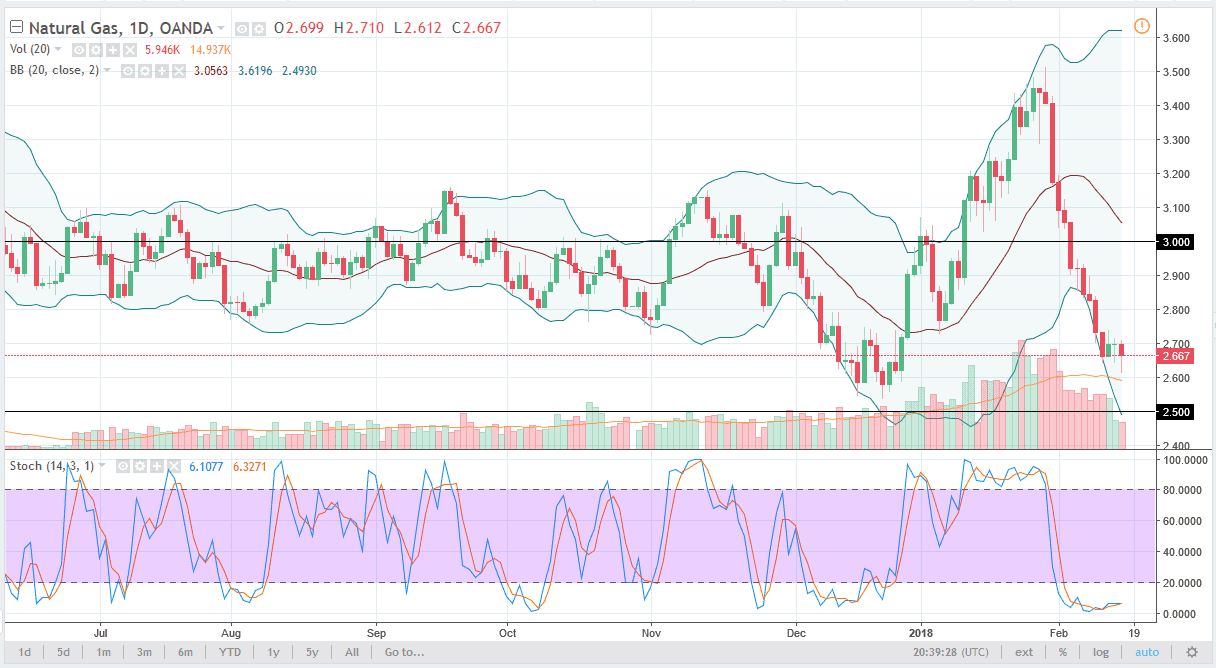

Natural Gas

The natural gas markets have initially started falling during the trading session on Thursday but has bounced to the upside to form a hammer. This is something that I’ve been waiting to see, because I need to see a higher level from which to sell. If we break above the top of the candle for the day, we could very well rally, but I think that the market will feature more of a dead cat bounce than anything else. I think that waiting for an exhausted candle above is probably the best way to go as we could short the market then. The $3.00 level above should be massively resistive, as it is essentially “fair value” of the consolidation area. Ultimately, we are exiting the bullish time of year for natural gas, so would not surprise me at all if we can break above there.