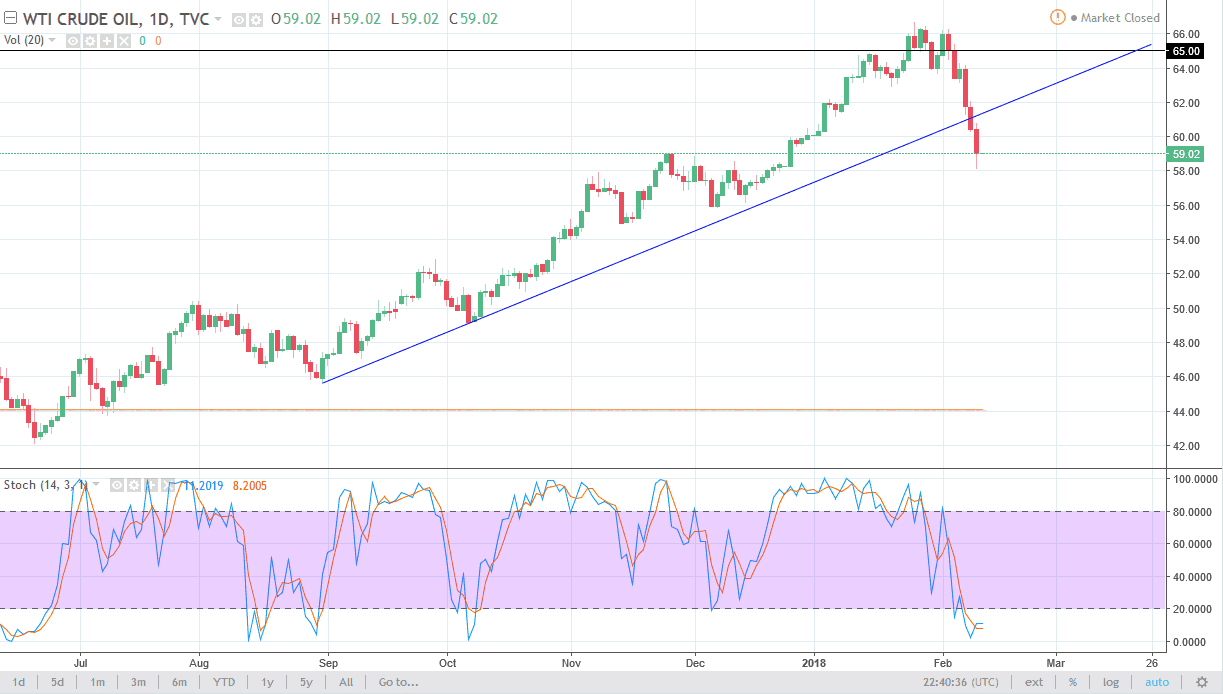

WTI Crude Oil

The WTI Crude Oil market has been very negative during the trading session on Friday, reaching down towards the $58 level. At this point, we did bounce towards the end of the day, so it’s likely that we could see a bit of a bounce in the short term. I believe that the previous uptrend line will cause resistance though, and that this will be more or less a “relief rally” than anything else. I am more than willing to sell and exhaustive candle after a bounce. If we break down below the $58 level, then the market should go down to the $56 level. Ultimately, I believe that the market goes much lower, as the Americans continue to flood the market with fresh oil. The market has been overdone, now that we have sliced through this uptrend line, I think that we are heading towards the $50 level over the longer term.

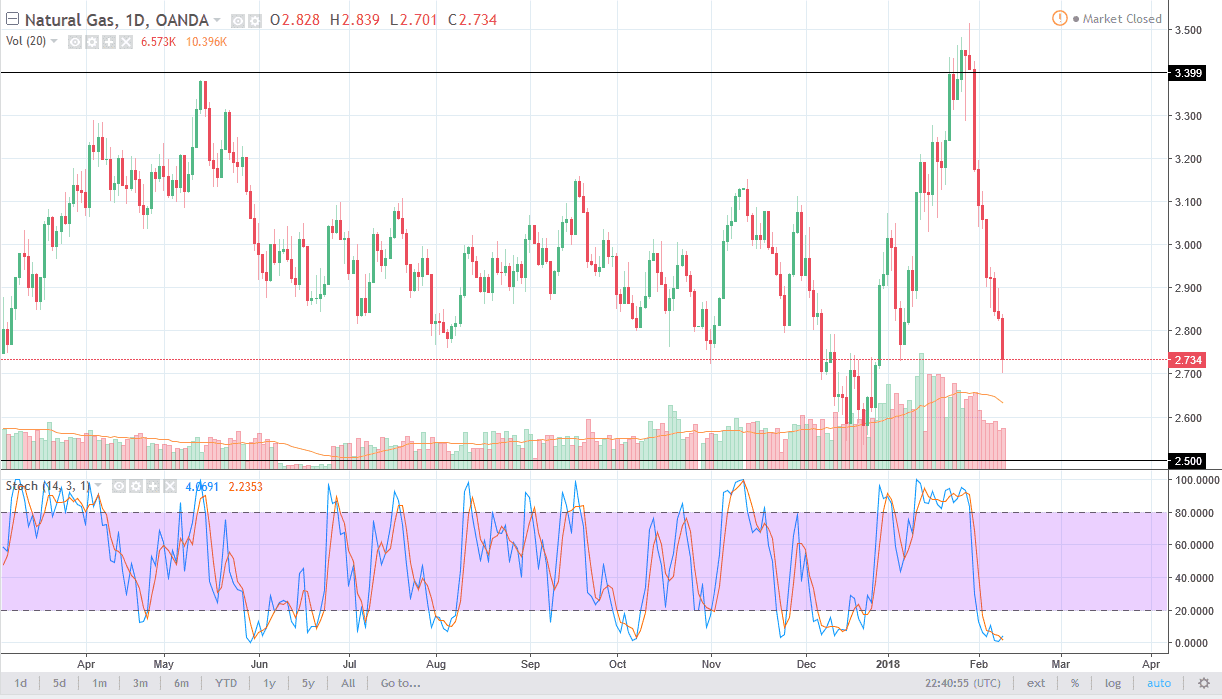

Natural Gas

Natural gas markets fell again during the trading session on Friday, losing over 3.3%. By any metric you measure it, the natural gas markets are oversold. That doesn’t mean I’m willing to step in and trying to pick it up, as this would be “catching a falling knife.” However, what I am willing to do is sit on the sidelines and wait for a significant bounce that I can sell. Unfortunately, it’s going to be very difficult to do anything in the next 24 hours. I see a chance of support at the $2.60 level, and if you are short-term incline, you may buy some type of bounce, but you would need to get out of this market at the first signs of exhaustion. I find that it’s much easier to simply sell after a rally of a couple of days.