Gold ended the week down $15.55 at $1316.14 an ounce, recoding a second consecutive weekly loss, as the dollar’s rebound from multi-year lows weighed on the precious metal. World stock markets were mostly lower, as worries about rising interest rates rattled financial markets, though they bounced on Friday. A stronger U.S. dollar index is working in favor of the gold market bears but volatility in stocks has limited losses. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 190877 contracts, from 207262 a week earlier.

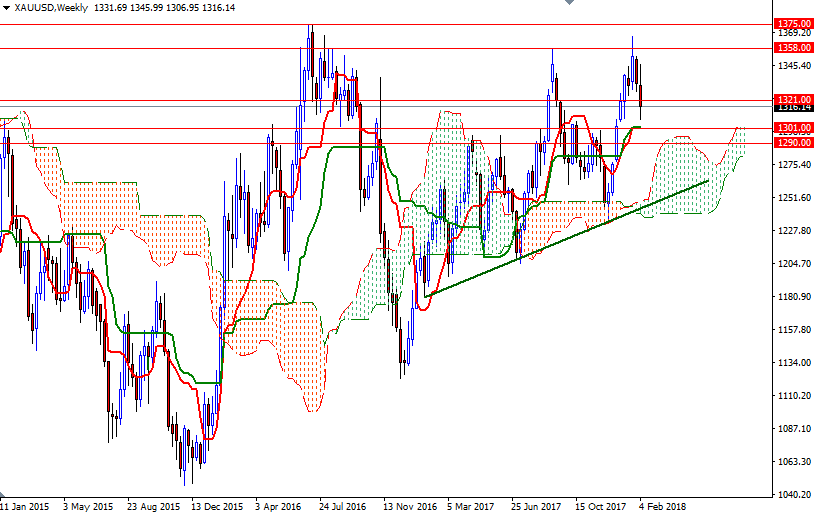

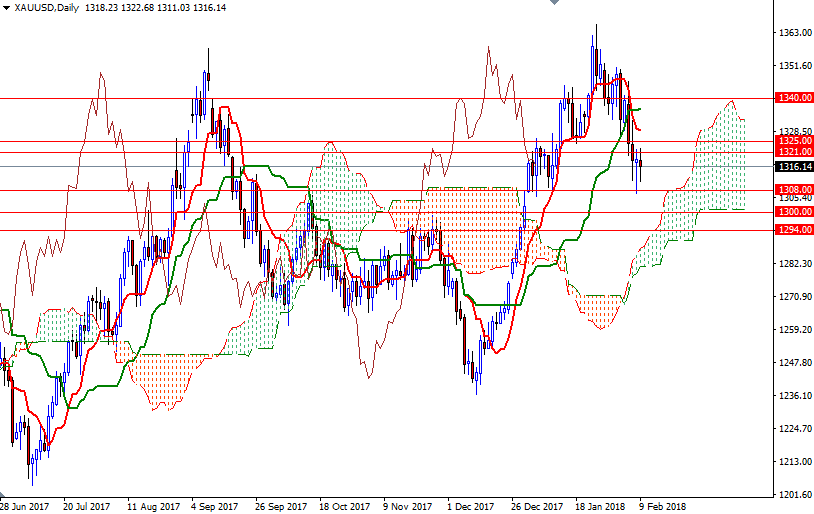

Technical selling pressure increased after XAU/USD failed to sustain a push above the 1340 level. The market fell below 1326/5 and tested the support in the 1308/5 area as expected. Despite the negative short-term outlook, XAU/USD pair is still trading above the Ichimoku clouds on the weekly and the daily Ichimoku clouds. Since buying interest in the 1308/5 zone put a floor in trading range, I think it will play an important role this week.

A break below this area on a daily basis would pull the Chikou-span (closing price plotted 26 periods behind, brown line) below prices and increase the possibility of a move towards the daily cloud. In that case, look for further downside with 1300-1298 and 1294/0 as targets. The bears have to produce a weekly close below 1290 to gain momentum for 1285/2. The bulls, on the other hand, have to penetrate the hourly cloud and lift prices above the 1325/1 area to make a run for 1334.30-1332 (the bottm of the 4-hourly cloud). Closing above that strategic barrier paves the way for a test of the 1342/0 zone.