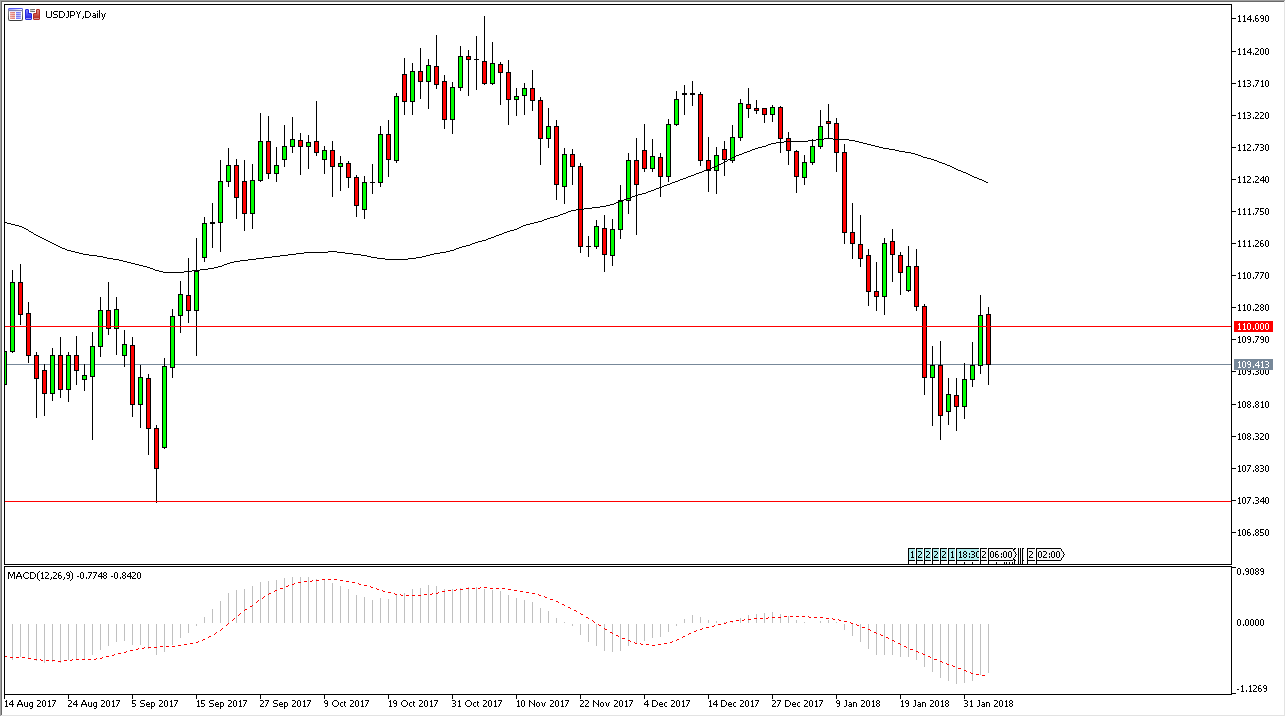

USD/JPY

The US dollar has fallen significantly against the Japanese yen on Monday, reaching down towards the 109 handle. It looks as if there could be a bit of support underneath, but I think that eventually we will break above the 110 level and extend to the 111 level. It’s going to take a certain amount of bullish pressure to have this occur, and I think that the market needs to get rid of some of the overall fear that we have seen jump into it. Eventually, we will probably go looking towards the 112 level, and then eventually the 114 level. I believe that it will be volatile of course, as this pair is quite often just that, but I think longer-term traders will continue to look for value. I believe that the 107.50 level underneath will continue to be an absolute “floor” in the market. If we break down below there, it would be a disaster.

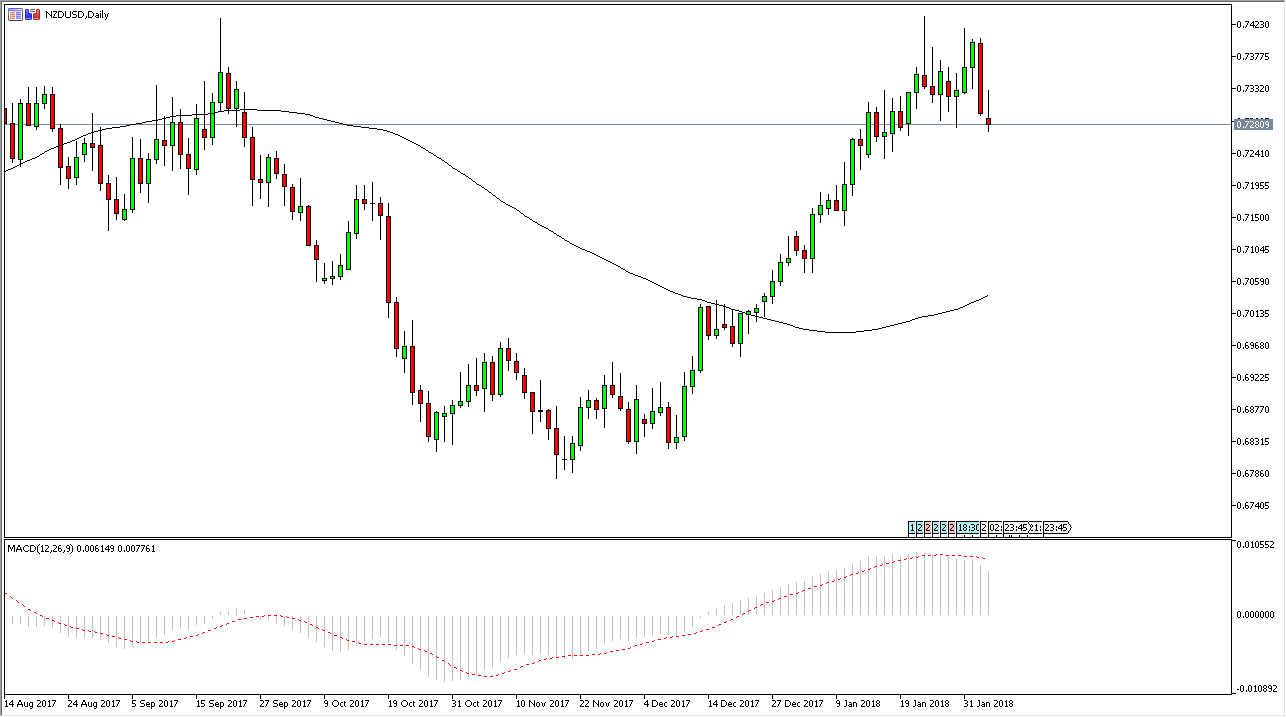

NZD/USD

The New Zealand dollar has gapped lower, rallied a bit during the day to fill that gap, and then rolled over again. I believe that the market is ready to break down, as the New Zealand dollar is considered to be a “risk on” currency. As the US dollar rallies, it should continue to push this market lower, as we have been far too overbought for a while. We are close to the top of the overall consolidation area, which extends to the 0.75 level, but the bottom is all the way down to the 0.68 handle. It’s very likely that we could reach towards the 0.7050 level, followed by the 0.68 handle after that. If we continue to see negativity in the markets, this pair will fall rather drastically, and should have no trouble reaching .68.