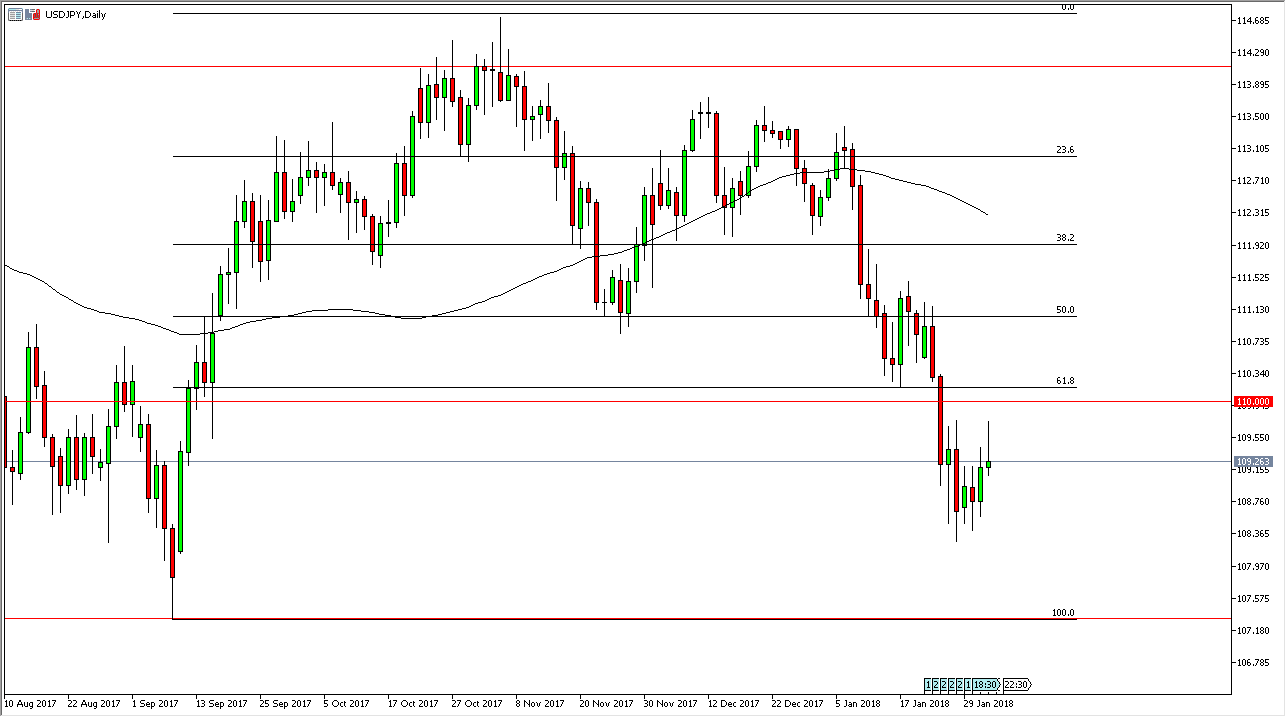

USD/JPY

The US dollar has initially tried to rally during the day on Thursday but sold off later as traders would have squared up their positions ahead of the jobs number. The jobs number of course will be vital, and the fact that we formed a shooting star, although bearish, is more of a signal that we are probably going to drift a little bit lower before the next move. I think that selling is all but impossible, least not until we get the jobs number. If we can break above the 110 handle, that would be very bullish sign, and should send this market looking towards the 111-level next. Alternately, if we pull back from here it’s likely that the 108 level will be targeted, and then eventually the 107.50 level which would wipe out the entire move. Longer-term, I anticipate that this market should try to rally.

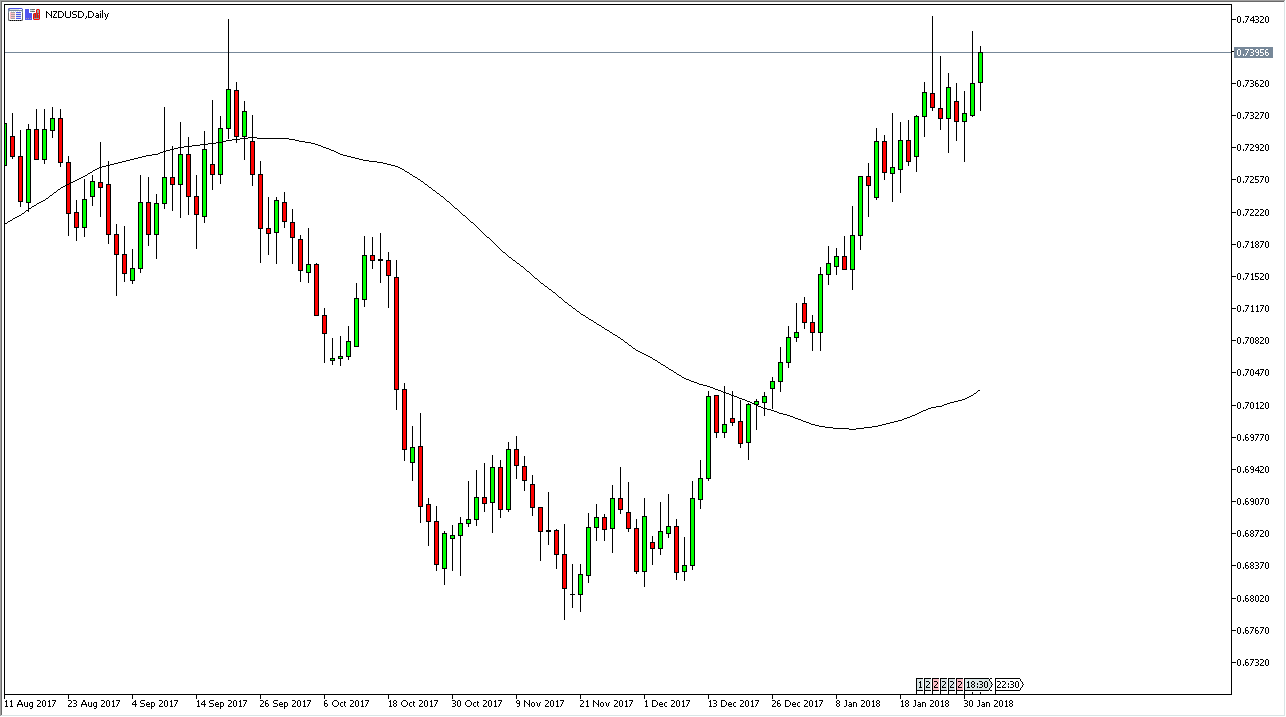

NZD/USD

The New Zealand dollar initially fell during the trading session on Thursday but found enough buyers to turn around and show signs of strength. The 0.74 level being tested of course is nothing new, and I think if we can break above there, the market should then go to the 0.75 level. That’s the top of an overall consolidated very, and that being the case it’s likely that we will struggle and that vicinity, but I think eventually we can get above it. Pullbacks of this point should be looked at as buying opportunities, and I think there’s plenty of support near the 0.73 level, and then the 0.72 handle. Longer-term, I fully anticipate seeing the New Zealand dollar going towards the 0.80 level, as the market continues to sell off the greenback in general. Overall, I am bullish, but I recognize that we could have a sudden pull back. That should be looked at as an opportunity.