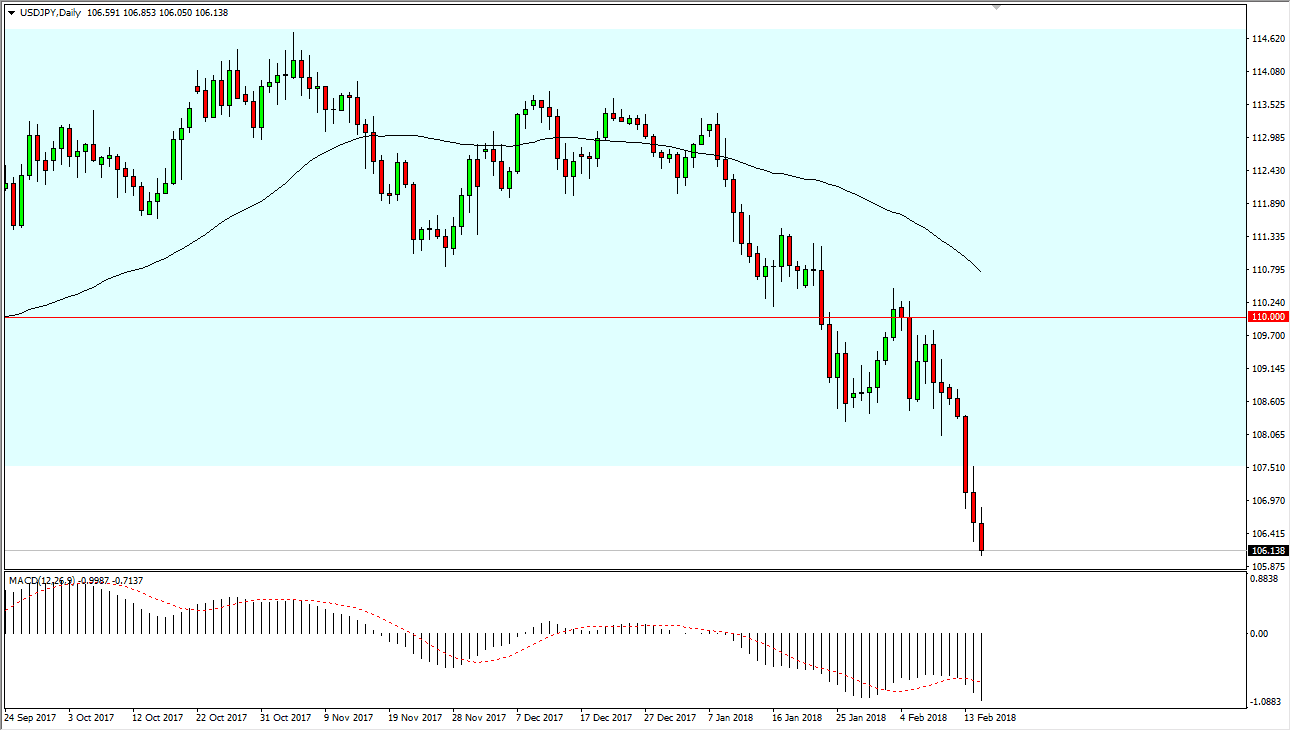

USD/JPY

The US dollar has fallen again against the Japanese yen after initially trying to rally on Thursday, showing even more weakness. The market is probably due for a bounce, but we have already seen that the 107.50 level is going to offer resistance. Longer-term, I think we’re going to go looking towards the 105-level underneath as it is a large, round, psychologically significant number, and an area where we have seen a lot of interest previously. Ultimately, I think that this pair will eventually rally, because if nothing else we have gotten a bit oversold. It is not until we break cleanly above the 107.50 level that I feel likely and comfortable to start buying. Ultimately, the market should then go to the 110 handle, an area that is a significant resistance barrier. If we can break above there, then the market is free to go to the 114 handle.

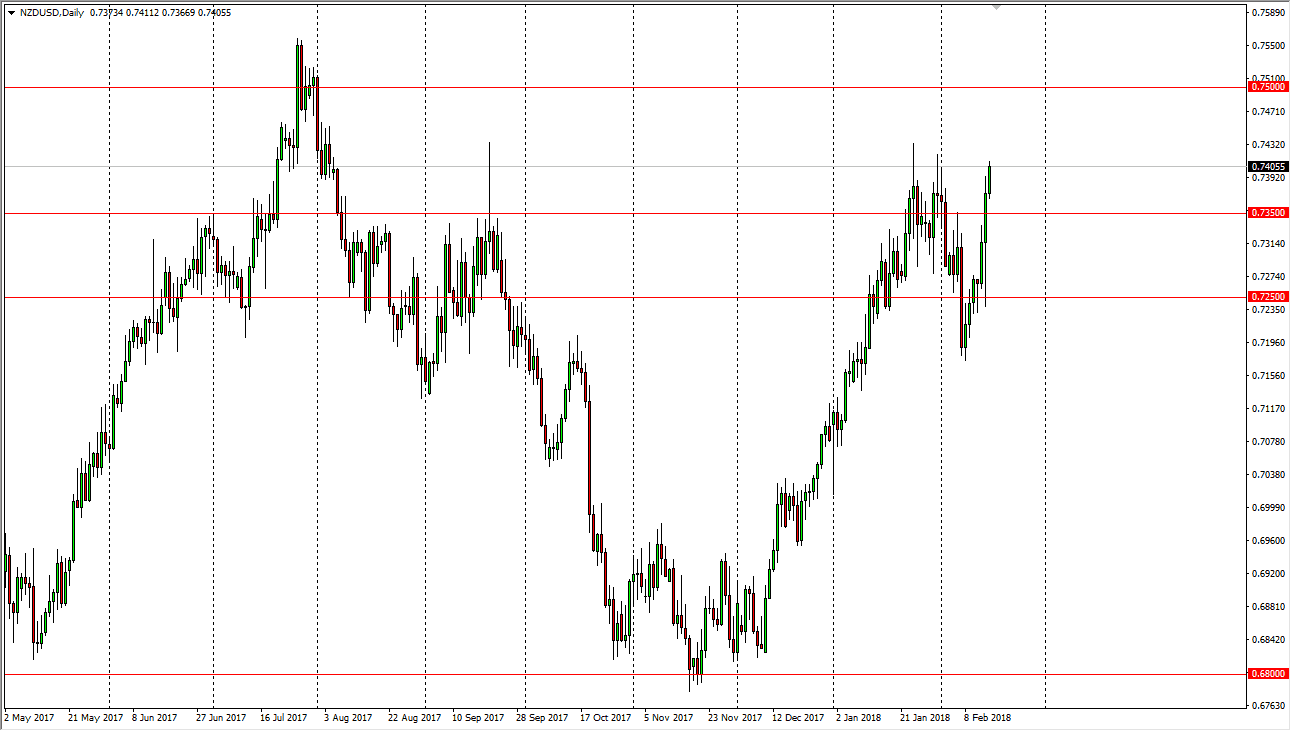

NZD/USD

The New Zealand dollar has broken to the upside again during the day on Thursday, reaching towards the 0.74 handle. That’s an area that has been resistance recently, and we have gotten to be a bit overbought in the short term, so would not surprise me at all to see this market roll over. I think that there is a massive amount of resistance between the 0.74 level and the 0.75 handle, so I’m not willing to buy at this point. If we clear the 0.75 handle, then it would be a different story. I think we will more than likely try to pull back so that we can build up momentum, and perhaps make a significant run at this barrier. In the meantime, I believe patience is what is needed to profit off this market, as buying at this level would be chasing the trade.