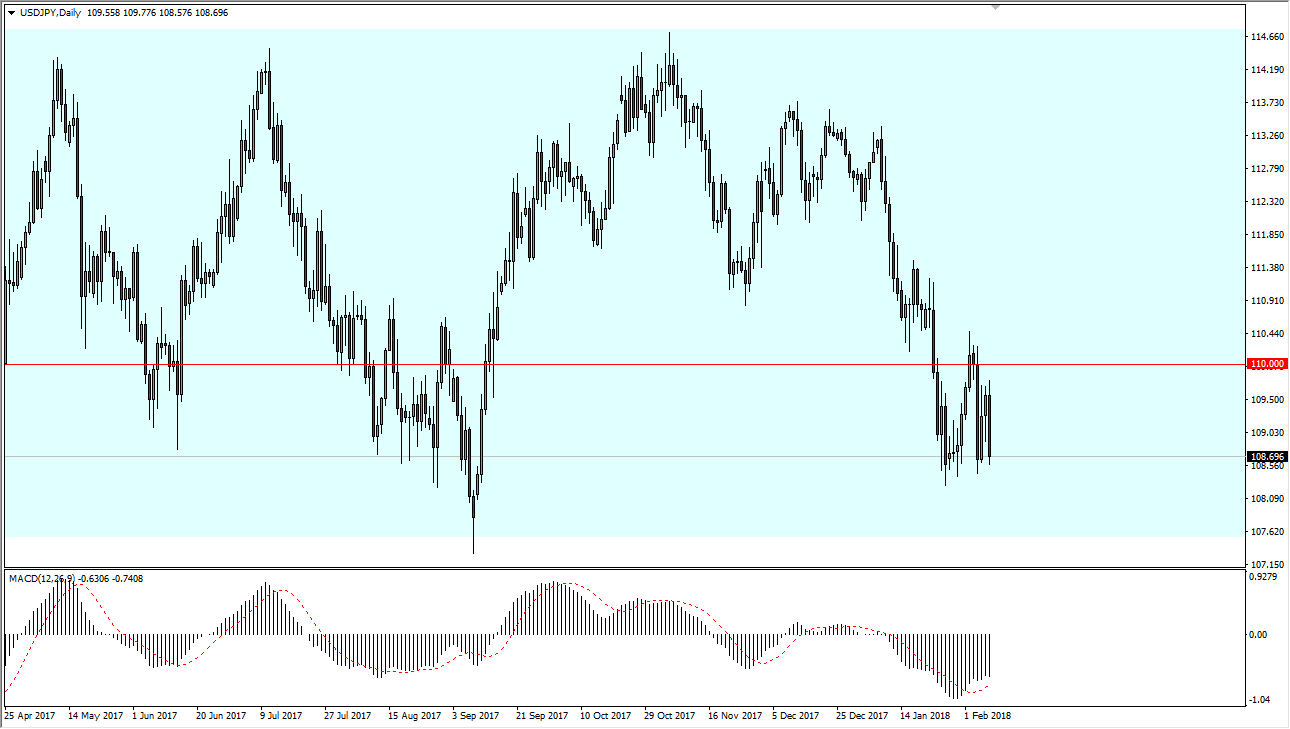

USD/JPY

The US dollar has initially tried to rally during the day on Thursday, but we have rolled over against the Japanese yen again as we are testing the 108.50 level. Although this market could breakdown, there is a massive amount of support down to the 107.50 level. Because of this, if we have a “risk off” move, although shorting this market isn’t the worst trade, I would prefer to focus on other markets that have a little bit more room to move. If we do bounce here, then we continue to consolidate just below the 110 level in general. A break above that level should send this market much higher. Ultimately, this is a market that should continue to be very noisy and move with risk appetite in general. If stock markets rise, this pair will as well. However, the S&P 500 fell, and that put downward pressure on this market.

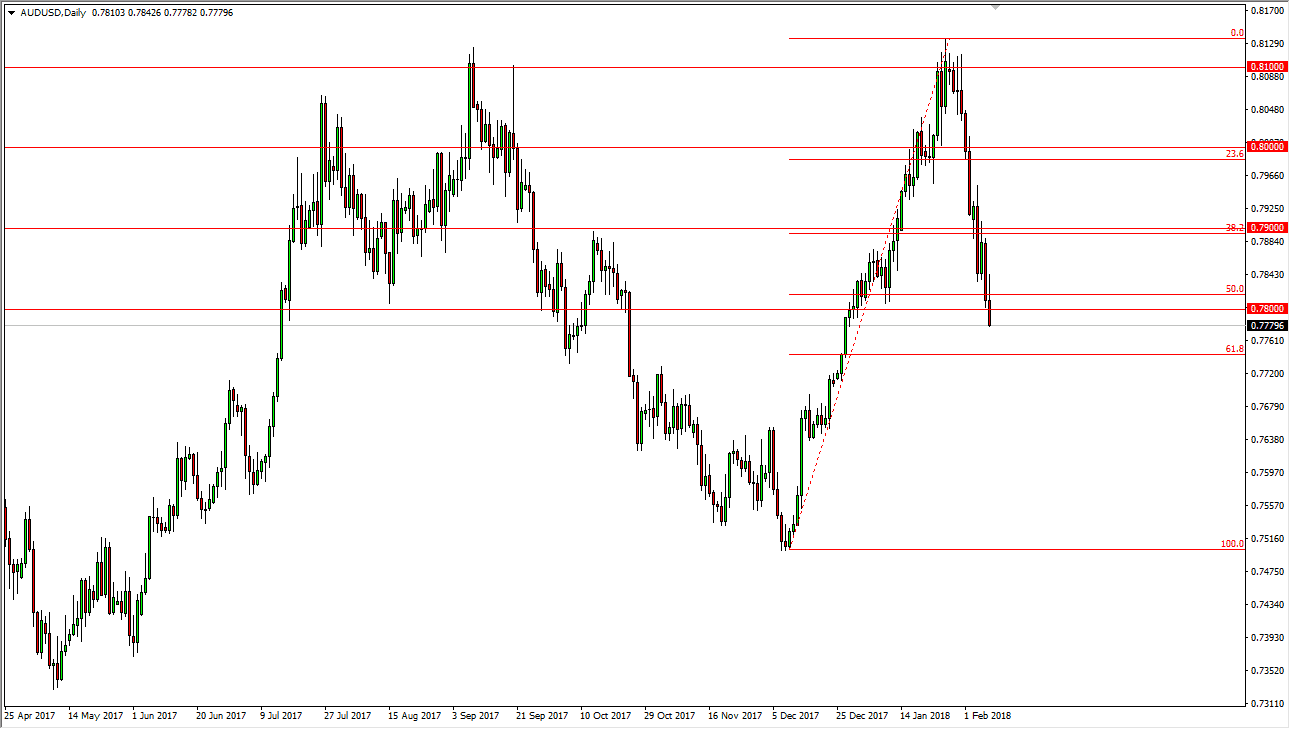

AUD/USD

The Australian dollar initially tried to rally during the trading session on Thursday, but then turned around and fell apart. I believe that the market looks very bearish at this point, and I think we’re going to go down to the 0.7750 level next, which is the 61.8% Fibonacci retracement level. A breakdown below there could send this market much lower, perhaps down to the 0.75 handle. The Australian dollar is a risk asset, so pay attention to gold and of course the stock markets in general. If they start to rally, that should help the Australian dollar, but right now it looks likely that we are going to roll over and continue falling. I have no interest in buying this market in the meantime, but if we get a supportive daily candle, I could be convinced to go the other way.