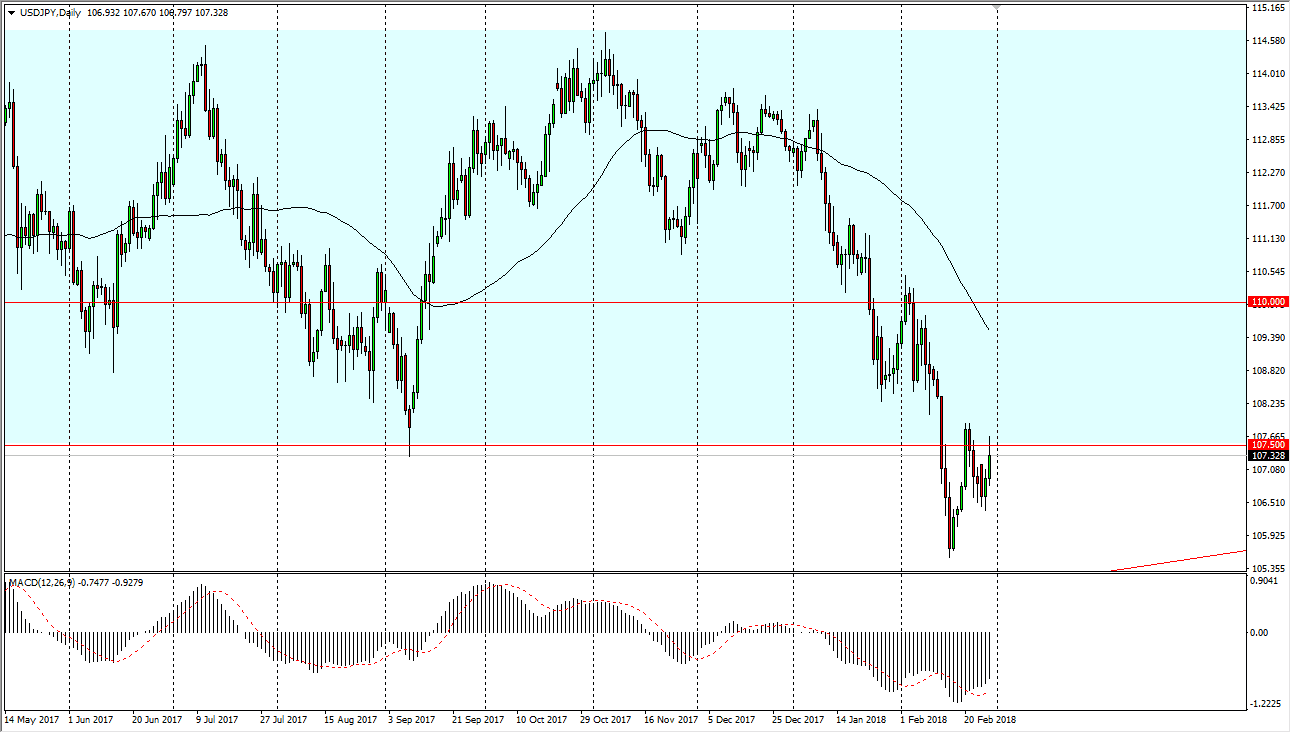

USD/JPY

The US dollar has rallied during the trading session on Monday, breaking above the 107.5 level at one point, and reaching higher towards the 108 level. If we can break above there, I believe that the market should then go to the 110 level, which should continue to offer a bit of resistance. A break above there should send this market even higher, perhaps reaching towards the 114 level. I believe that given enough time, that’s exactly what will happen, based upon a risk appetite that continues to strengthen for stocks over the longer term. These pullbacks will probably be looked at as potential buying opportunities, but we may have some noise in the short run that will continue to chop this market around. I believe that 105 underneath is even more supportive, so if we break down below there the market would probably collapse down to the 100 level.

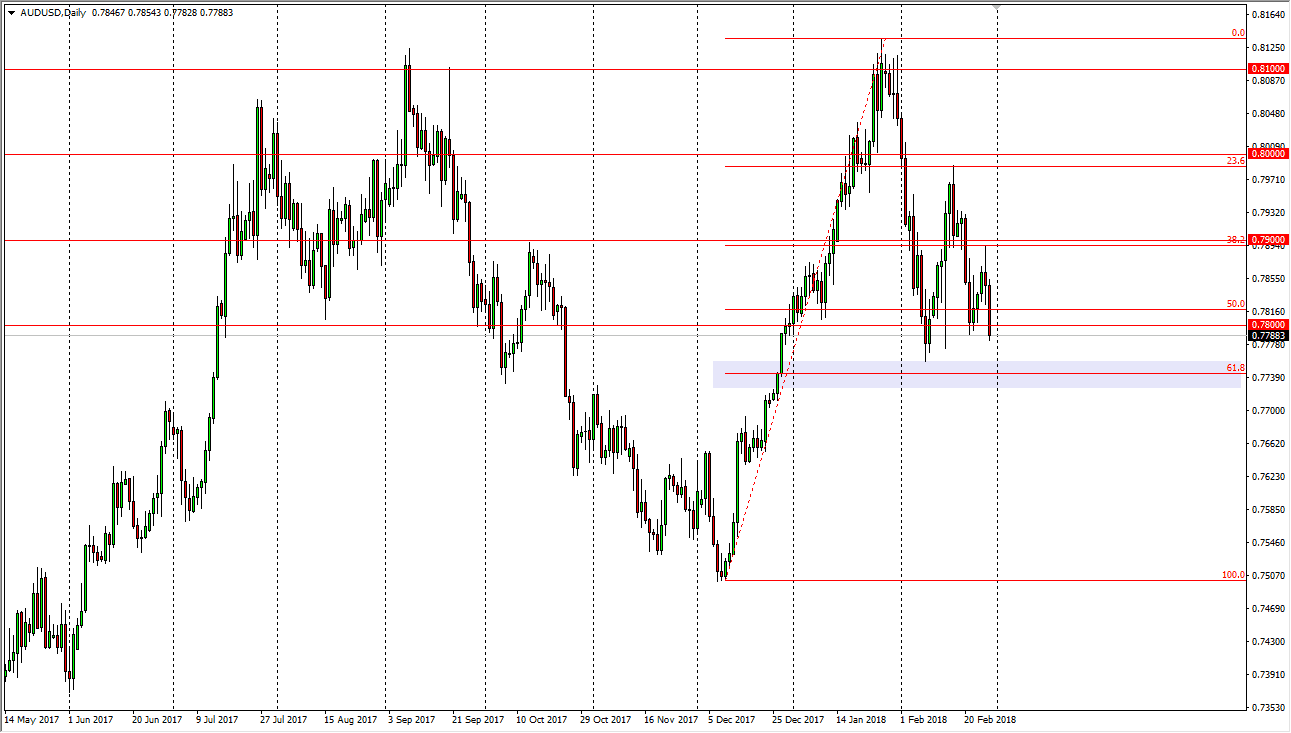

AUD/USD

The Australian dollar has broken down significantly during the trading session on Tuesday, reaching towards the 0.7750 level. As you can see on the daily chart, I have a lavender rectangle at the 61.8% Fibonacci retracement level. If we break down below that level, I think we will wipe out the entire up move, reaching back towards the 0.75 level, and continuing the overall consolidation that we have seen for some time. I do believe that the US dollar eventually falls, but perhaps the rest of the world isn’t quite convinced. At this point, I’m waiting to see if the 61.8% Fibonacci retracement offer support, or if it gives way. I will buy a bounce, I will short this market we break down below there. Beyond that, there is in a whole lot to say about this market other than that. Obviously, pay attention to gold markets as they can have a major influence.