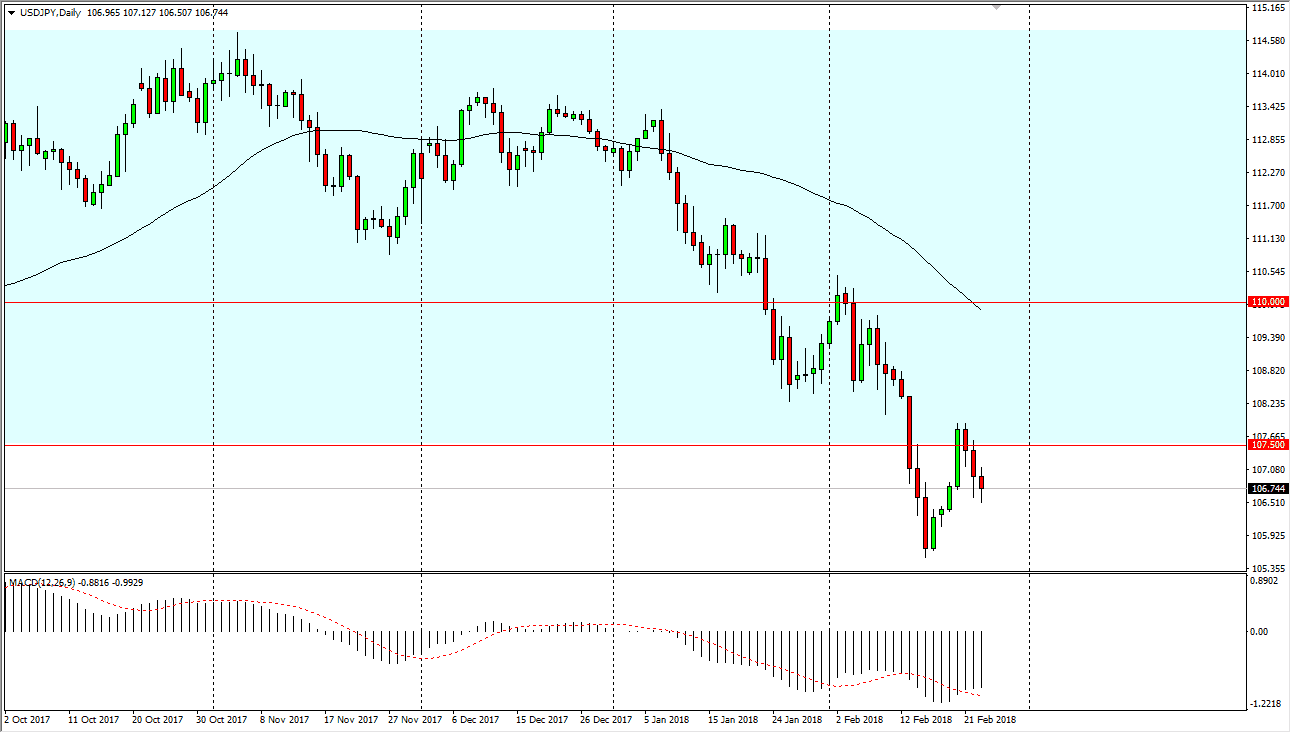

USD/JPY

The US dollar has fallen initially against the Japanese yen during the trading session on Friday but bounced enough to form a bit of a hammer. That’s a bullish sign, but I also recognize that we continue to struggle near the 107.50 level. In order to buy this market, I would need to see a “higher high” as it would show a continuation of momentum. If we were to break down below the bottom of the hammer, that could send this market down to the 106 handle, and then eventually the 105 level. The weekly chart looks a bit soft, but the daily chart looks as if we are trying to at least put up a fight. You would not be shunned by stepping away from this market, because quite frankly it’s very noisy.

AUD/USD

The Australian dollar has initially fallen during the trading session on Friday but found the 0.70 level to be supportive enough to turn around and form a very bullish looking candle. If we can break above the top of the shooting star from the Thursday session, I feel that the market will have proven itself to be very bullish, perhaps reaching towards the 0.79 level, and then eventually the 0.80 level. Alternately, if we break down below the 61.8% Fibonacci retracement level, the 0.7750 level, the market could breakdown rather significantly. At that point, I would anticipate a move down to the 0.75 handle. Remember, gold is a major driver of where the Australian dollar goes, so pay attention to the futures markets. If gold rallies, the Australian dollar rallies, perhaps to the 0.80 level, and then eventually the 0.81 handle. I have no interest in shorting unless we make a fresh, new low.