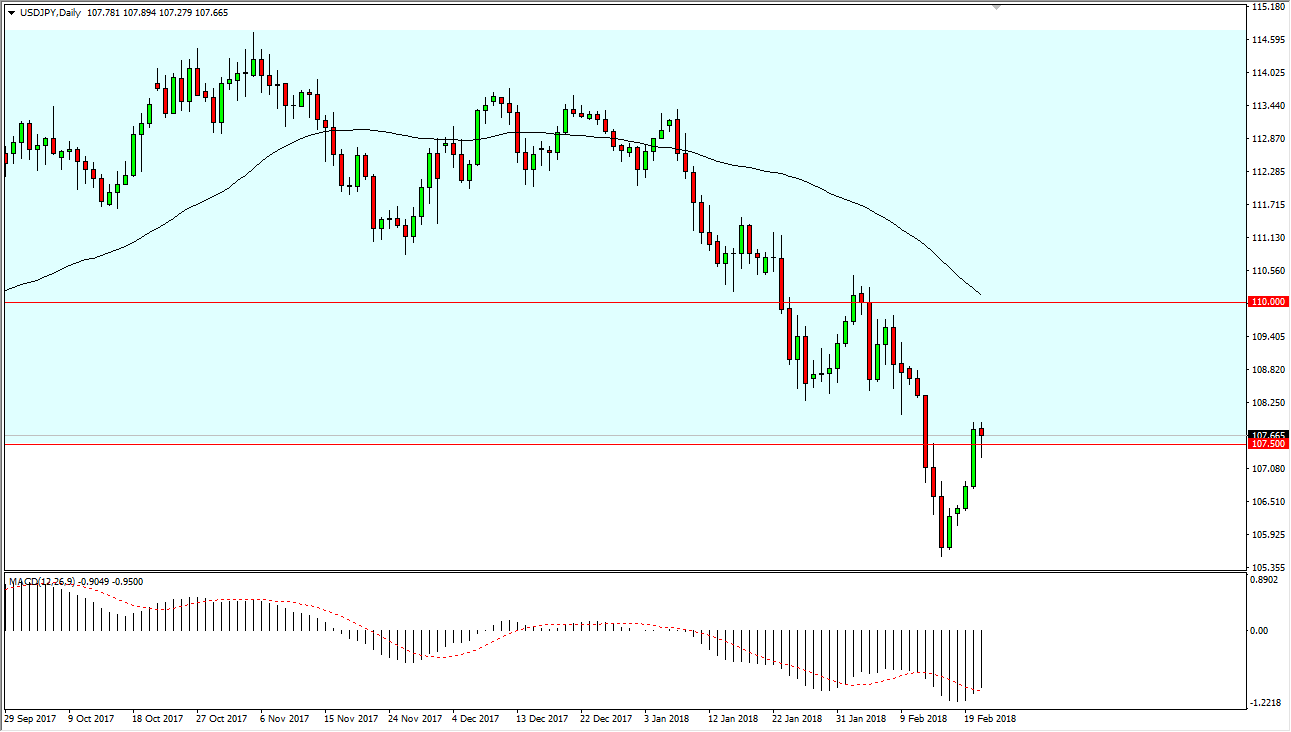

USD/JPY

The US dollar fell initially during the trading session on Wednesday but found enough support underneath the 107.50 level to turn around and form a hammer. For me, this is a very bullish sign, especially considering that the US dollar looks ready to take off due to rising yields in the United States after the FOMC Meeting Minutes. Ultimately, I think that this pair goes looking towards the 110 level again, but it may be a bit rocky occasionally. Overall, I think that the pair has try to make a bottom, and if we can stay above the bottom of the range for the trading session on Wednesday, we continue to go reaching forward. If we can break above the 110 level, then the market goes even higher, perhaps reaching as high as 114 longer term.

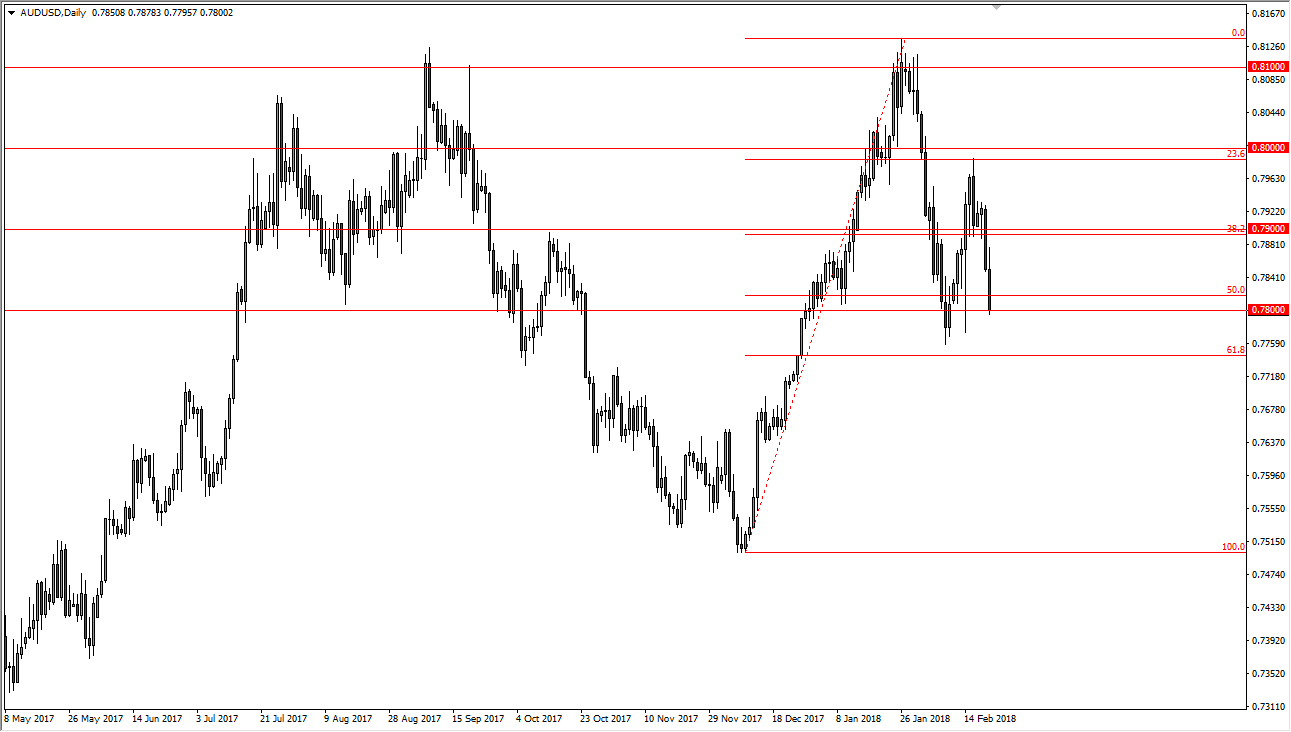

AUD/USD

The Australian dollar initially tried to rally during the day as well, but then broke down towards the 0.78 handle. That’s the beginning of significant support, and the 61.8% Fibonacci retracement level is closer to the 0.7750 level as well. However, it looks as if we have made a “lower high”, and that could be a bad sign. It will be interesting to see how the 61.8% Fibonacci retracement level comes into play, but I think that we will eventually see that level put up a significant fight. If we were to break down below there, then I don’t see any reason we won’t go down to the 100% Fibonacci retracement level, the 0.75 handle. At this point, it does look as if the Australian dollar is going to continue to struggle, however if we were to get some type of supportive daily candle, then I could be convinced to start buying again. Longer-term, we have been consolidating, so even if we did breakdown, that doesn’t necessarily mean that is a longer-term move.