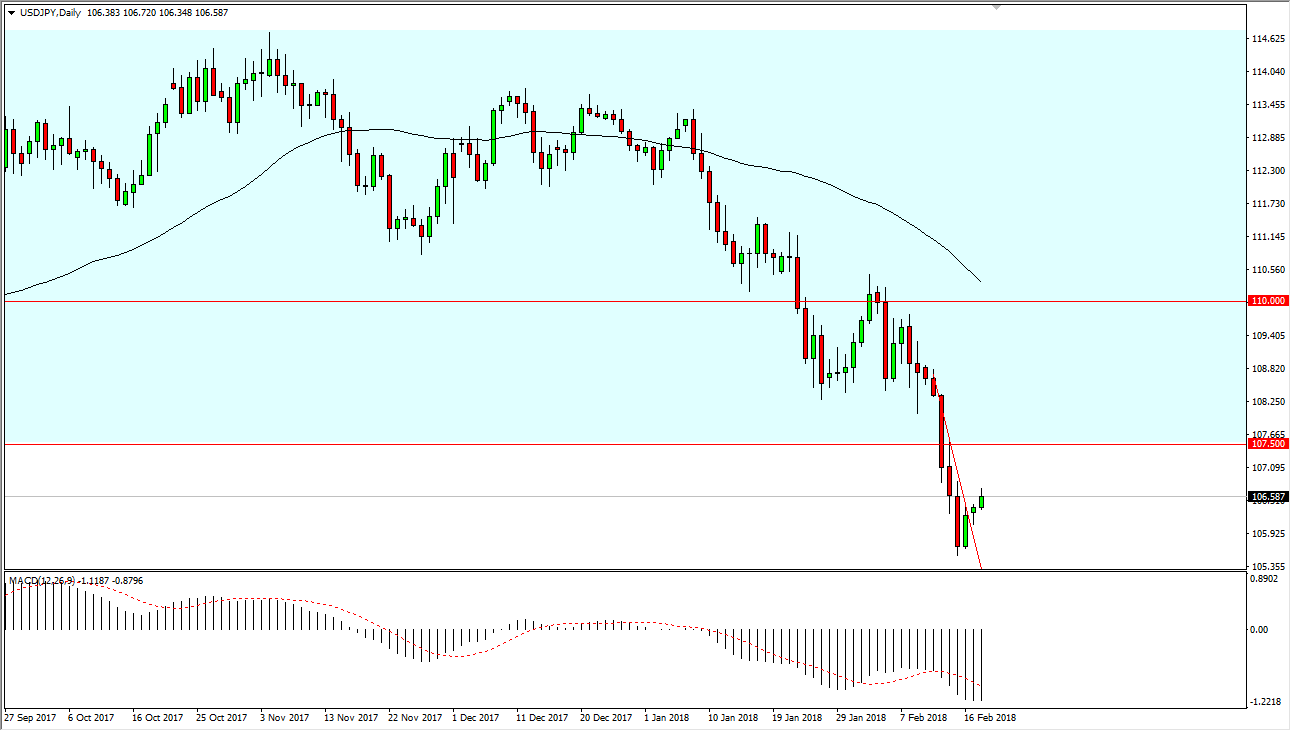

USD/JPY

The US dollar has rallied slightly during the trading session on Monday but would have been in very thin volume during American trading as they were celebrating the Presidents’ Day holiday. Ultimately, the market looks very likely to continue the rally a bit, but I think there is a significant amount of resistance above, especially near the 107.50 level. That was the scene of the previous support level, so it would make sense that it would be resistance. I think that the market will struggle a break above there, and on the first signs of a roll over, I would be interested in selling. If we did break above the 107.50 level on a daily close, then I think the market would go looking towards the 108.50 level, and then eventually the 110 handle.

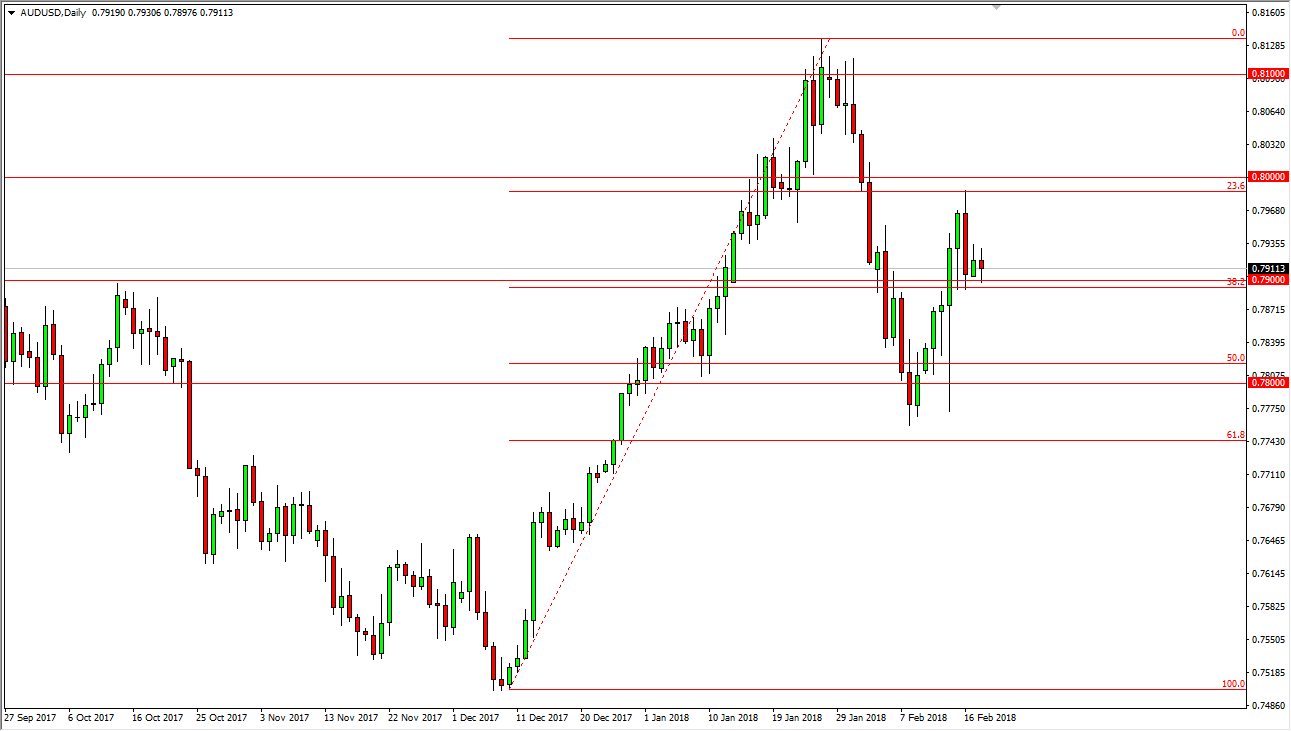

AUD/USD

The Australian dollar has gone back and forth during the trading session on Monday as well, bouncing off the 0.79 level. Ultimately, we ended up settling on a slightly negative candle, but I think this consolidation will continue, and therefore I think that it makes sense that we may get a lot of sideways and choppy trading. Short-term trading and short-term charts will probably make the most sense, employing some type of range bound system. Otherwise, if we can break above the top of the daily candle, then I think we go looking towards the 0.80 level, which has been important going back to the late 1980s. Alternately, if we break down below the 0.79 level, it’s likely that we will continue to drop from here and go down to the 0.78 level. That’s an area that has been supportive in the past and should be in the future.