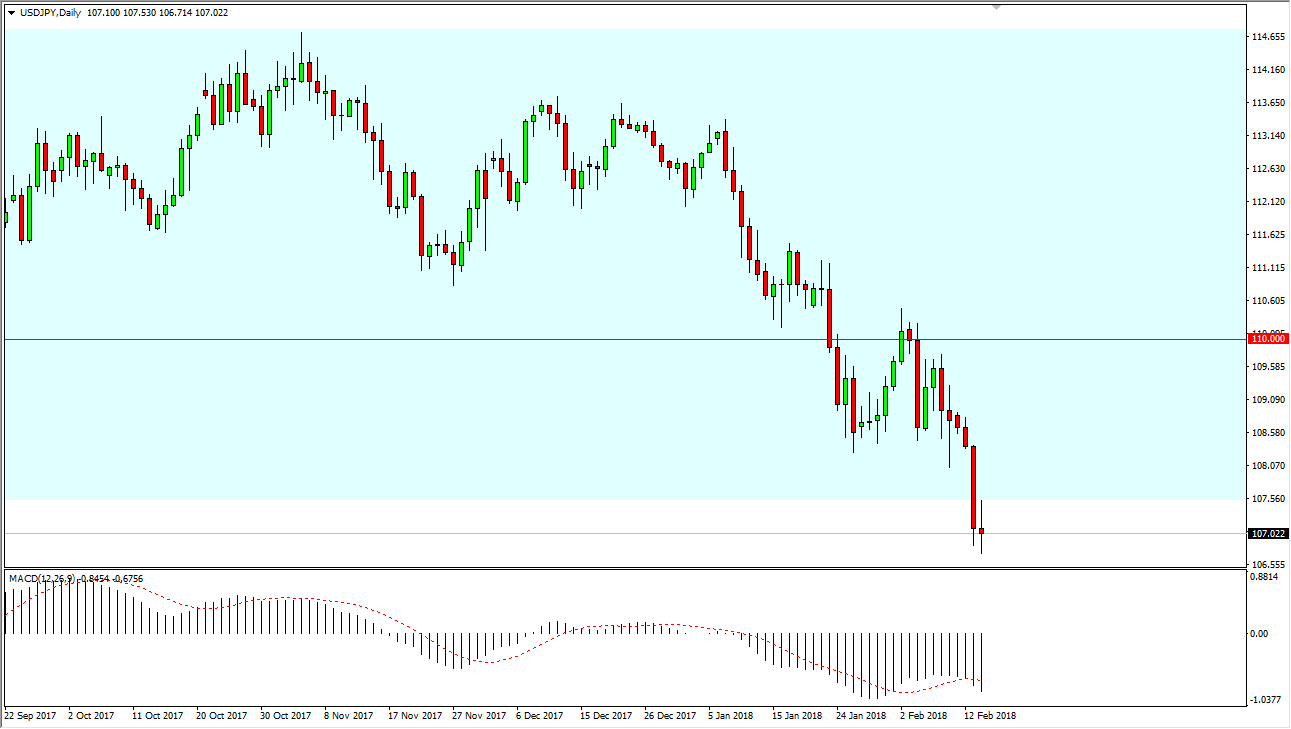

USD/JPY

The US dollar nosedived against the Japanese yen late on Tuesday, and then spent a portion of the day on Wednesday trying to wipe out those losses. The 107.50 level had been significant support in the past, keeping the consolidation area intact. However, breaking down below there was of course a negative sign, and we have since rallied towards that area only to turn around and fall again. Market memory dictates that a previous support level should be resistance in the future, and that’s exactly what we have seen. The daily candle looks like a bit of a shooting star at the bottom of the downtrend, meaning that we will continue to see this pair struggle. The pair is sensitive to risk appetite, but more importantly, it appears that the US dollar is being sold off everywhere. I have no interest in buying this pair in the short term, but I recognize there is a massive amount of noise below at the 105 handle.

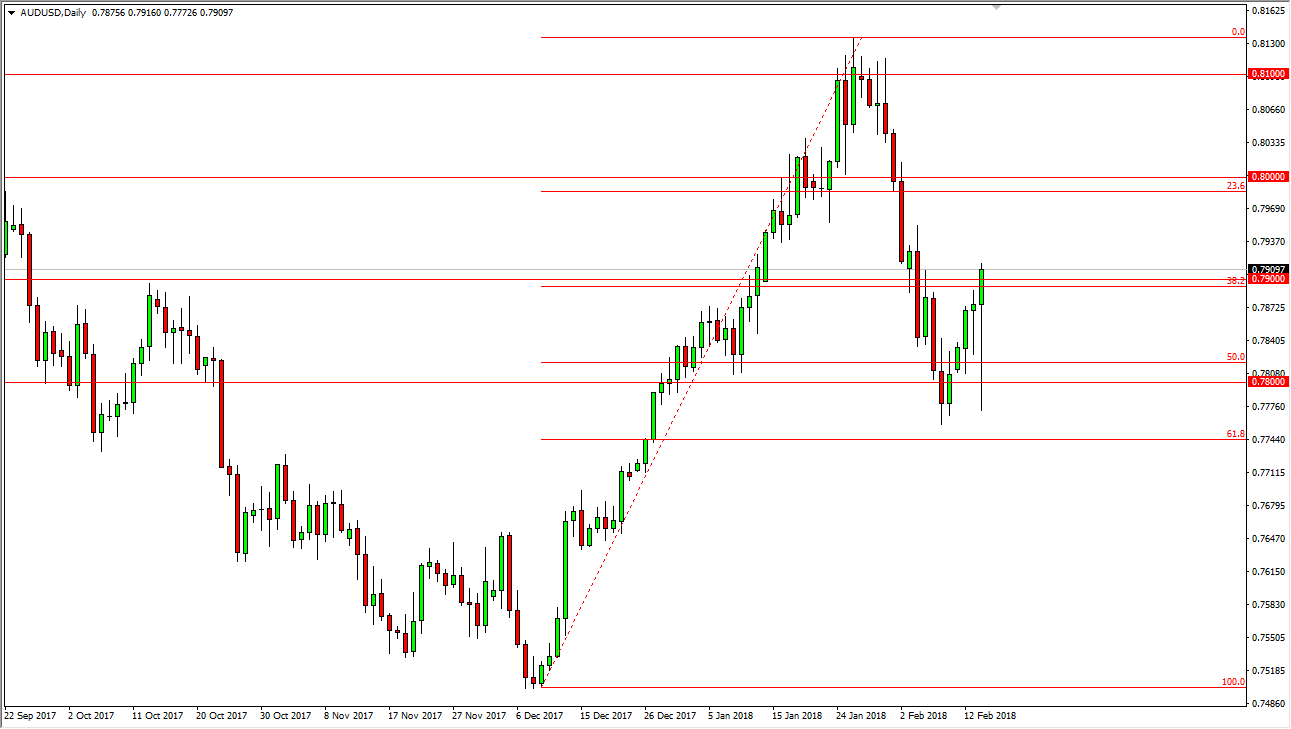

AUD/USD

The Australian dollar fell significantly during the day on Wednesday but found enough support just below the 0.78 handle to turn around and form a massive hammer. That was preceded by a hammer on Tuesday as well, so that suggests that we are going to continue to see a lot of volatility but also traders coming in and picking up the Australian dollar every time it falls. I believe that we are going to go towards the 0.80 level above, an area that is important on longer-term charts, essentially a massive “pivot point” going back decades, to at least the late 1980s. The market will have resistance going all the way to the 0.81 handle, and if we can break above there I think we finally become more of a “buy-and-hold” situation. This will be especially true of gold breaks out.