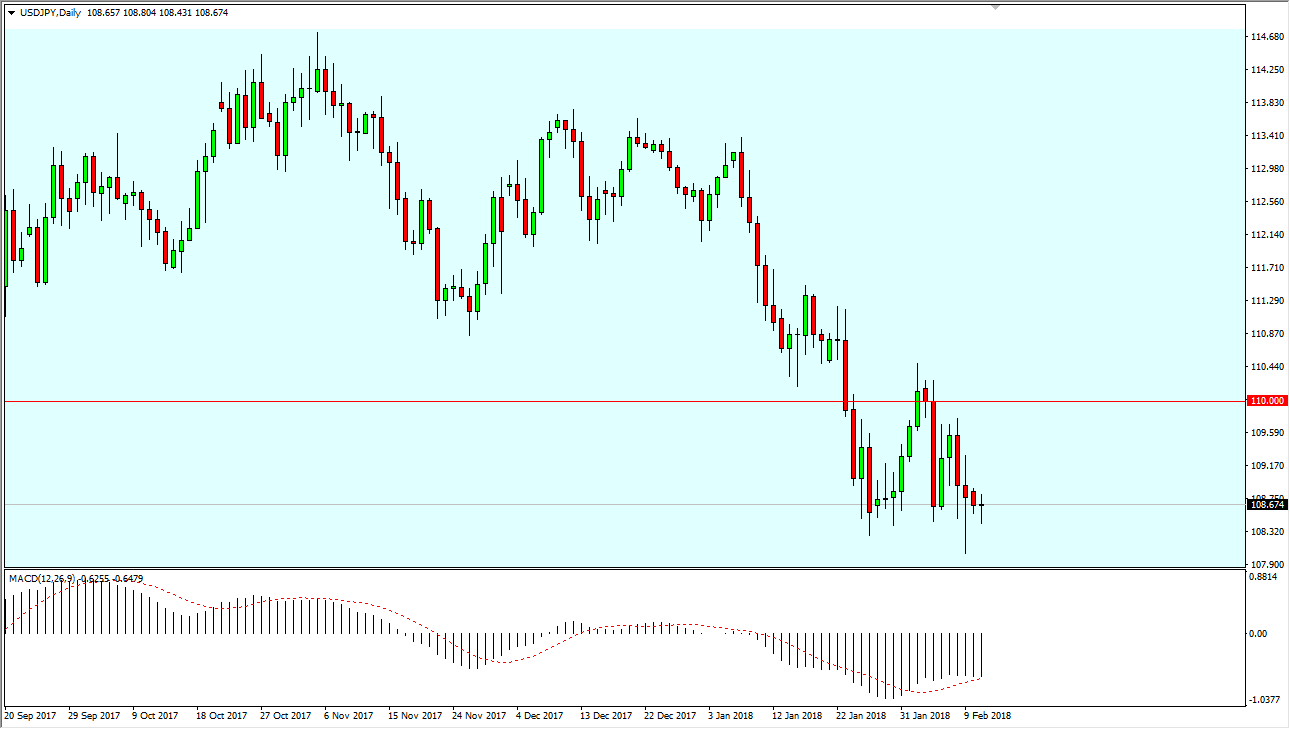

USD/JPY

The US dollar has done very little against the Japanese yen during the trading session on Monday, but the one thing that I do see is that the 108.50 level continues to attract a lot of attention. Because of this, and the fact that I see even more support at the 107.50 level, it’s likely that any time we dip, there will be buyers underneath to pick this market out. If we can break above the 110 handle substantially, that should form a short-term bottom for the market and I believe at that point will probably go looking towards the 113.50 level above. Obviously, we need risk appetite to pick up to get that moved, as typically this pair will rise with the S&P 500. If we break down from here, on a move below the 107.50 level, I would anticipate that the market goes looking towards the 105 level.

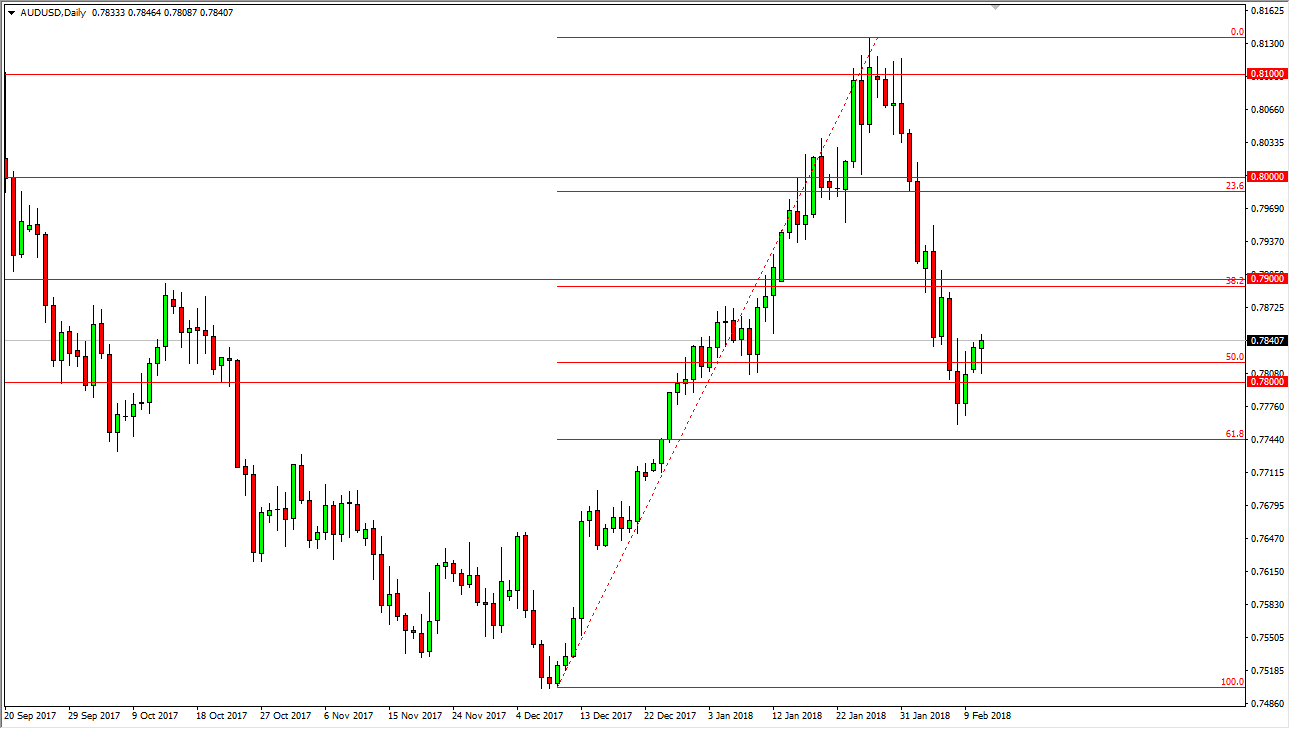

AUD/USD

The Australian dollar has initially pulled back against the US dollar on Monday but found enough support above the 0.78 level to turn around and form a hammer. I believe that if we break above the top of the range for the day, the Australian dollar is free to go higher, perhaps towards the 0.79 level initially. A break above there has the market looking for the 0.80 level, and then eventually the 0.81 handle. I have no interest in shorting this market, as I believe that the pullback to the 61.8% Fibonacci retracement level has made a lot of sense, and it does look like the buyers are coming back. Moreover, I believe that the market got far too ahead of itself earlier, and now we have corrected that overbought condition. Overall, I am a buyer of dips on short-term charts.