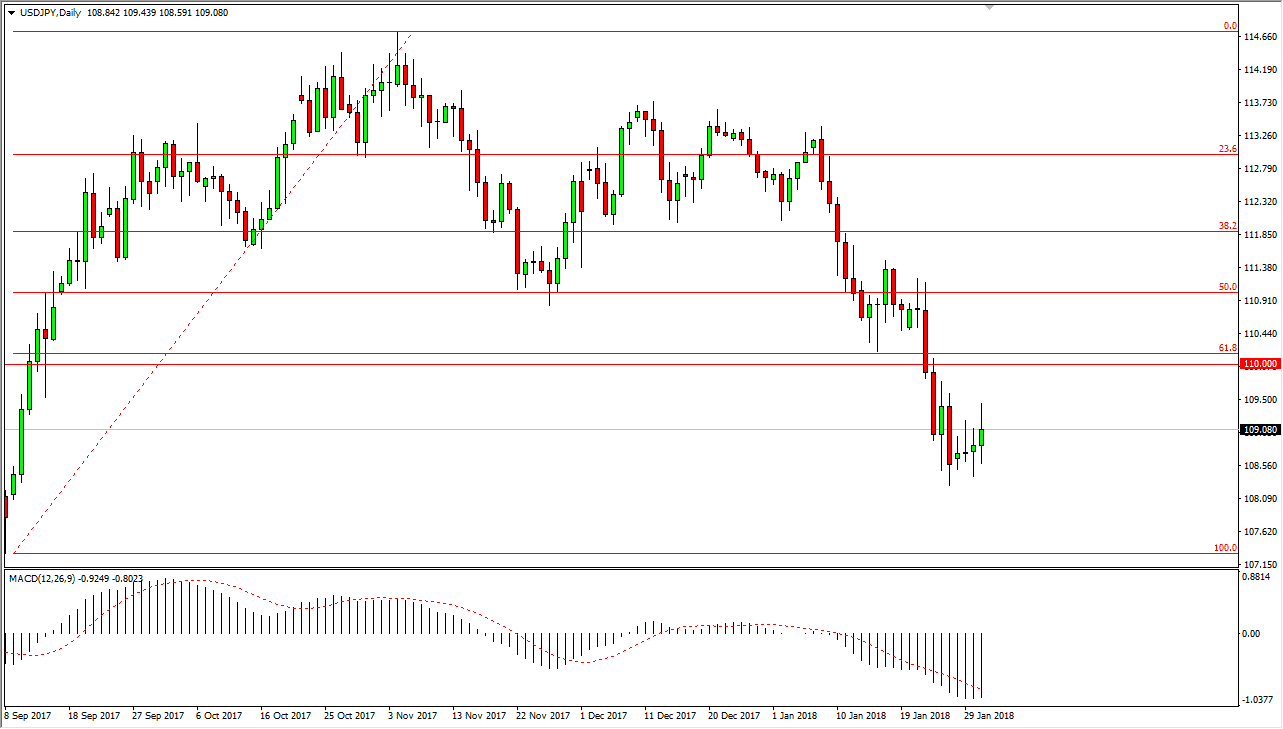

USD/JPY

The US dollar rallied against the Japanese yen during the trading session on Wednesday but struggled to maintain those gains towards the end of the day. That does not surprise me, I believe that most traders will be concerned about the jobs number coming out this week, and that of course will have a massive effect on this market as it typically does. In general, if the jobs number in America is good, this pair will rally, and of course the opposite is true. I think there is a hard “floor” at the 107.50 level, and a “ceiling” at the 110 level. If we do break above the 110 level, then we are free to go to the 111.50 level, and possibly beyond that level towards the 112 level, followed very quickly by the 114 handle. This is a market that will be very volatile, but not today, at least under normal circumstances.

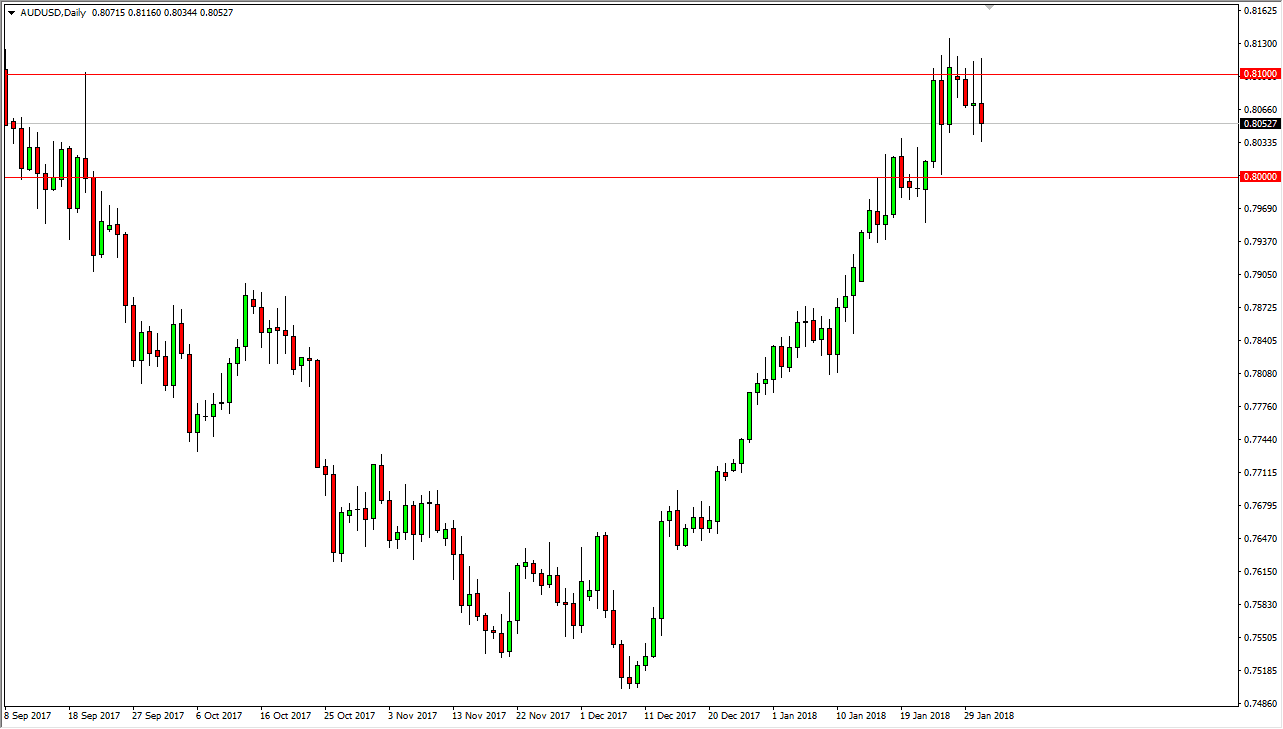

AUD/USD

The Australian dollar initially tried to rally during the day, but then turned around to form a shooting star. The shooting star is of course a very negative sign, and it shows that the market is perhaps going to roll over slightly, but I think there is a significant amount of bullish pressure underneath near the 0.80 level. If we can break out to a fresh, new high, then the market should continue to rally, but it will more than likely need the help of gold to do so, and it probably won’t happen until we get those vital job numbers. If the US dollar sells off, that could be reason enough for this market to continue to go higher, and certainly would influence gold which also has a secondary effect here as well. If we break down below the 0.7950 level, then we could have more of a selloff coming.