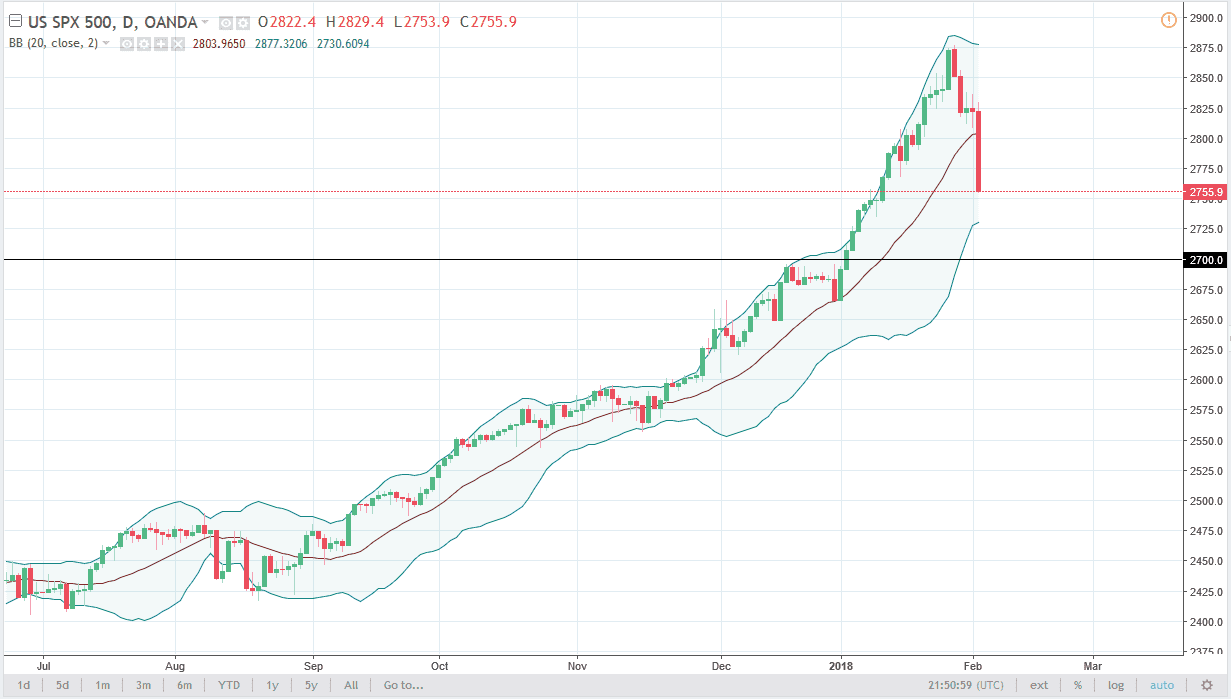

S&P 500

The S&P 500 broke down significantly on Friday, losing over 2%. This was due to fears about interest rates rising, as the bond market has started to selloff. This of course influences stocks, because suddenly you can find yield on bonds. Bonds are obviously much safer to trade than starts, so that hurts the stock market. This is especially true when it comes to dividend paying stocks, as although they offer yield, they also can lose underlying value much quicker. Ultimately, it looks as if investors are starting to get an idea that bonds may work out, and if that’s the case suddenly stocks have a bit of competition. The 2700 level underneath should continue to be supportive though, and I think somewhere in that area we may get buyers coming back in to take advantage of value. I would not short this market, I think simply waiting for stabilization to go long is probably the way to trade.

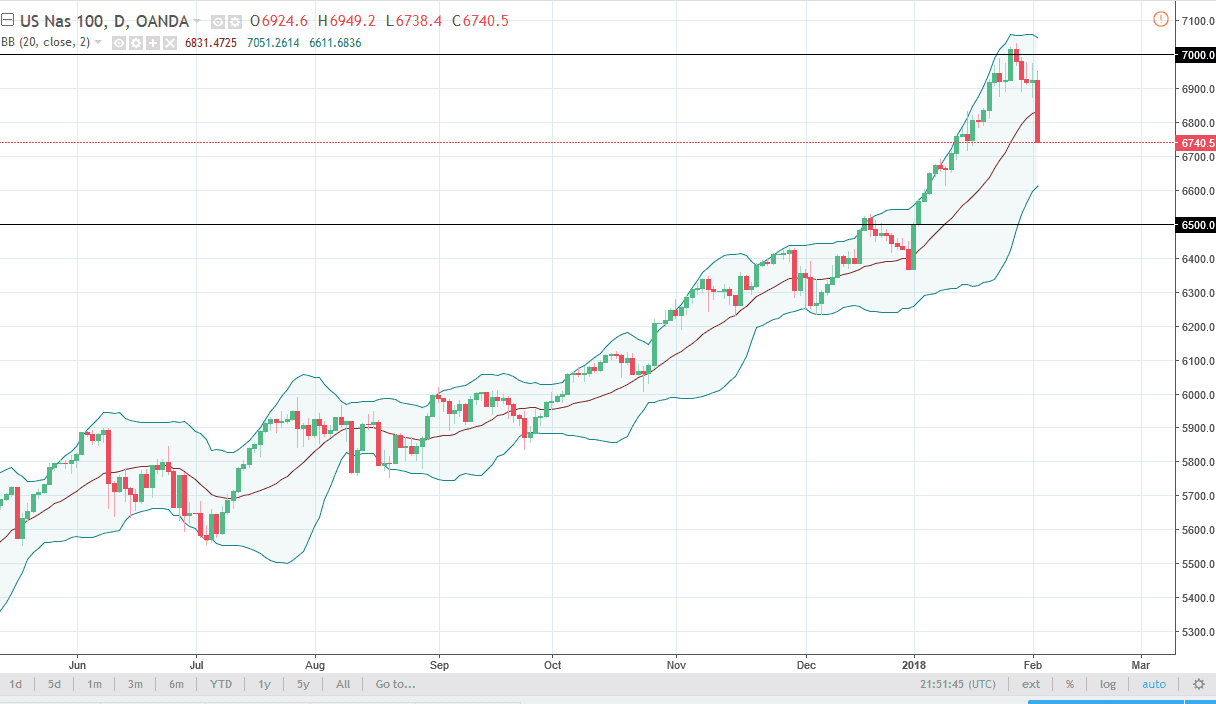

NASDAQ 100

The NASDAQ 100 also broke down during the day, as the 7000 level has offered far too much in the way of resistance. We broke down below 6900, and then sliced through the 6800 level. That is a negative sign, and as you can see on the chart, I have a line at 6500. I think if we can go as low as 6500, traders will jump back into this market on the possibility of value. If we break down below the 6400 level, it could be rather ugly, but I think it’s only a matter of time before buyers would return. 7000 of course is psychologically resistive, so it’s not a surprise that we rolled over there. Given enough time, I believe that buyers will return, but be patient and wait for value.