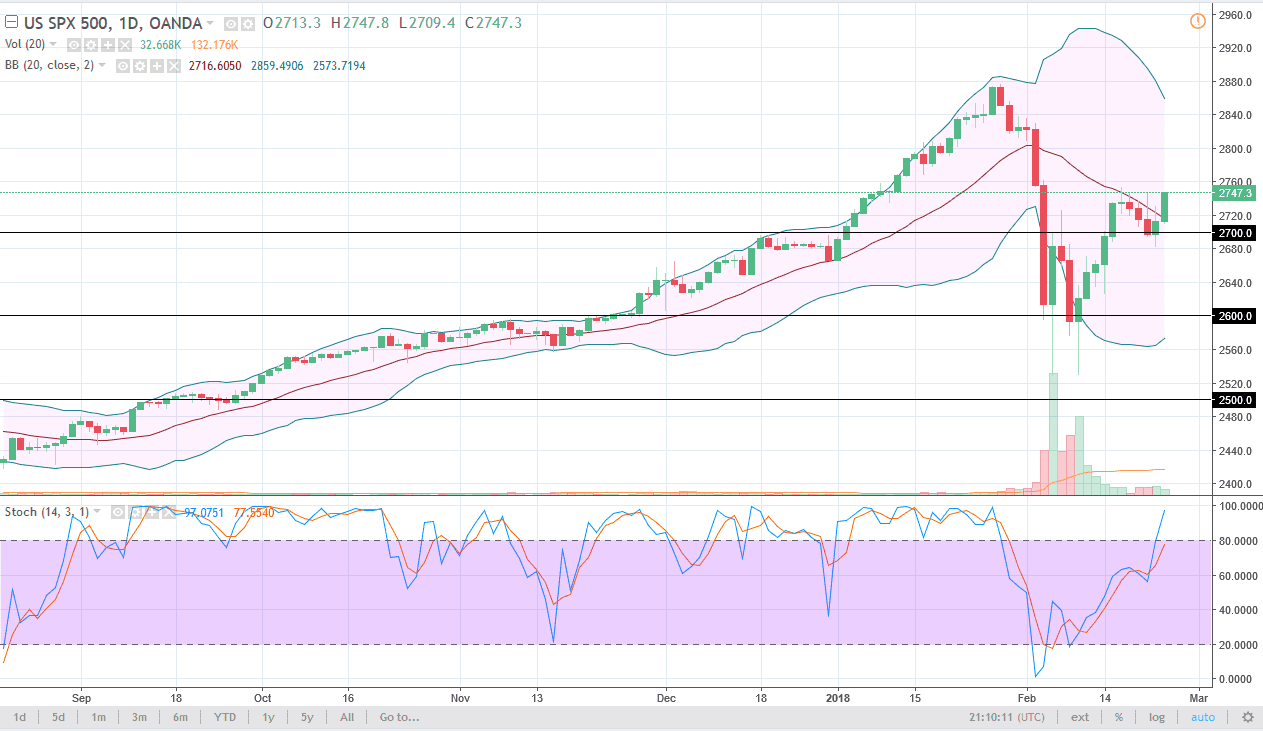

S&P 500

The S&P 500 has rallied significantly during the trading session on Friday, gaining over 1.25%. It looks as if we are pressing the top of the recent consolidation, and the weekly chart formed a hammer. I think we are going to continue to go higher, a break above the 2758 level then sends the market looking for the 2850 level over the longer term. I think that this week should be very bullish for the S&P 500 barring some type of negative headline coming out. I think that the 2600 level underneath is support, extending down to the 2500 level. Longer-term, I believe that we are going to continue to go towards the 3000 level, which is my longer-term target for the year, perhaps even by the end of the summer.

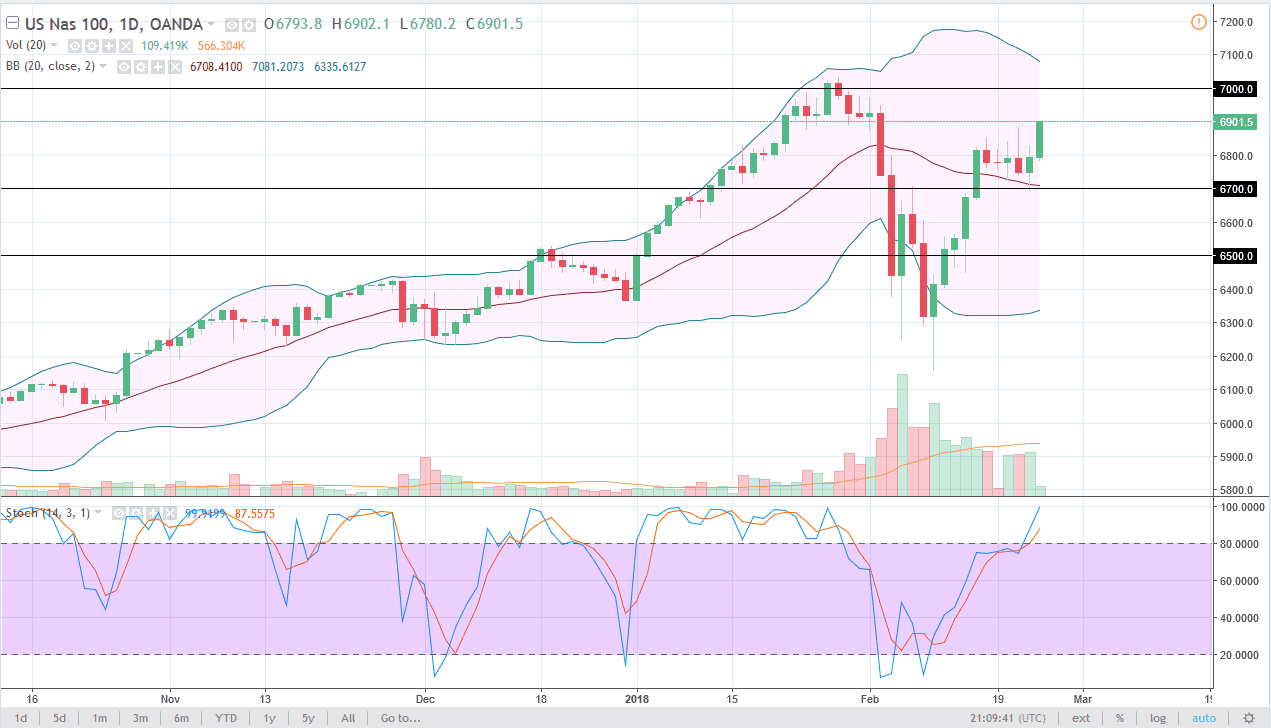

NASDAQ 100

The NASDAQ 100 also rally during the day, gaining over 1.6%, as we have broken above the 6900 level. It looks as if we are going to go to the 7000 handle above which has been resistance in the past. While I don’t know if we can break above there and one attempt, certainly we will given enough time. If we can break above the 7000 level, then the market goes to the 7200 level, as it is the measured move from a recent consolidate of break out. I think that short-term pullbacks give us opportunities to pick up value, and the 6700 level very well could become the next “floor” in the market. If the US dollar roles over, that should continue to help US stock markets as well, and that could give us yet another reason to start buying the NASDAQ. It makes technology cheap, which is one of the bigger drivers of this market.