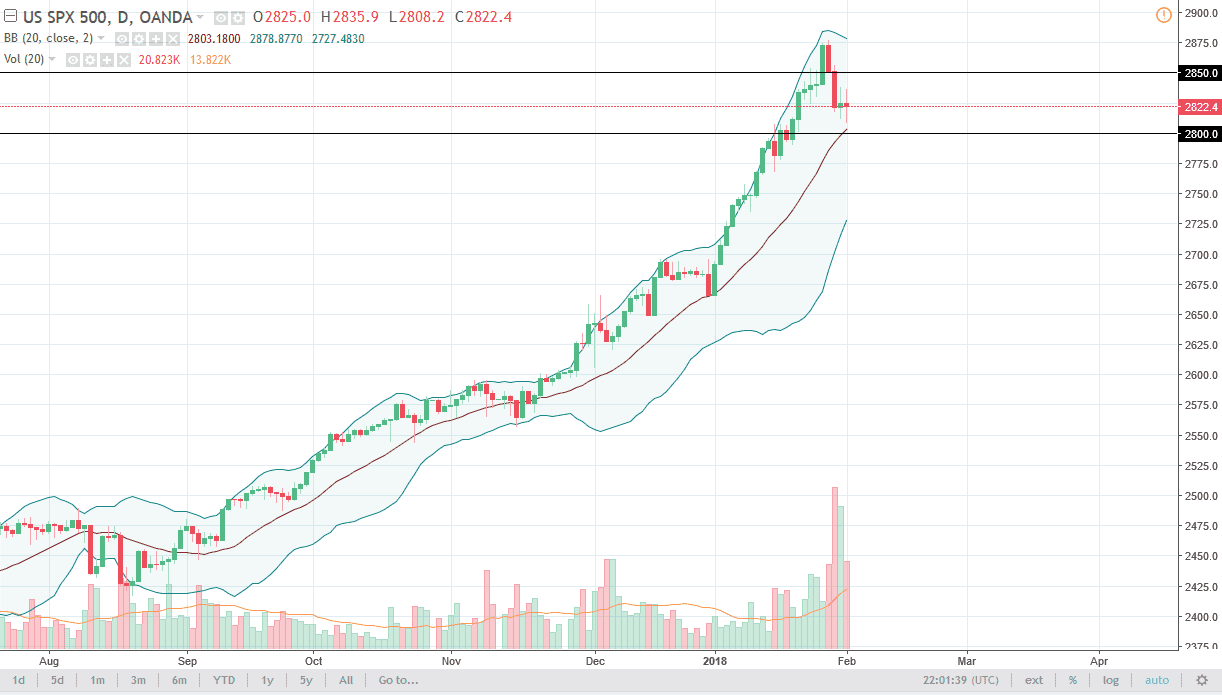

S&P 500

The S&P 500 went back and forth during the trading session on Thursday, which makes a lot of sense considering we are awaiting the jobs numbers today. You can see that the volume has been rather strong as of late, but we are essentially going nowhere as we await this announcement. If we can continue to go higher, the market will probably look for the 3000 level above, and that is my best case scenario. However, we will occasionally get a bit of a pullback, but that should be a buying opportunity. It looks like the 2800 level is trying to offer support, and it is the 20 SMA from the Bollinger Bands indicator on the daily chart as well.

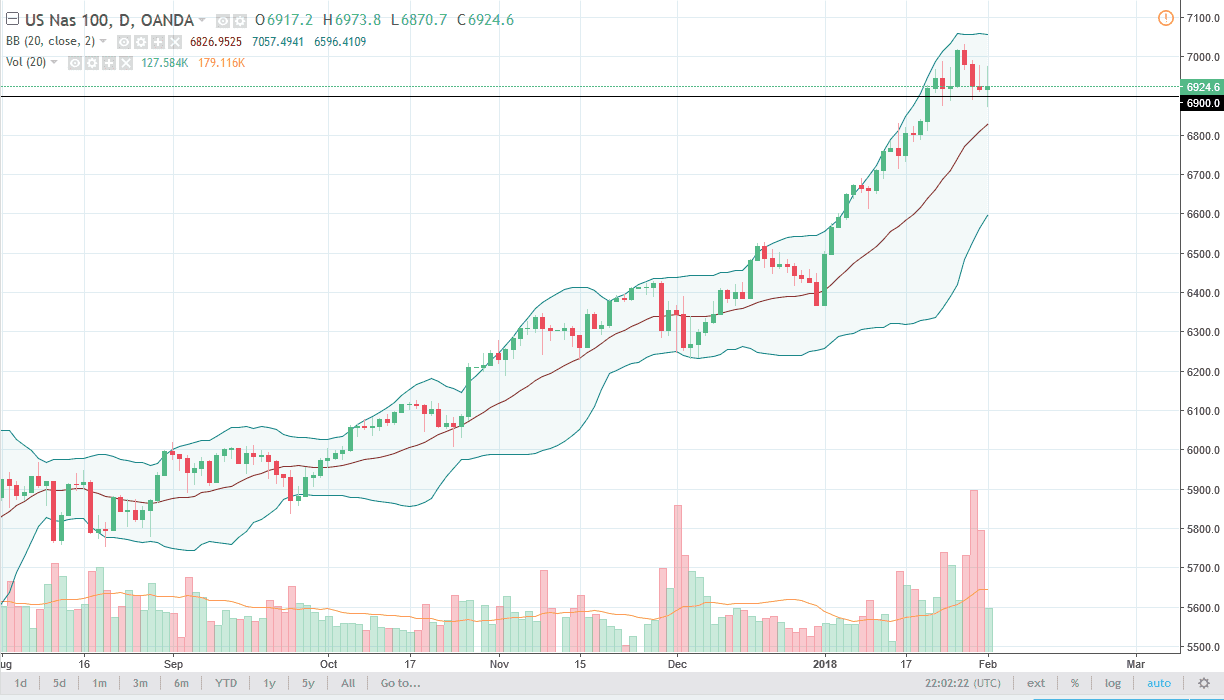

NASDAQ 100

The NASDAQ 100 went back and forth during the trading session as well, bouncing from the 6900-level region. I think that the market will eventually go looking towards higher levels, and I think that buying dips continues to be the way going forward in the NASDAQ 100. I think that the 6800 level is also massively supportive, and it’s probably only a matter of time before we build up the necessary momentum to break above 7000. Once we do, I expect to see a large move to the upside, perhaps the next leg higher in the longer-term move. I believe that we will eventually find reasons to go higher, perhaps a shrinking US dollar could be one of the major drivers. I believe that the market pulling back only offers an opportunity for those who are longer-term investors to pick up bits of value. If we break down below the 6500 level, then the uptrend is over, but we are quite some distance from doing that.