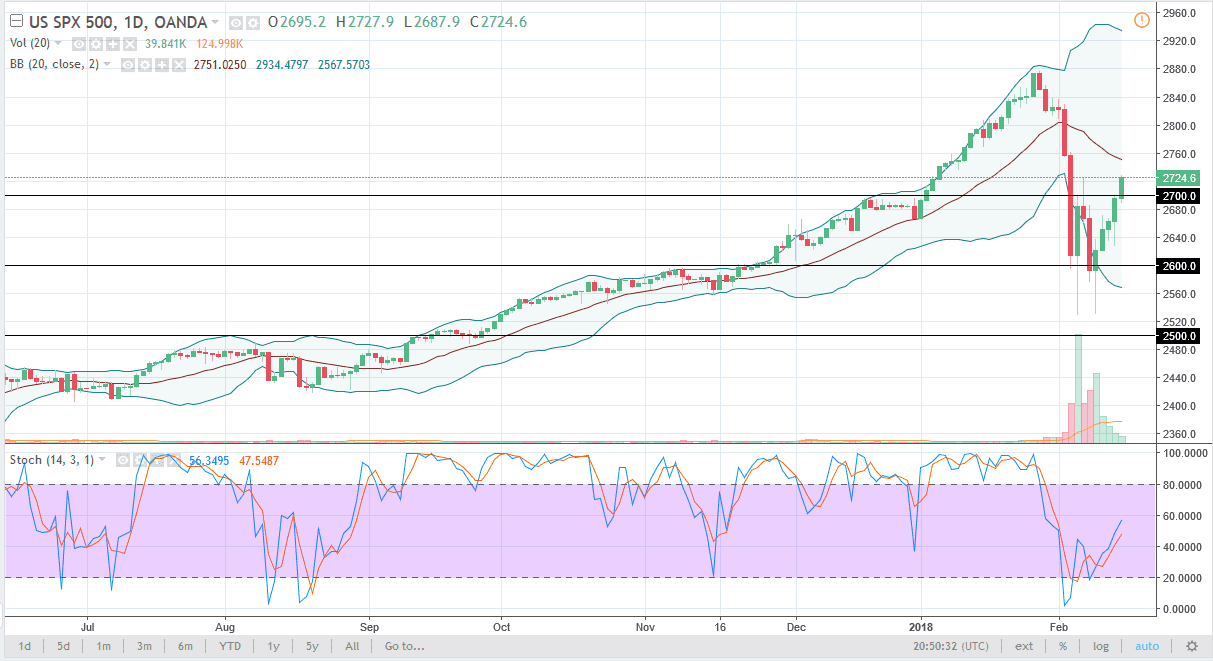

S&P 500

The S&P 500 traders rallied a bit during the trading session on Thursday, breaking significantly above the 2700 level, and pressuring the top of the shooting star from last week. If we can break above there, the market should continue to go much higher, and I think that’s about to happen. If we do get a short-term pullback, it should be a buying opportunity eventually, with the 2700 level possibly offering support. If we break above the top of that shooting star from last week, the market should then go to the 2800 level, and then eventually the highs again. I believe that a lot of larger players have jumped back into the market, and that should help continue to push this market. I have no interest in shorting this market, least not until we break down below the 2600 level, perhaps even the 2500 level which I see as the “floor” of the uptrend.

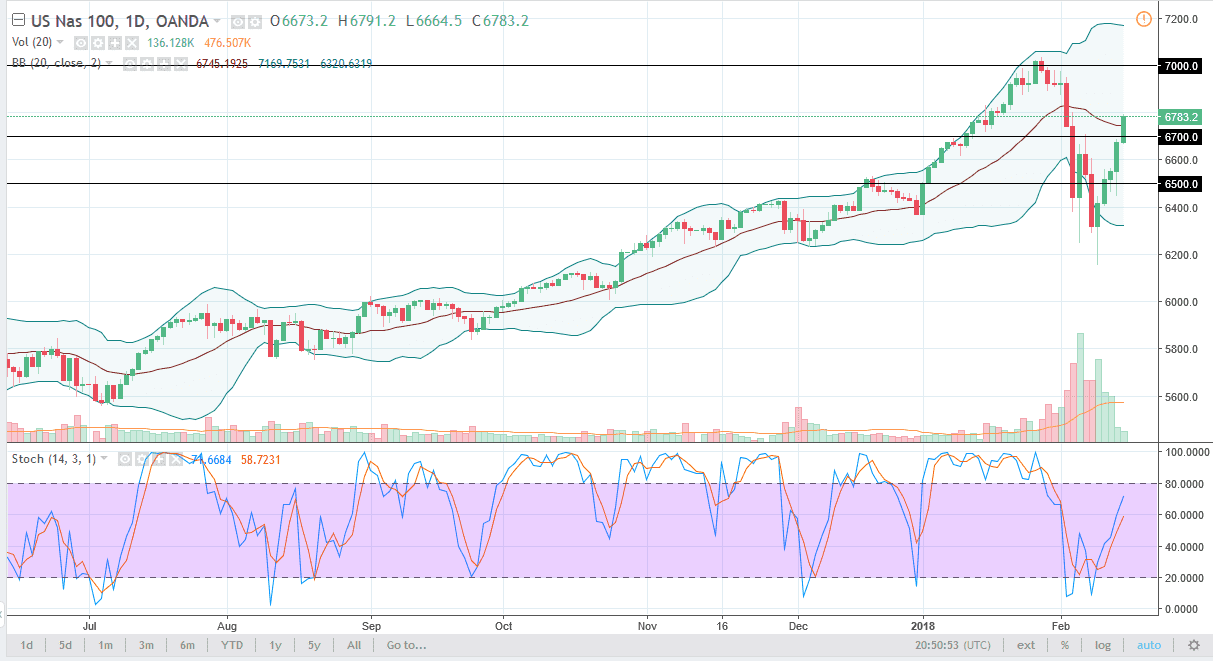

NASDAQ 100

The NASDAQ 100 also broke out to the upside during the day and managed to clear the vital 6700 level. The 7000 level above is the longer-term target that I see, but I think short-term pullbacks will occasionally happen. The should be buying opportunities, as US stock markets in general look very likely to continue to see bullish pressure. If we can break above the 7000 handle, the market is very likely to continue to go much higher, perhaps reaching towards the 8000 level over the long term. In the meantime, I have no interest in shorting this market and I believe that the “floor” of the market is somewhere near the 6200 level. If we break down below there, the market could fall apart but I think we will continue to see money go flowing into New York and pushing the US indices higher.