S&P 500

The S&P 500 went sideways initially during the trading session on Wednesday, but then pulled back to the 2625 level as CPI numbers came out stronger than anticipated in America. This shows inflationary pressure, and stock traders freaked. However, we bounced above and reached towards the 2700 level, as the market has recovered quite nicely. If we can break above the 2725 level, the market should continue to go much higher, reaching towards the 2800 level after that, eventually reaching towards the 3000 later in the year. I believe in buying on dips, as this market has been in a very strong uptrend. The market is ran by algorithmic traders, and the of course have been very aggressive and very tenacious in their buying. It’s not until we break down below the 2500 level that we would have to worry about the overall uptrend.

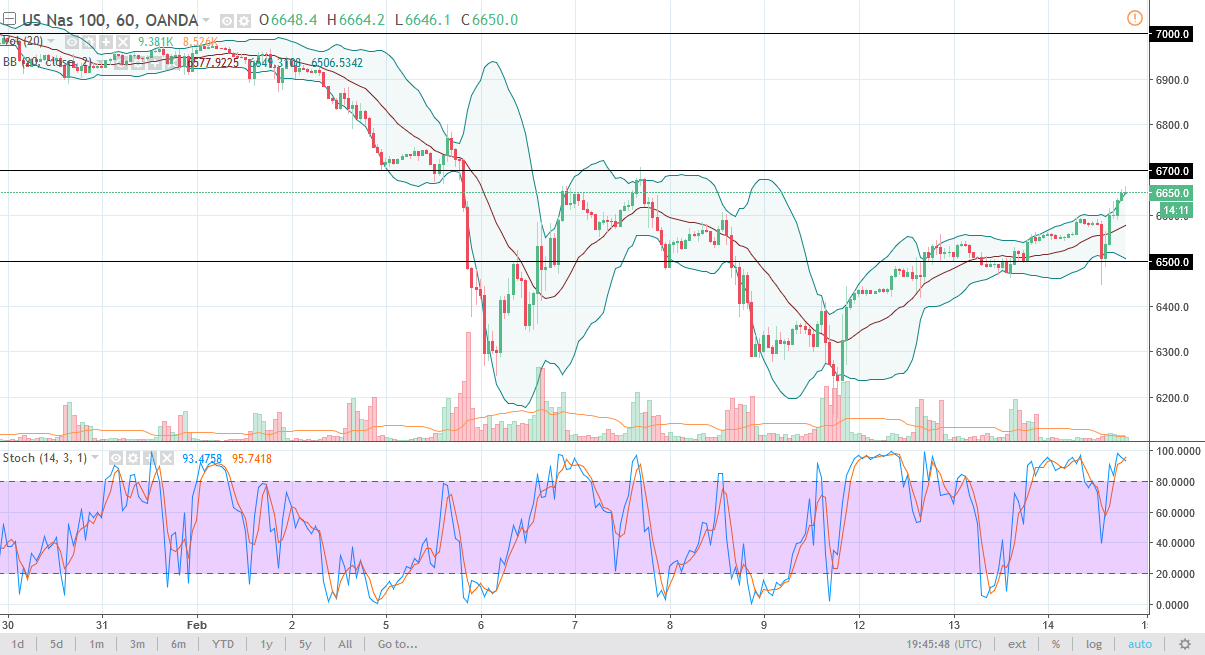

NASDAQ 100

The NASDAQ 100 initially went sideways during the trading session on Wednesday, but then pulled back to the 6500 level. The 6500-level underneath is previous support and resistance, and of course a large, round, psychologically significant number. By bouncing from there, it looks as if the uptrend is going to continue, and perhaps reach towards the 6700 level. If we can clear the 6700 level, the market is free to go much higher, perhaps reaching towards the 7000 handle. Ultimately, this is a market that is going to continue to be a “buy on the dips” scenario, as the bullish pressure is relentless. I believe that the 6500 level will be a floor in the market, and I think that the bottom of the uptrend is somewhere near the 6200 level. Because of this, I have no interest in shorting this market, and I believe that the longer-term outlook for this market is very strong.