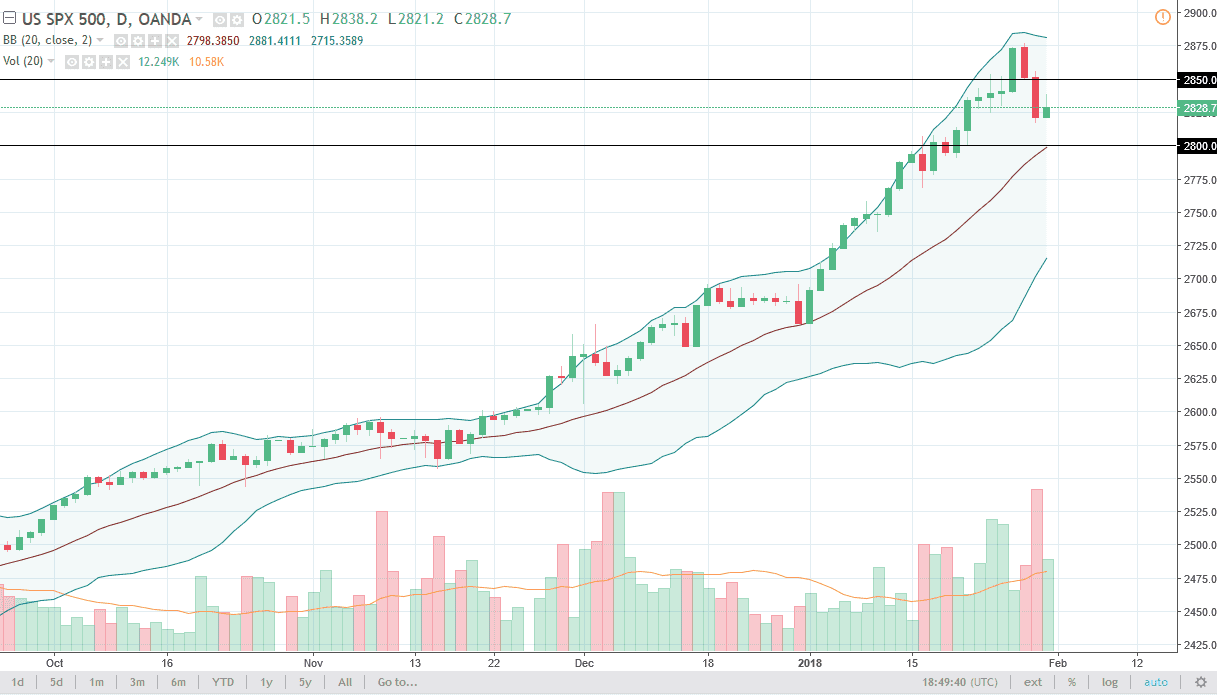

S&P 500

The S&P 500 rallied during the trading session on Wednesday but gave back quite a bit of the gains. By doing so, it was somewhat of a lackluster day, and we had formed something that looks a bit like a shooting star. However, I don’t read too much into it as we have the jobs number coming out on Friday, so it’s likely that we will continue to struggle to find the people willing to throw money into this market with confidence. Looking forward, I fully anticipate that any pullback will be thought of as a buying opportunity, and traders will be willing to pick it up. The 2800 level should be supportive, but I believe that the 2775 level is supportive as well. It’s only a matter of time before the buyers get involved, but it may take 24 hours or so for them to do so.

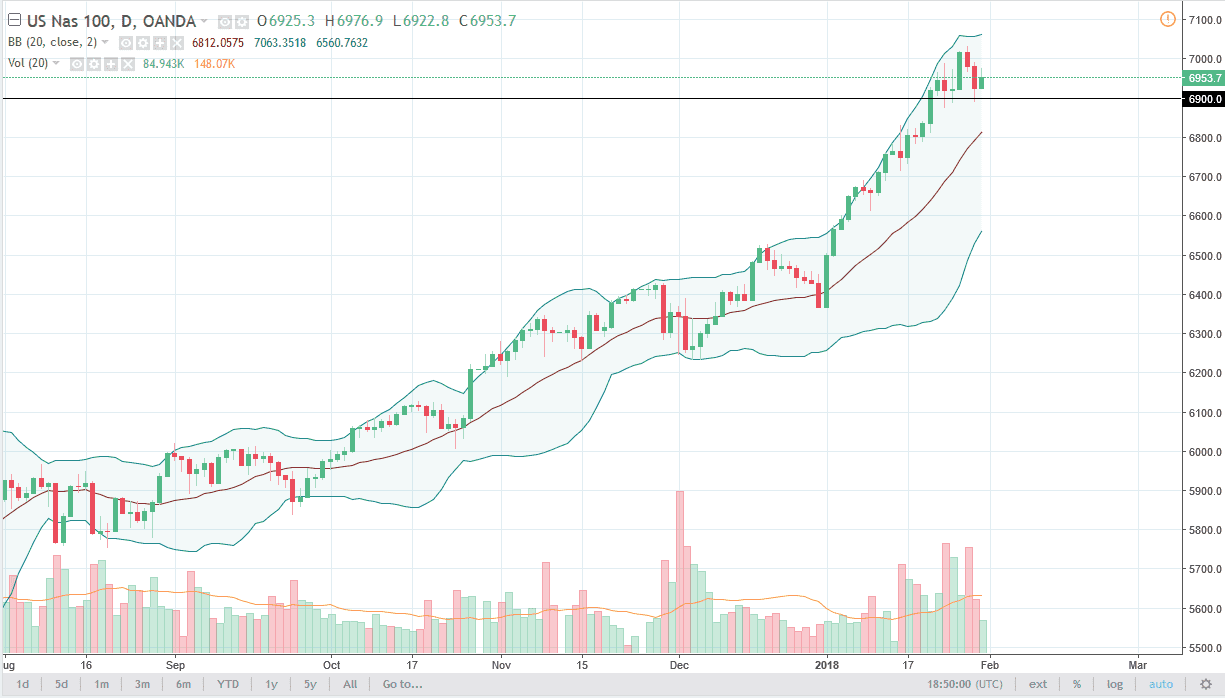

NASDAQ 100

The NASDAQ 100 has rallied a bit during the day as well, gaining about 30 points. I believe that the market should continue to go higher, reaching towards the 7000 handle. A break above that level should send this market much higher, but it might be difficult to happen in the next 24 hours, as the market is awaiting the jobs number. The jobs number of course has a massive influence on the stock market, so a lot of traders will be waiting before they put a lot at risk. If we break down below the 6900 level, I also believe that the 6800-level underneath will be supportive. It is only a matter of time before the buyers get involved, and therefore I am patiently waiting some type of dip to take advantage of. I have no interest in shorting the NASDAQ 100.