Gold prices fell for a fourth straight session on Wednesday to settle at their lowest level in a week as the dollar strengthened after minutes from the latest Federal Reserve Open Market Committee meeting showed that policymakers backed further interest rate hikes. Global stock markets, including U.S. stock indexes, were lower yesterday, weighed down by fresh concerns about higher interest rates. A solid rally in the U.S. dollar index worked against the precious metal but volatility in the stock market limited selling pressure.

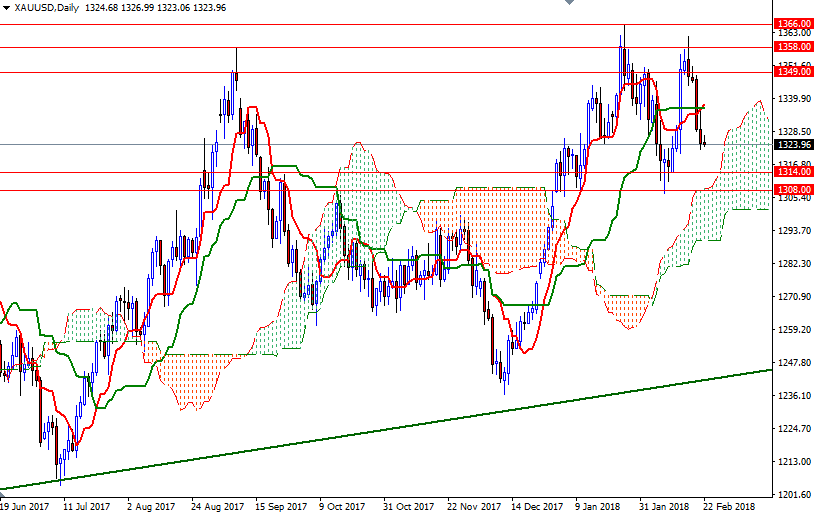

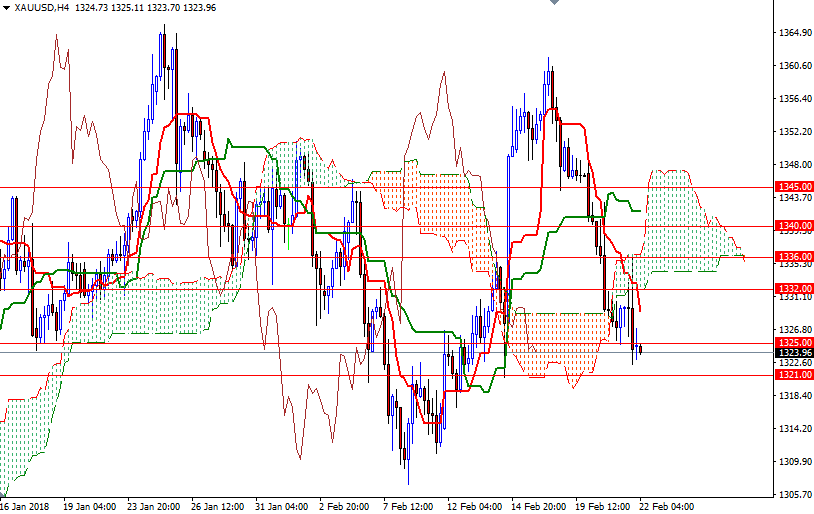

From a chart perspective, the bears still have the near-term technical advantage, with the market trading below the Ichimoku clouds on the H4 and the H1 charts. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned on both time frames, and the daily Chikou-span (closing price plotted 26 periods behind, brown line) is below prices. However, note that there is a critical support right below at 1321 and the bears have to capture this camp to make an assault on 1316 and 1314/2. A successful break below 1312 could foreshadow a move down to 1308/4.

Interim resistance is seen at 1327.50 and then at 1329.50. If XAU/USD pushes through 1329.50, a test of 1333.30-1332 seems possible. The top of the hourly Ichimoku cloud stands in the 1337/6 area so the bulls will have to produce a daily close above there to take the reins and challenge the next strategic resistance in 1342/0.