The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 25th February 2018

In my previous piece last week, I saw the best possible trades for the coming week as long of the S%P 500 Index, short of the USD/JPY currency pair, and half-size short of the Forex currency pairs GBP/USD and EUR/USD respectively. The S&P 500 Index rose by 0.36%, but the USD/JPY rose by 0.55%, while GBP/USD fell by 0.45% and EUR/USD by 0.93%. The results were not good, producing an average loss of 0.29%.

The most important development in the market last week was the continuing recovery in the U.S. stock market from its recent corrective low, with more than half of the S&P 500 Index’s losses being recovered so far. The market has seen the U.S. Dollar undergo a consolidation within its downwards movement, casting some doubt on the long-term bearish trend in the greenback. Many analysts note that there has been no notable change to underlying economic conditions, except for the 10-year bond yield rising towards 3%. It was a very quiet week in the market overall.

As for other currencies, the Japanese Yen remains in the spotlight, as it recently broke up and made a new 15-month high price against the U.S. Dollar, and a new 3-month high price against the Euro. The Japanese Central Bank is not sending out any signals in favor of this strengthening, and there is speculation that some of the Yen’s rise may be caused by Japanese investors repatriating overseas investment, yet that is questionable. It is true however that the market consensus sees the Bank of Japan as likely to begin tightening monetary policy later this year, even though dovish senior staff are being left in place, and the Finance Minister recently remarking last upon the importance of exchange rate stability and the possibility of market intervention.

Fundamental Analysis & Market Sentiment

Sentiment and fundamentals are hard to read, except on the U.S. stock market where it seems both are aligned with bulls. The two factors affecting sentiment in the Forex market over the course of this week are likely to be the testimony before Congress by the new Chair of the Federal Reserve, and Preliminary GDP data, followed by a speech from the British Prime Minister on Brexit.

Technical Analysis

U.S. Dollar Index

This index printed a weakly bullish inside candlestick, although it has a significant upper wick, which closed in its upper half. The price was again unable to make a new low. There is a strong, long-term bearish trend, and a bearish trend line dominates the price chart shown below. However, despite the generally bearish action, this indecisive candle might give bears some reason for caution and suggest a bottoming out.

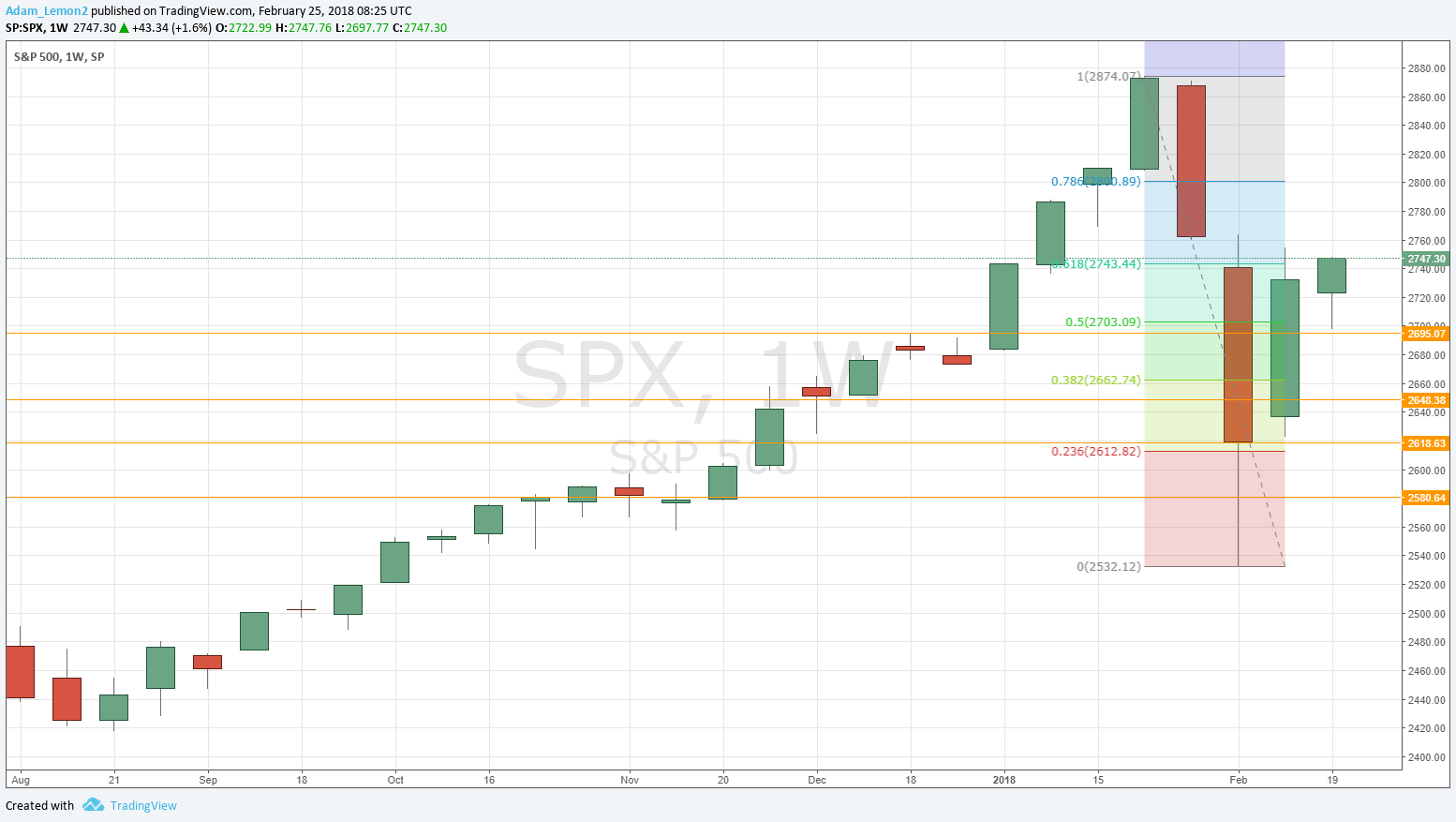

S&P 500 Index

This stock Index is in a long-term upwards trend, and despite the strong, sharp fall since the end of January, last week saw another bullish inside candle that closed right on its high and continued erased more than half of the losses. Volatility is slowing, which is another bullish sign that the bullish trend has most likely resumed.

USD/JPY

This pair has been in a long-term downwards trend, but the long-term picture is relatively consolidative, with a lot of ranging movement within the trend and rejection of key long-term lows. A new 15-month low price was recently made, but last week printed a slightly bullish inside candle. The bullishness is not yet significant, and the Japanese Yen is trending more strongly against the U.S. Dollar than any other major currency. The Euro and British Pound are both at 1-month lows against the greenback.

Conclusion

Bullish on the S&P 500 Index; bearish on the USD/JPY currency pair.