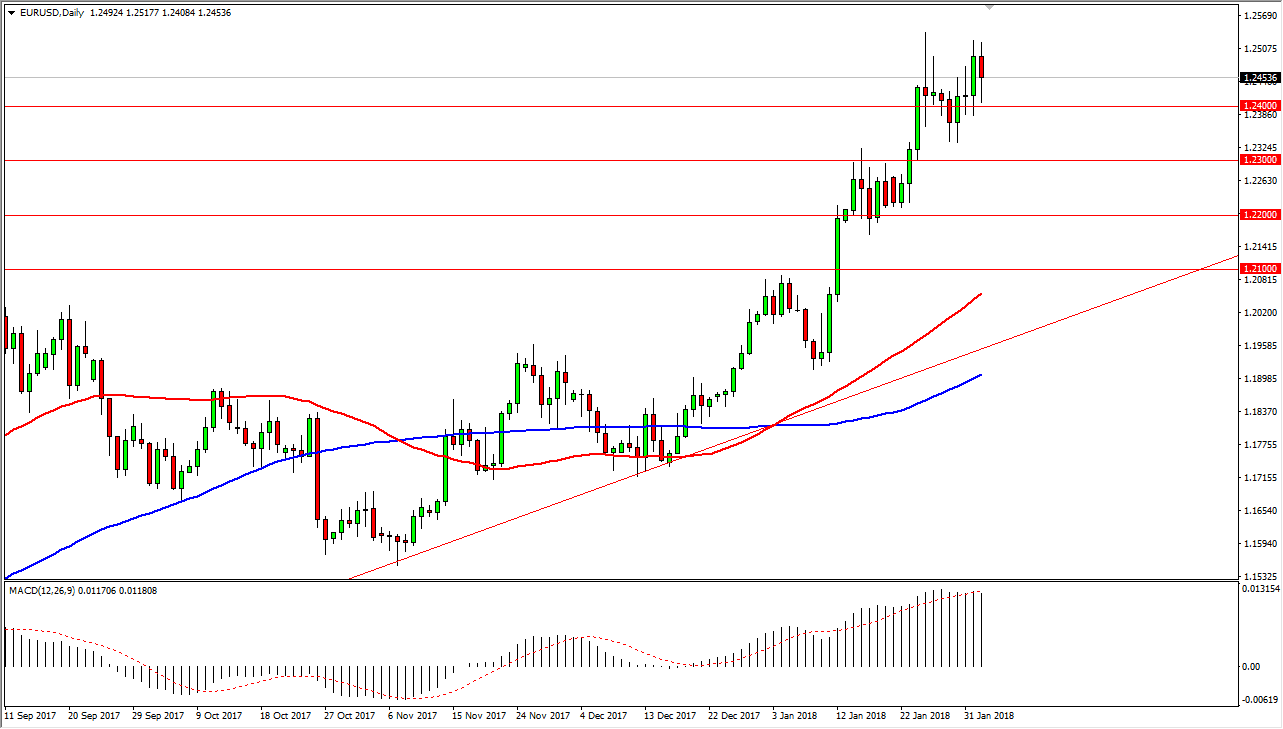

EUR/USD

The EUR/USD pair broke down during the trading session on Friday, reaching down towards the 1.24 level before bouncing significantly. This was the jobs number coming out of America at 200,000 for the month of January that move the market, but quite frankly it looks like we are trying to consolidate in general. The 1.25 level above offers resistance, but I do think that it’s only a matter of time before we break out to the upside. Once we do, I think that this market will eventually reach towards the 1.30 level and based upon a massive bullish flag on the weekly chart, I anticipate that the market could go as high as 1.32 over the longer term. Buying on the dips continues to be a viable strategy for the EUR/USD pair, so I have no interest in shorting, least not until we would break down below the 1.20 level at the minimum.

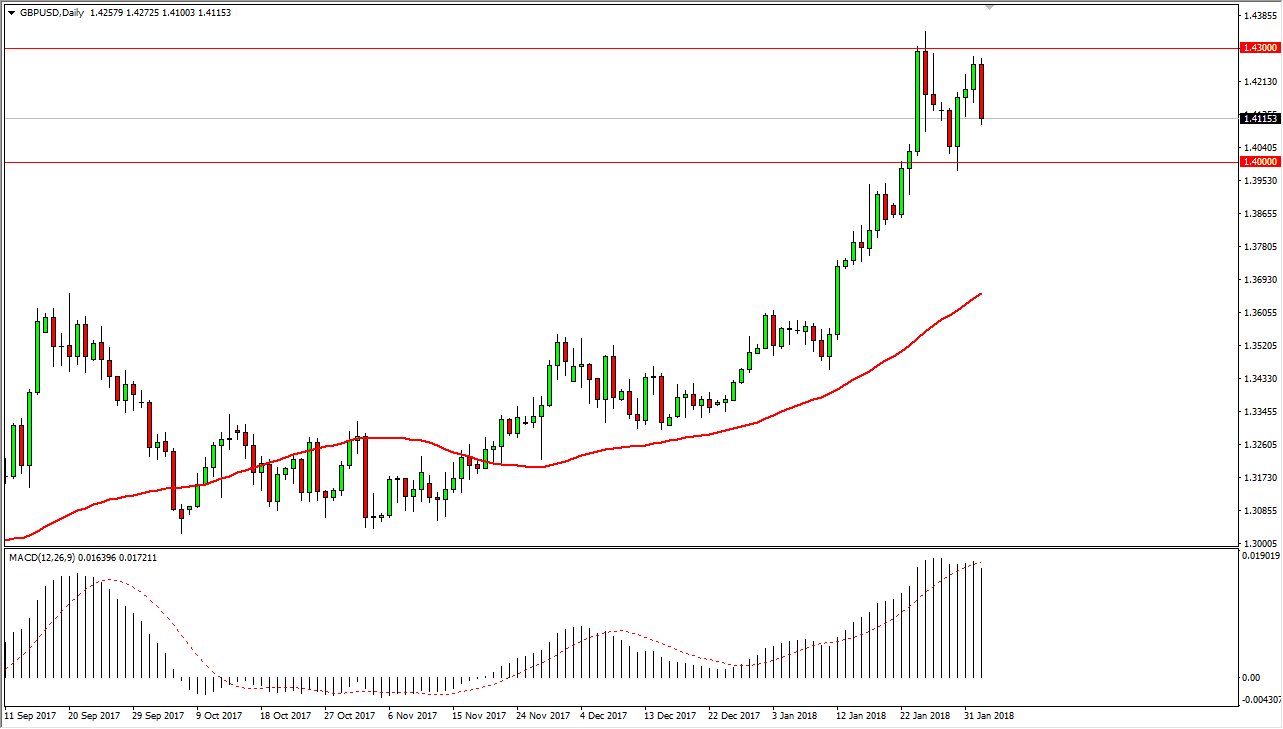

GBP/USD

The British pound has sold off rather significantly during the trading session on Friday but has stabilized a bit after the jobs number. I think that there is a massive amount of support below at the 1.40 level though, so it’s only a matter of time before the buyers get involved. If they do, the market should then reach towards the 1.43 level, and then perhaps reach towards the 1.45 level longer term. This market has been very bullish for some time, and the choppiness that we find now is simply a function of this market trying to chew through the massive amounts of noise just above on the longer-term charts. I do believe that eventually we go much higher, but we had gotten a bit parabolic, so it makes sense that we would take a bit of a breather in this area.