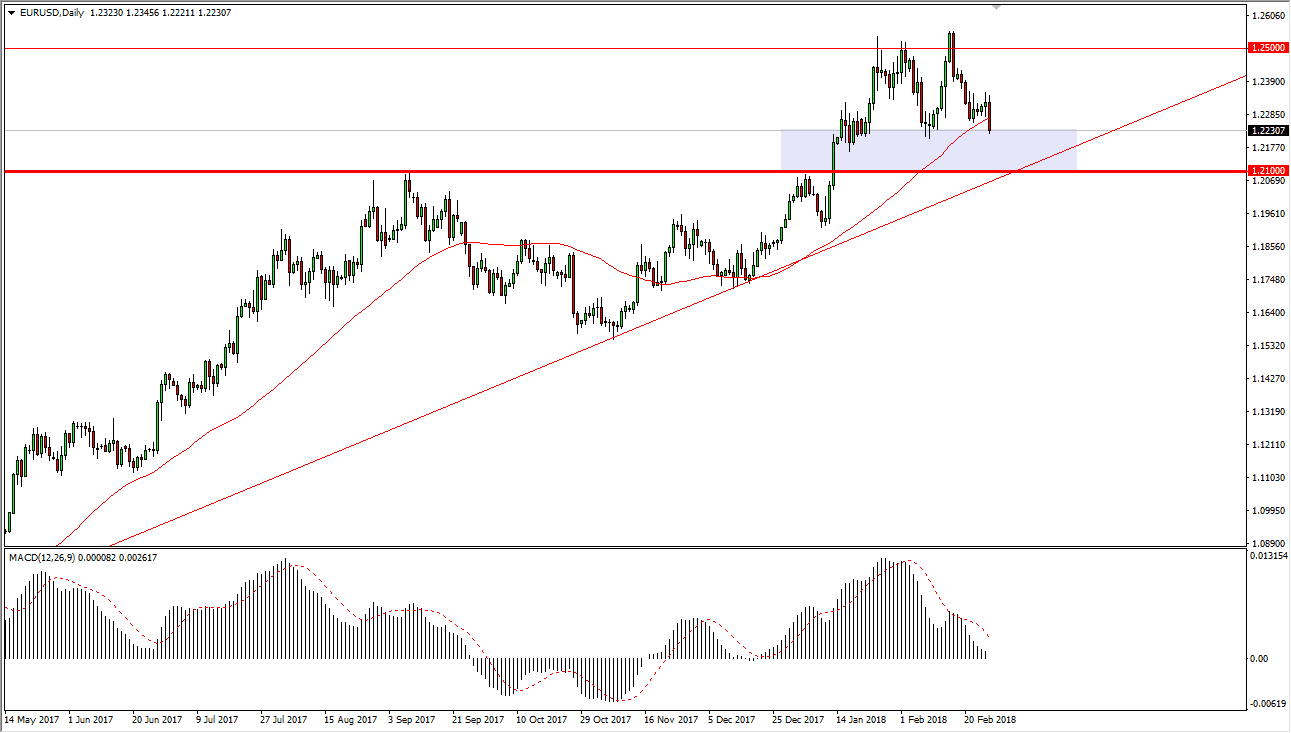

EUR/USD

The EUR/USD pair fell initially during the trading session on Tuesday but is starting to see a bit of support near the 1.22 handle. The area just below continues to show a lot of support, extending down to the 1.21 handle. I believe that the uptrend line that coincides with that area will also offer a bit of support, and we are currently trading around the 50-day EMA. I think that if we do fall from here, it should be a nice buying opportunity, if we can stay above the 1.21 handle. The 1.20 level underneath should be the “bottom” of the uptrend, and therefore I believe that we are going to see plenty of value hunters come into this market sooner, rather than later. Eventually, I anticipate that we will build up the necessary momentum to finally break above the 1.25 handle. I have no interest in shorting this pair if we remain above 1.20 below.

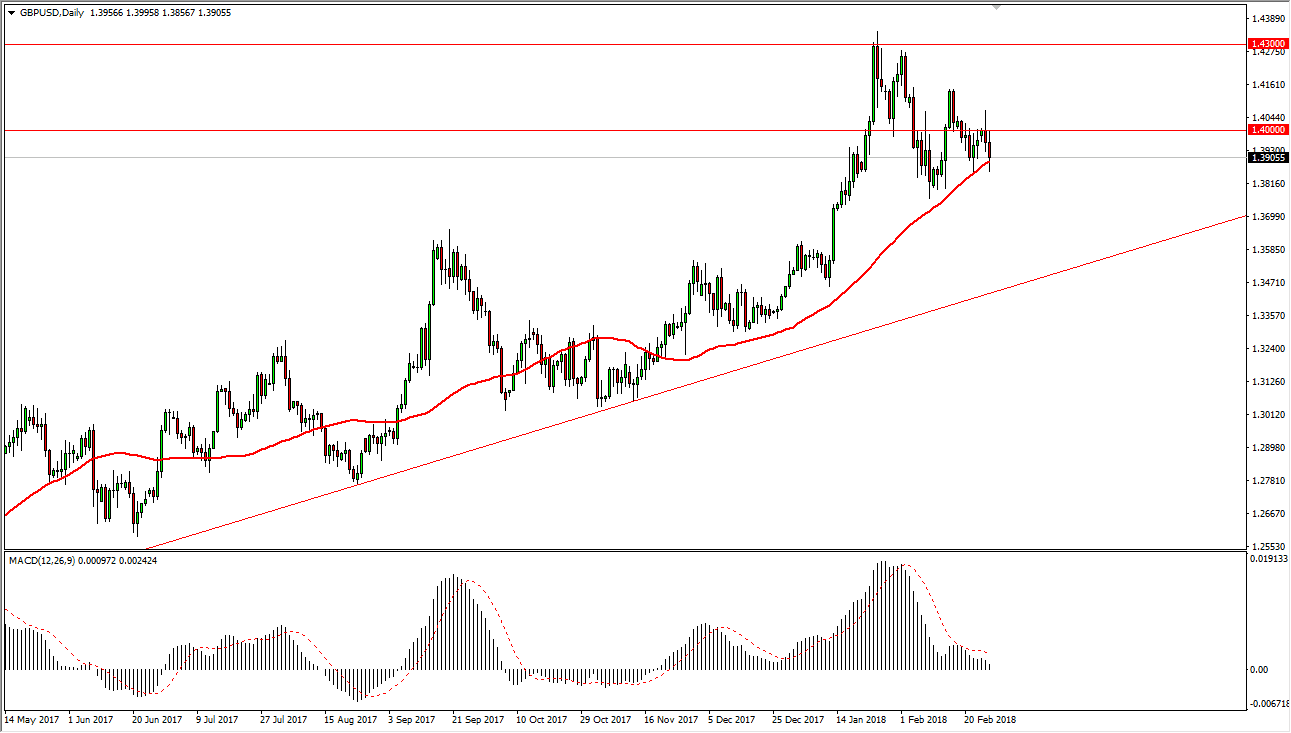

GBP/USD

The British pound went back and forth during the trading session on Tuesday, as we continue to see a lot of interest around the 50-day exponential moving average. I recognize that the 1.40 level above will be resistive, and I prefer to see this market break above the Monday highs, shattering the top of the shooting star, before I start buying. I think that the market will then go to the 1.43 level above, and then eventually break out above there and reach towards the 1.45 handle afterwards. I believe the pullbacks of this point should continue to find buyers, but we could need to draw back towards the uptrend line. At this point, I believe that simply waiting for some type of bounce or a move to the upside is probably the best way to go. I have no interest in shorting.