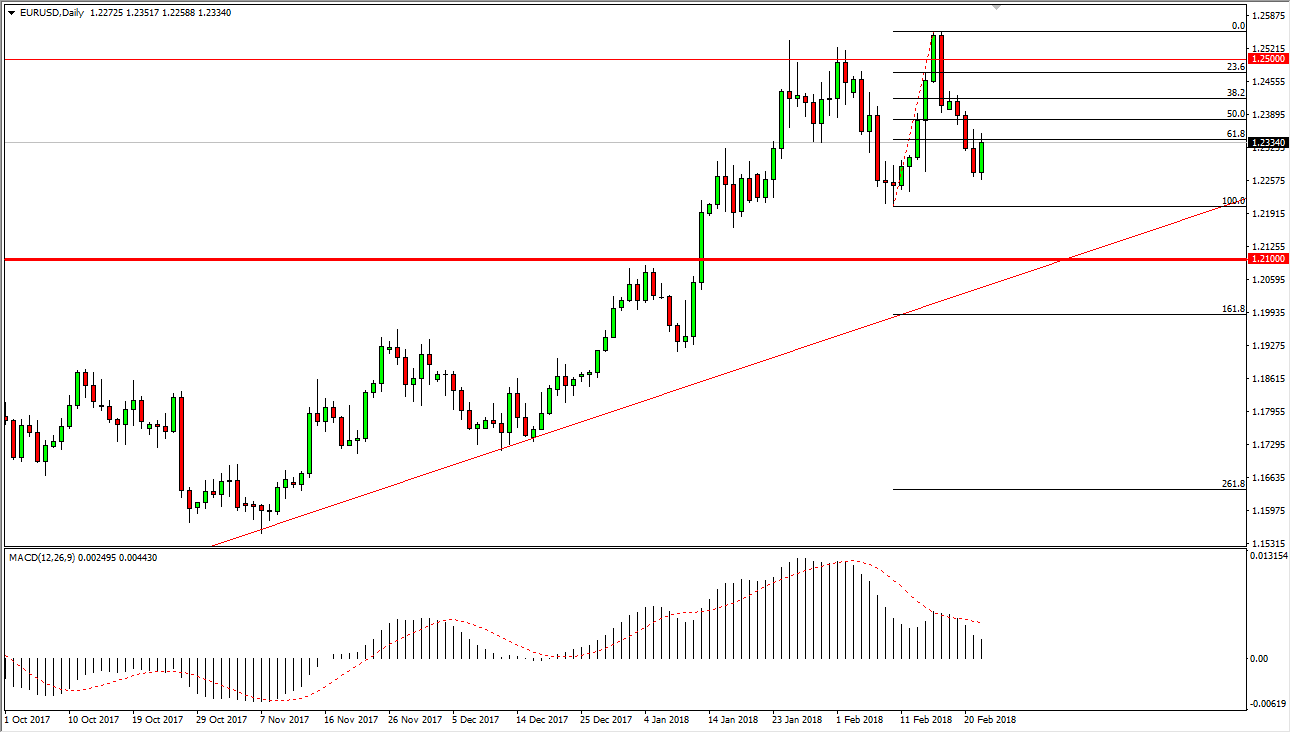

EUR/USD

The Euro rallied during the trading session on Thursday, bouncing from the lows that had been made on Wednesday. We are now wrestling with the 61.8% Fibonacci retracement level of the most recent move higher, an area that could bring out sellers as we have seen support there in the past. Ultimately, I think this market will eventually find buyers for the longer-term move, but right now looks as if we are probably going to grind sideways in general, making this a very difficult market to put a lot of money more faith in. I believe that the 1.21 level underneath will be the massive “floor” that the market needs, and that if we can stay above that level, then it is a “buy the dips” scenario. That being said, I think that you should have plenty of time to put your position to work, because quite frankly I don’t expect anything explosive the happen with this type of market.

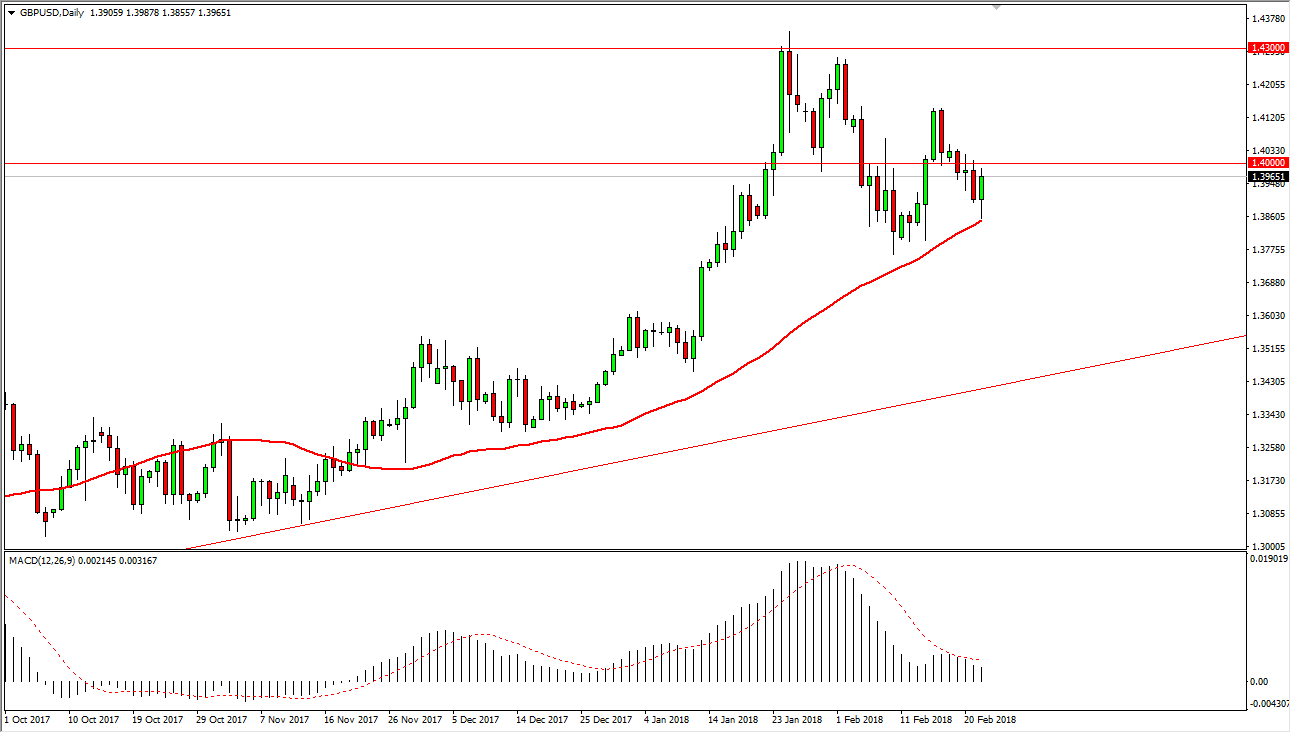

GBP/USD

Interestingly, the British pound drifted down towards the 50-day exponential moving average, only to turn around and bounce. It looks as if we are going to test the 1.40 level again, and if we can break above that level on a daily close, I feel that the buyers will come in and start pushing higher again. When I look at this chart, I recognize that we are in an uptrend, but the most recent high has fallen short of the previous one, which of course fell short of the one before that. Longer-term, I do think that we go higher, but I certainly also recognize that there is a lot of volatility just waiting to happen, so therefore I think we are going to go into a bit of a sideways grind as the world tries to figure out with the Federal Reserve is going to do next. During the session, the Federal Reserve member came out and said that the markets reading the FOMC minutes as being overly hawkish may have been wrong.