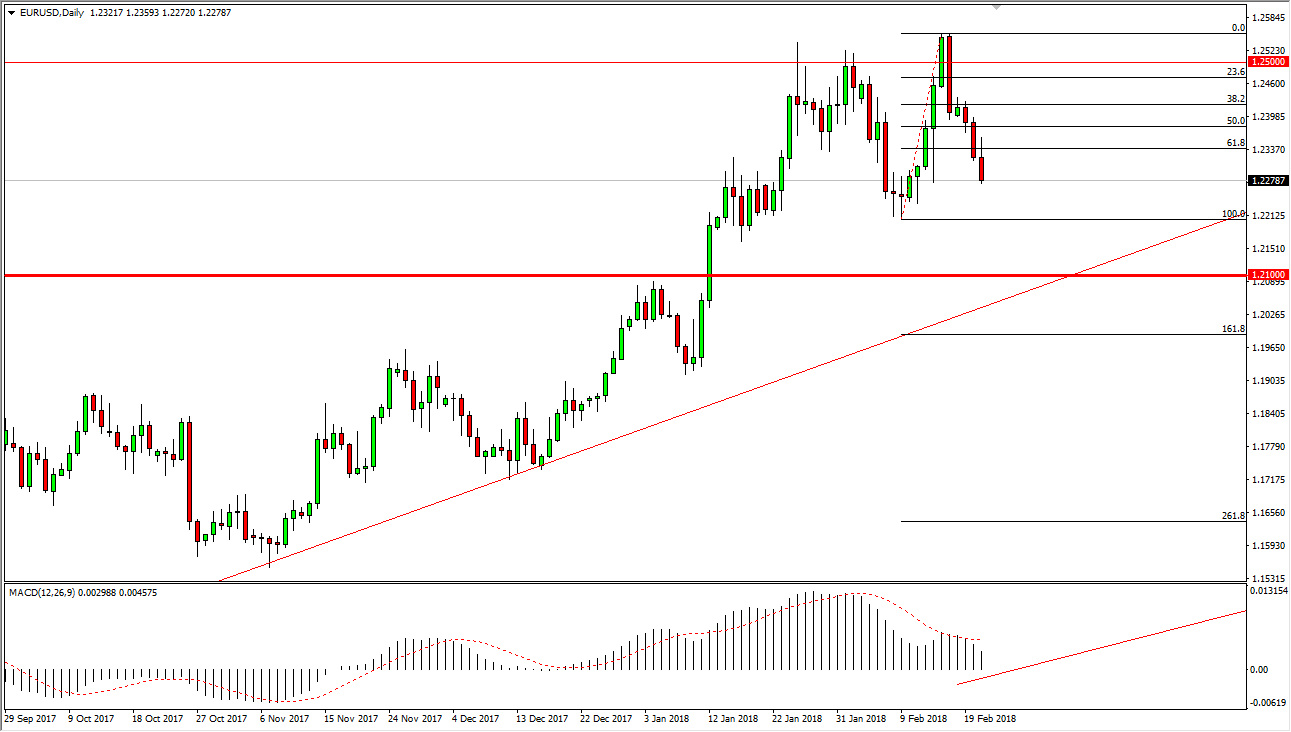

EUR/USD

The EUR/USD pair has rallied initially during the trading session on Wednesday, breaking above the 1.2350 level initially, before rolling over. A lot of the selloff has been due to interest rates rallying in the United States after the FOMC Meeting Minutes came out. This of course drives demand for the US dollar, and now I think we are going to see the market reach towards the 1.22 level again, which is the 100% Fibonacci retracement level. I believe that the 1.21 level underneath is the “floor” in the market, or at least the uptrend. The uptrend line is just below there as well, so I think that given enough time we will see buyers jump into this market, and I also believe that the value hunters will come out at that point. If we were to break down below the uptrend line, then that changes everything in the market could break down significantly.

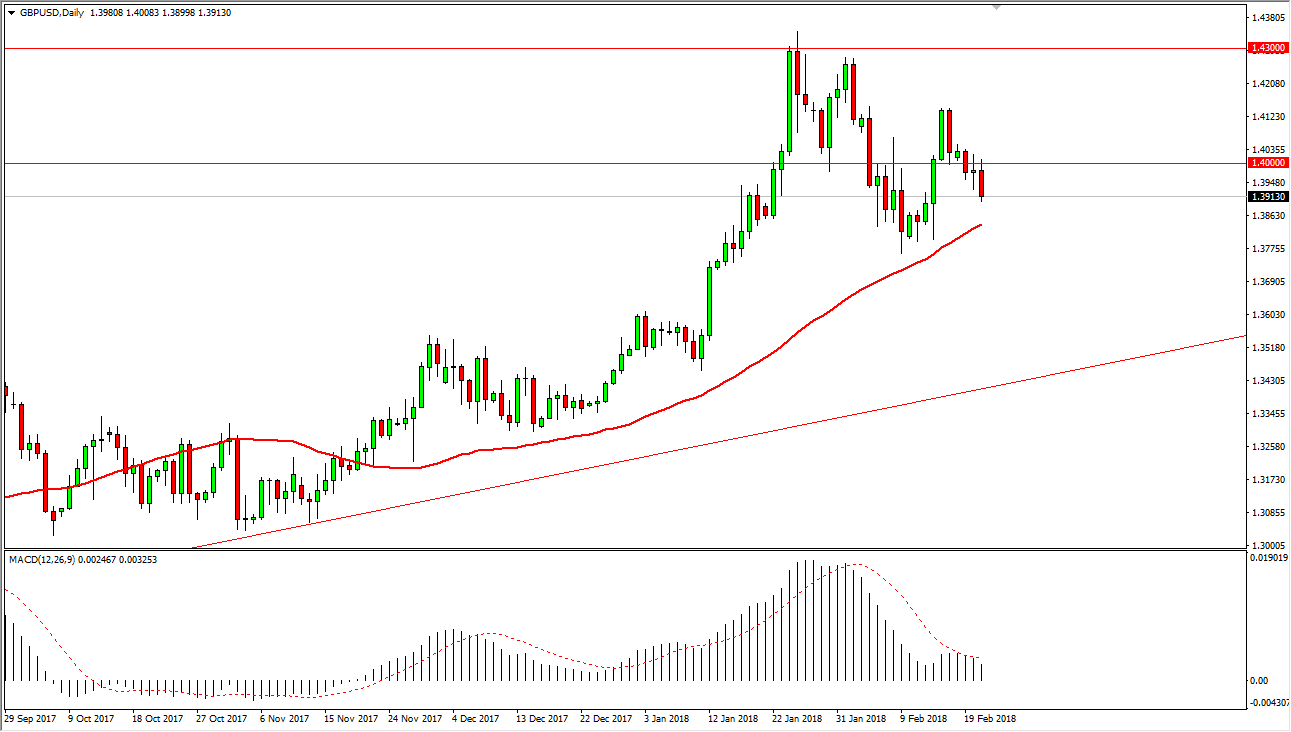

GBP/USD

The British pound market rallied a bit during the trading session on Wednesday, but then found the area above the 1.40 level to be far too restrictive to continue going higher. I believe that the market should continue to find plenty of buyers below, especially near the 50 EMA level. I believe that if we break above the 1.40 level, the market can continue to go higher. However, with yields rallying in the United States, that of course helps the US dollar. There is a nice uptrend line underneath, and that should continue to keep this market afloat longer term. I believe that the 1.43 level above is resistance, but ultimately it can be difficult to break above there, and perhaps extend to the 1.45 handle which is my longer-term target. However, I will be the first to admit that it looks as we are forming a “lower high”, so given enough time we could see a change. I think we’re in for a bumpy ride in the short term.