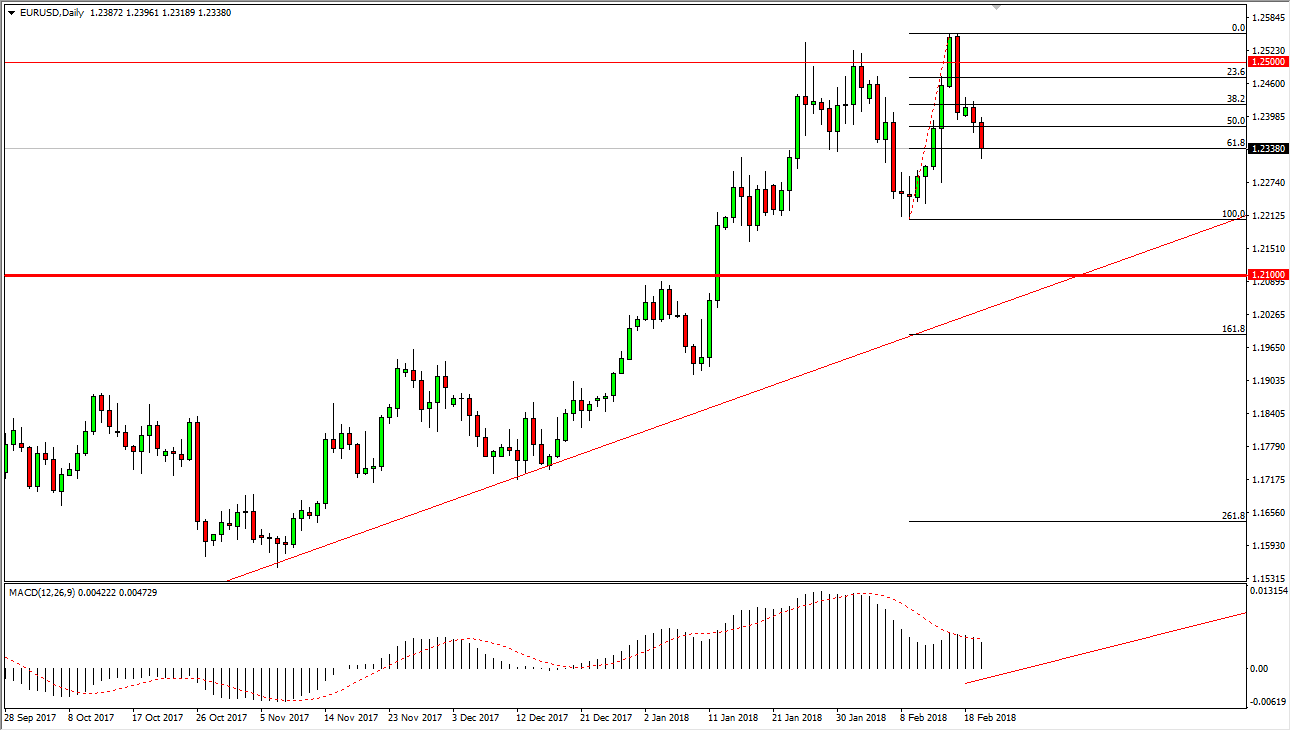

EUR/USD

The EUR/USD lost a significant amount of momentum after the initial rally on Tuesday, breaking down to the 61.8% Fibonacci retracement level of the most recent move higher. The market looks likely to continue to find buyers underneath, and I do believe that we eventually rally. In the meantime, I look at these little pullbacks as value, but I would be taken advantage of them in very small increments, as we obviously have a lot of volatility to contend with. Eventually, I do think that we break above the 1.25 level, but as you to take a certain amount of momentum building to accomplish this. Because of this I remain bullish but cautious, and I will be on the sidelines until I see the market prove itself a little bit.

GBP/USD

The British pound was very noisy during the trading session on Tuesday as well, as we continue to hover around the 1.40 level. I think this market is trying to find buyers underneath, and the neutral candle during the day on Tuesday is a good start. If we can break above the top of the range for the trading session I believe that we will then go looking towards the 1.41 level above, and then possibly the 1.43 level. A breakdown below the bottom of the candle sends this market looking towards the 50 EMA that I have marked on the chart, a common area of dynamic support. I believe that the British pound will continue to try to rally, and if you squint, you can make out an uptrend line that I don’t have marked on the chart. In other words, I do think that the buyers return, but we may need to drift around a little bit and build up confidence before we take off.