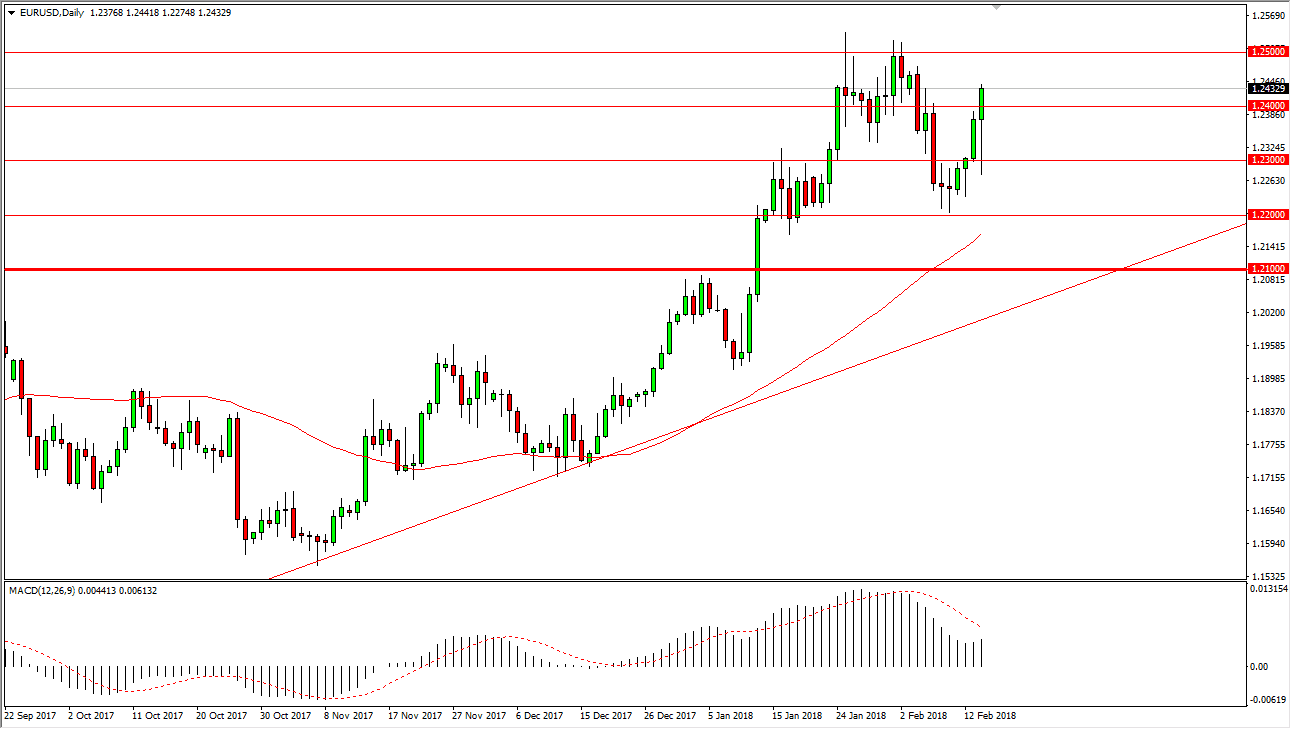

EUR/USD

The EUR/USD pair initially fell during trading on Wednesday, breaking below the 1.23 level. However, we found enough support underneath that level to turn the market around and send it reaching above the 1.24 handle. CPI numbers coming out of America were stronger than anticipated, and therefore there was a significant amount of US dollar buying during the day. However, buyers came in and picked up with a saw as value and the Euro, and we took off to the upside. I still see a significant amount of resistance at the 1.25 handle, so I think it’s going to take a couple of attempts to break above there. Regardless, this is an extraordinarily strong looking candle, and I think it’s only a matter of time before the break out in question does happen. At this point, I have no plans to sell and I think that the “floor” in the market has moved up to the 1.22 handle.

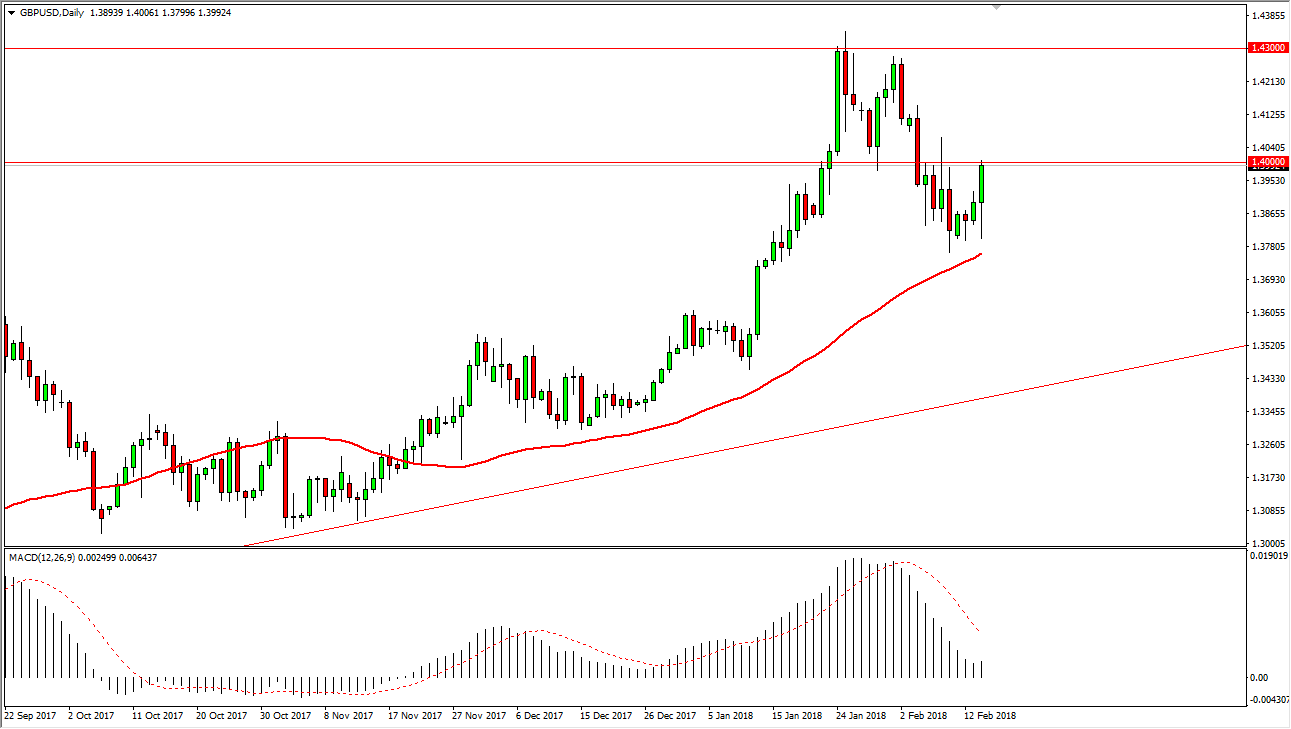

GBP/USD

The British pound initially fell as well but has found the 50-day EMA as support, sending the market higher. The market looks likely to continue to rally from here, reaching towards the 1.43 level over the longer term. It looks as if the uptrend continues, and that we are going to make a serious attempt to break above the 1.40 handle. The US dollar initially surged after the stronger than anticipated CPI numbers, but it’s obvious that traders are still looking to sell the greenback after Wednesday’s action. Buying on the dips continues to work, so I don’t see any reason and trying to fight that plan of action. In fact, I don’t have a selling scenario in this market, and I believe that we will eventually go looking towards the 1.45 handle, although that will be later this year.