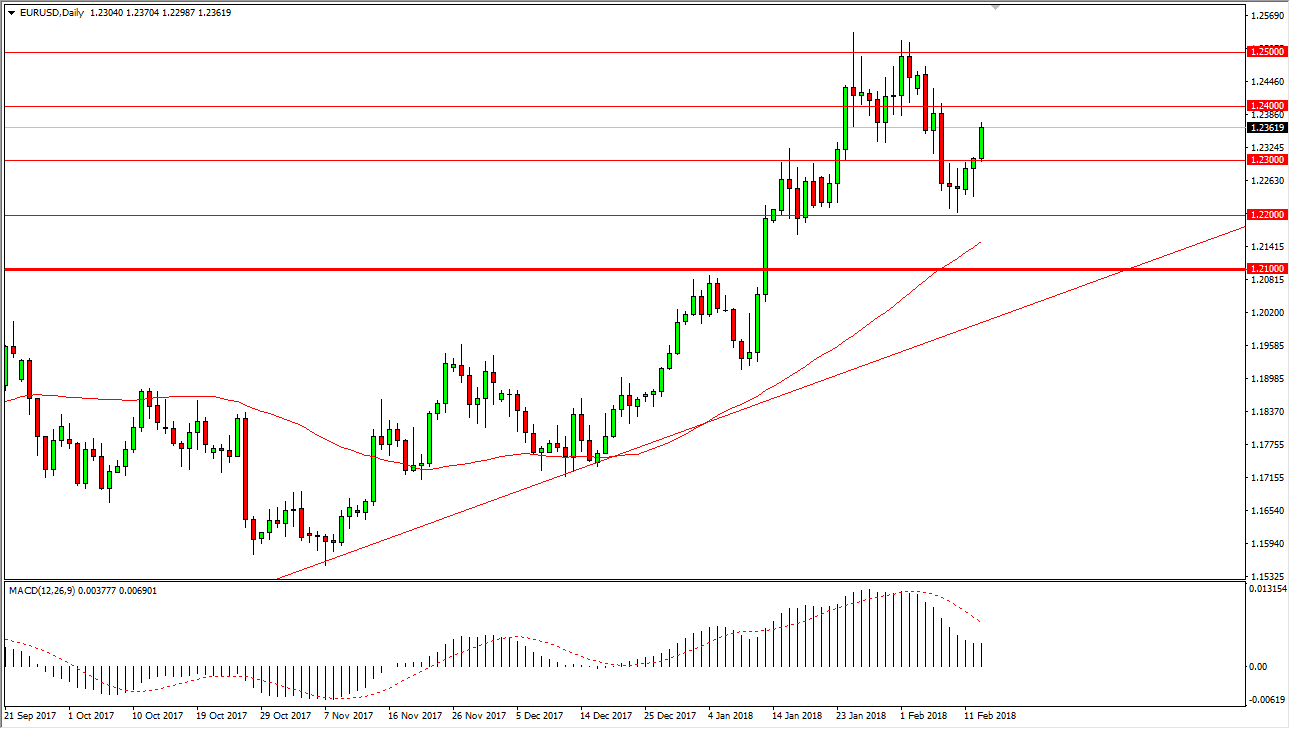

EUR/USD

The EUR/USD pair has rallied significantly on Tuesday, as we broke above the top of the hammer from Monday. It now looks as if we are ready to challenge the 1.24 level above, but there is a little bit of resistance so don’t be surprised if we get a short-term pullback. Longer-term, I believe that we will go looking for the 1.25 level again, but it is going to take some work. I believe that the 1.22 level is now offering a bit of a short-term floor, with the 1.21 level under there been even more important. Because of that, I believe that buying on the dips on short-term charts should continue to pay off, in shorting is all but impossible as the strength of the pair cannot be denied at this point. If we can break above the 1.25 level, it’s likely that we will continue to go even higher for a longer-term buy-and-hold type of situation.

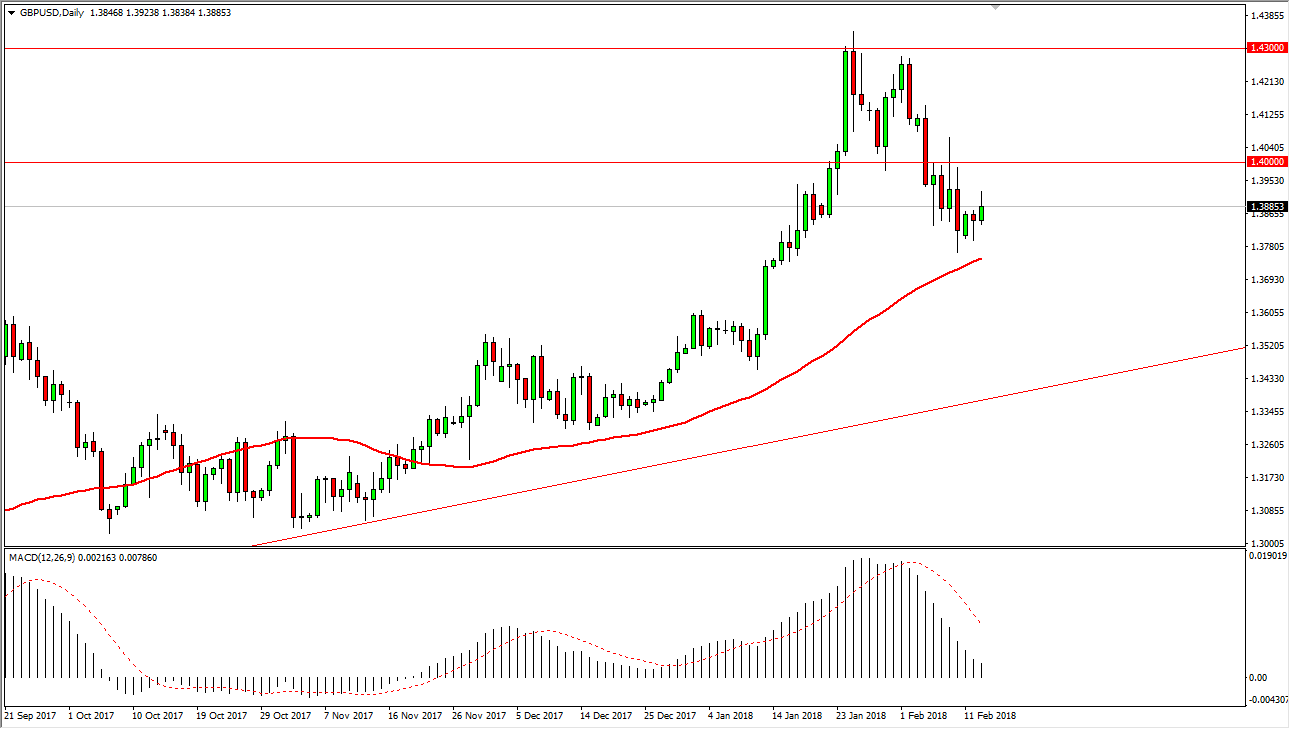

GBP/USD

The British pound rallied a bit during the day on Tuesday as well, reaching above the 1.39 level. It looks as if we’re going to try to continue to go higher, and the 50-day EMA looks as if it is offering support. If we can break above the 1.40 level, the market should continue to go higher, and that would have me looking for the 1.43 level again, which was the most recent high. I believe that the 50-day exponential moving average is going to continue to offer dynamic support, so therefore don’t have any interest in selling this market, especially considering that the US dollar itself looks a bit vulnerable going forward, while the British pound might be a major beneficiary of US dollar weakness. Ultimately, I think we not only go to the 1.43 level, but we continue to go even further than that.