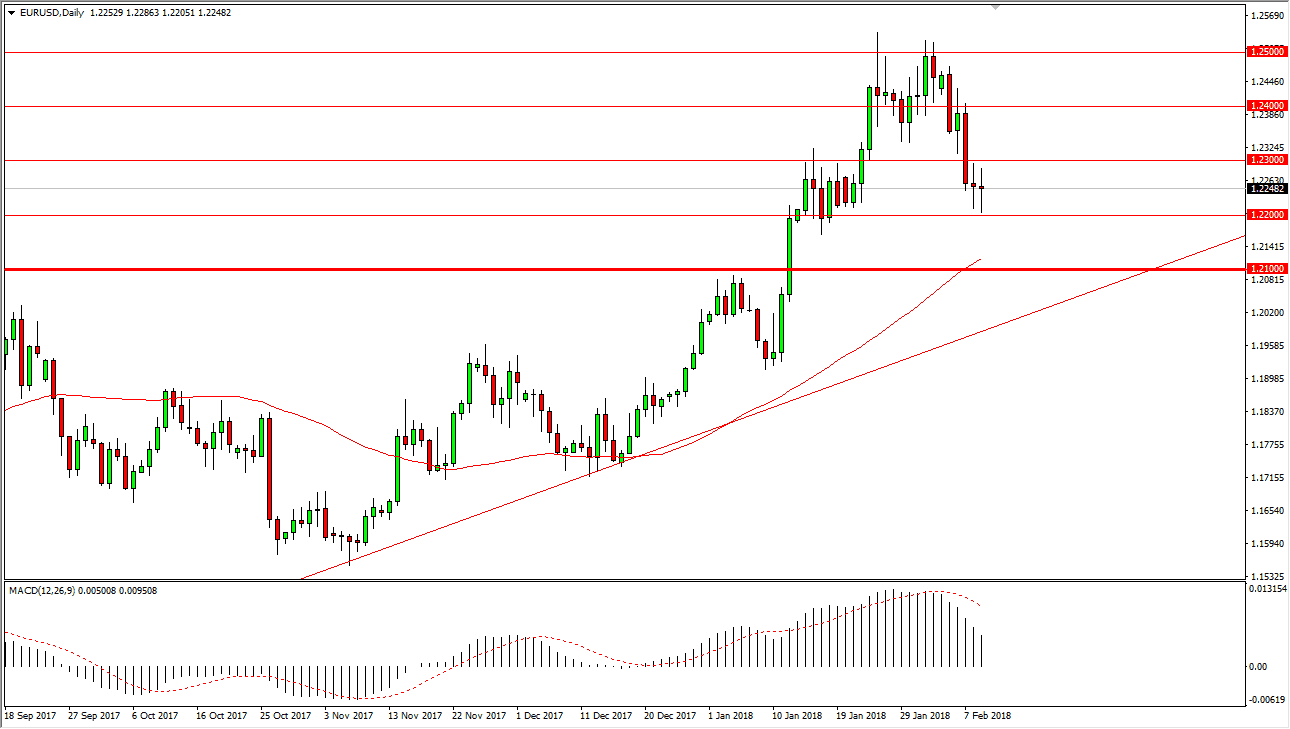

EUR/USD

The EUR/USD pair went back and forth during the trading session on Friday, showing volatility yet again. Just as we did on Thursday, we ended up with a neutral candle, using the 1.22 level as support. We also have resistance at the 1.23 level, so I think that if we can break above there, the uptrend will continue. For what it’s worth, the 50 EMA is just below at the 1.21 handle, the scene of a major breakout. I believe it is only a matter of time before the buyers return, and the uptrend continues. In fact, I think there is enough support to make an argument for buying as low as 1.20. The uptrend line underneath would need to be violated for me to consider shorting. I look at this as a market that is offering value at the lower levels.

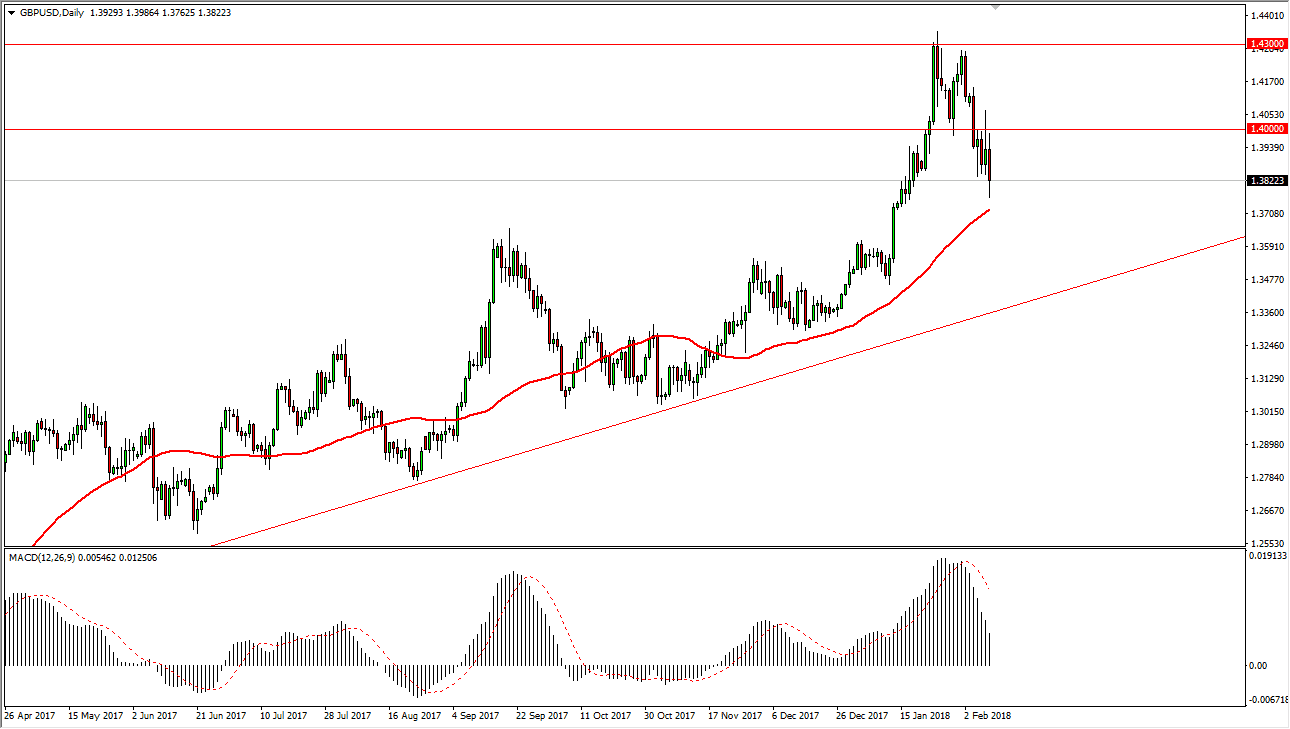

GBP/USD

The British pound has rallied a bit during the trading session on Friday to test the 1.40 level, but we found sellers there again. By pulling back towards the 50-day EMA, it looks as if the buyers could return rather soon, and I think that there is a massive support level at the 1.3650 level. Longer-term, I believe that a move above the 1.40 level would be very strong, sending this market towards the 1.43 level. That’s an area that has been massive resistance, so I think we can break above there the market will go much higher, perhaps targeting the 1.45 handle. Ultimately, this is a market that I think is a “buy on the dips” situation, but patience will be needed to continue to see profits. I have no interest in shorting, I believe that the British pound is trying to break out longer-term as well.