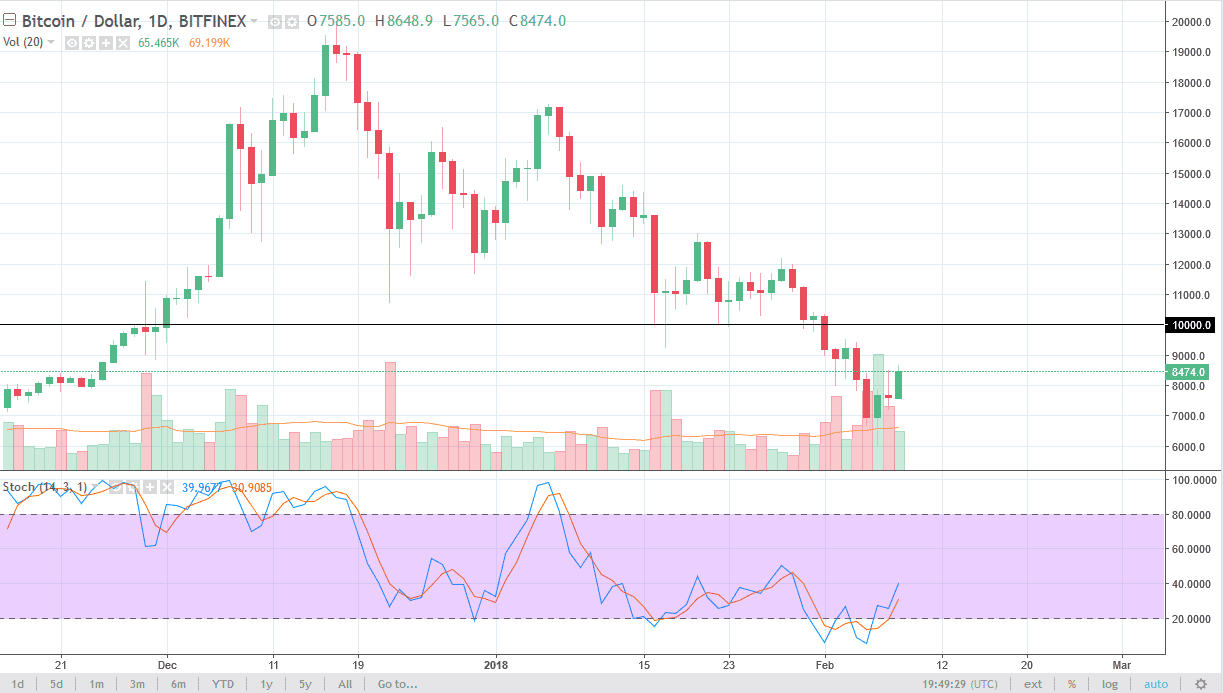

BTC/USD

The Bitcoin market has rallied a bit during the trading session on Thursday, reaching towards the top of the shooting star from Wednesday. While a very positive sign, volume is a bit light, so I think at this point waiting until we can clear the $10,000 level might be the smart move. I would also like to see another high-volume candle like we had a couple of days ago, as it shows conviction. I suspect we will probably try to form some type of base around this level, meaning that we will probably bounce around over the next several sessions. If we were to roll over and break below the $7000 level again, that would be a very negative sign. I also believe that most retail traders have been spooked by what has just happened.

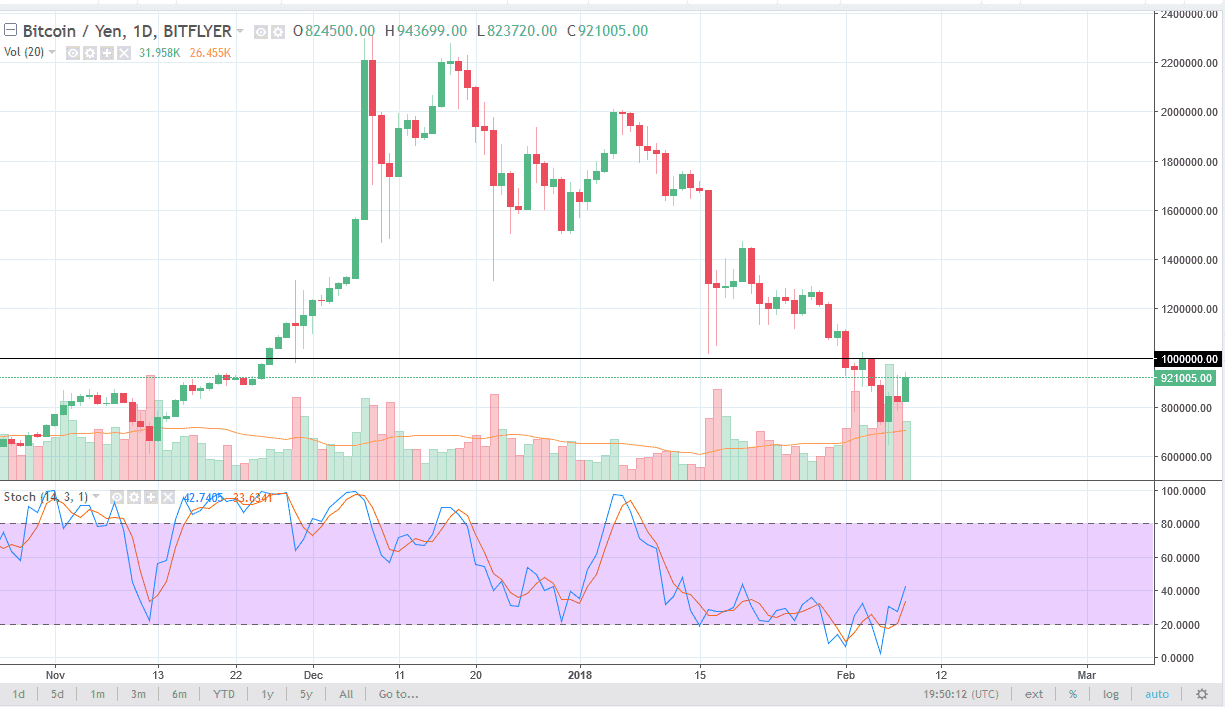

BTC/JPY

Bitcoin also rallied against the Japanese yen and just like against the US dollar, is threatening the top of the shooting star from the previous session. I think that the 1 million level should be resistive, and I think at this point if we can break above there the market should continue to go even higher, perhaps reaching towards the ¥1.25 million level next. This is an area that I think could have a lot of resistance, and as a result I am a bit hesitant to get involved. However, I do recognize that if this market rally significantly, then Bitcoin should do well against the US dollar. Remember, 40% of Bitcoin trading is done in Japan, but is also done with high leverage. In other words, while the chart looks horrible of the last couple of weeks, the losses are much worse than it appears. I suspect the average retail trader in Japan has lost a lot of money.