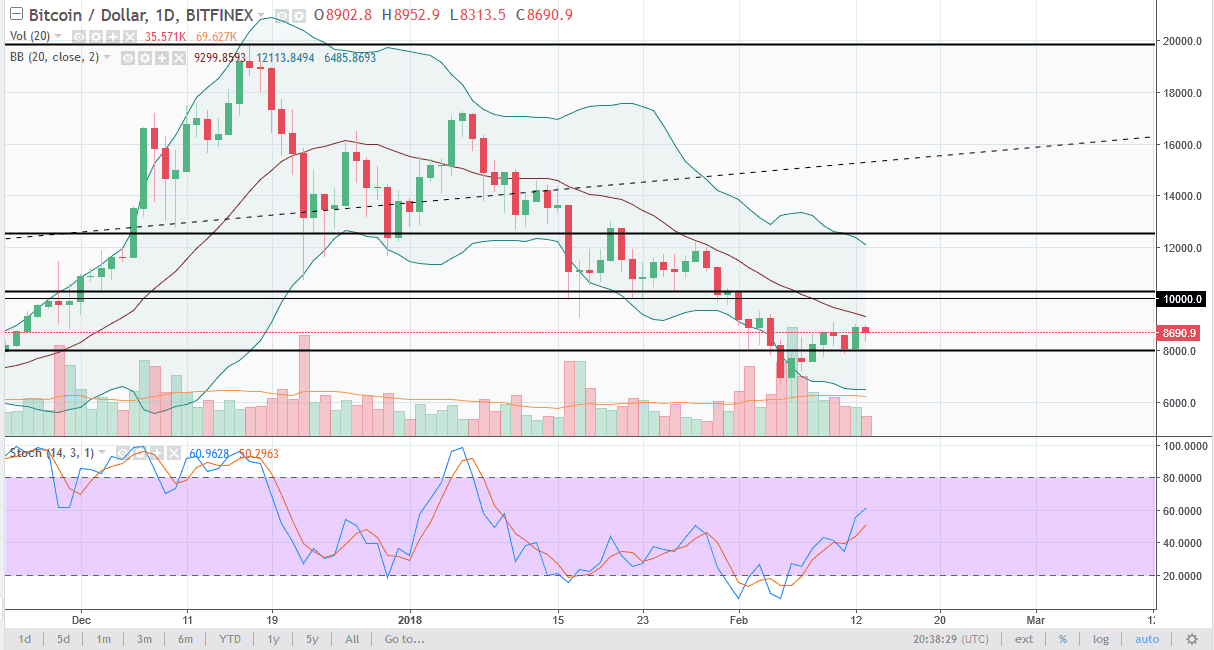

BTC/USD

Bitcoin markets fell during most of the session on but as you can see have turned around to form a bit of a hammer which of course is a bullish sign. I think there is a lot of resistance above though, and it’s not until we clear the $10,000 level that I feel a true statement has been made. At this point, volume is very low, and that isn’t exactly the most positive of factors. However, if we were to close above $10,000 on a daily candle, then I would more than likely look at this as a market that can be bought again. In the meantime, I anticipate that rallies will probably get a bit of a push back, and I think that the market needs to consolidate more than anything else. Quite frankly, the more we consolidate the more confidence we can build in what probably has been a very shocking turn of events for most retail traders.

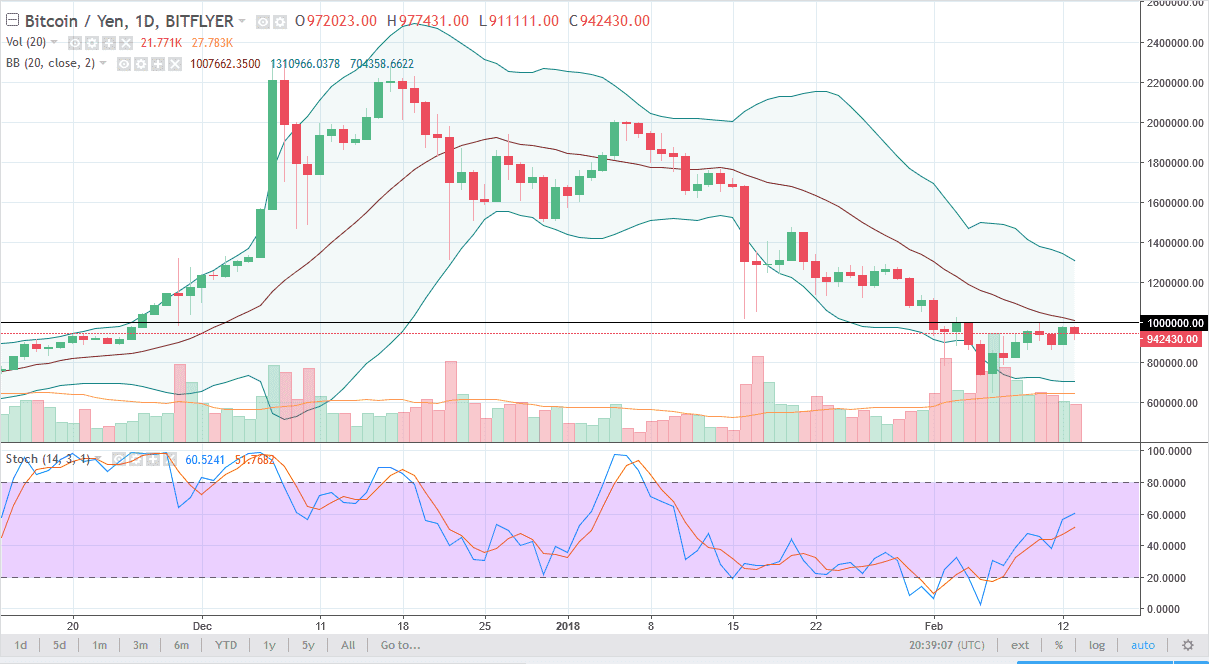

BTC/JPY

Bitcoin also fell against the Japanese yen, struggling at the ¥1 million level. However, it looks as if the buyers have come back, trying to turn things around and rally. If we can break above the ¥1 million level, I think we will probably go looking towards the ¥1.2 million level, which should also be resistive. I think given enough time, if we can break above there, especially if there’s volume involved, the market could go much higher. It looks as if we are trying to form some type of bottoming pattern, and this is the market you should be paying the most attention to as 40% of Bitcoin trading is done in Japan. If this market rallies, it’s a healthy sign for the rest of the Bitcoin markets. Obviously, it works in both directions.