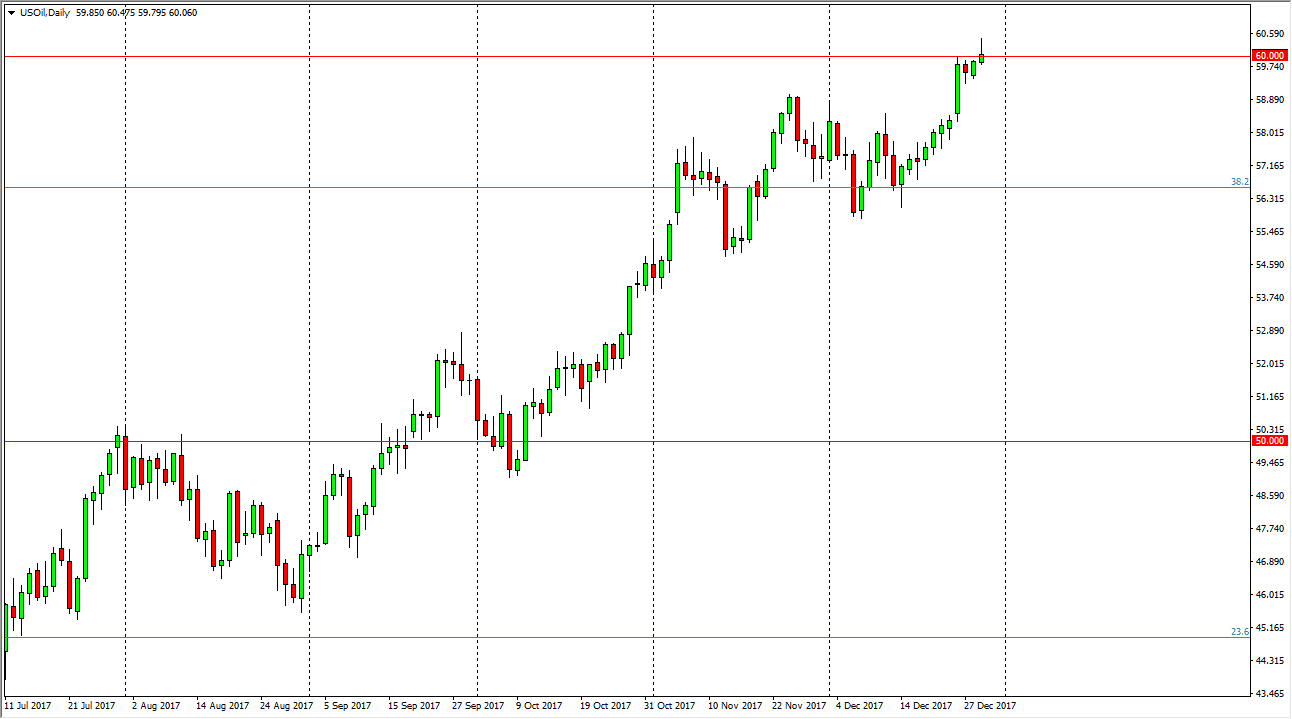

WTI Crude Oil

The WTI Crude Oil market rallied during the day on Friday, and what would have been very thin trading. I think that the thin trading environment will continue to be an issue for the next couple of sessions, and as a result traders were not able to hang on to gain as much be the $60 handle. That’s not a huge surprise, and I think that we may see the market go sideways in general over the next couple of sessions. I do believe that eventually the buyers get involved and push higher, so it would not surprise me to see the $62.50 level be targeted between now and the end of the week. Pullbacks to the $58 level are very possible though, as we try to build up the necessary momentum to continue.

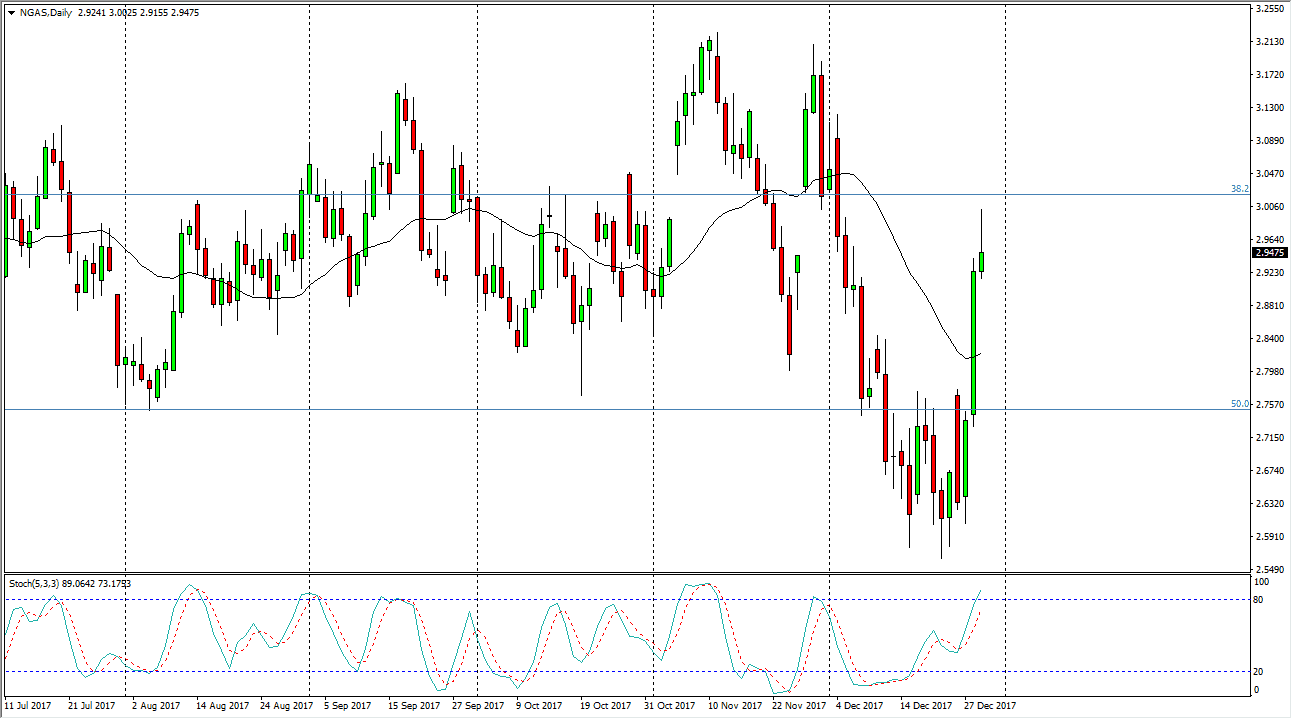

Natural Gas

Natural gas markets rallied rather significantly during the trading session on Friday, but turned around to form a shooting star. This is essentially what I have been waiting for, signs of weakness in the market after this overdone rally. A break below the bottom of the daily candle would have me shorting this market, as we should then go looking towards the $2.75 level. I think that the natural gas markets continue to be soft in general, and the recent reaction was due to a serious lack of volume and the inventory number coming in exactly where they had anticipated it, something that hasn’t happened much lately. I believe that the $2.75 level will be a bit supportive, so I’d be willing to take profit there. Longer-term, we can break down below there, but at the end of the day the one thing that I can say about this market is I don’t want to buy it.