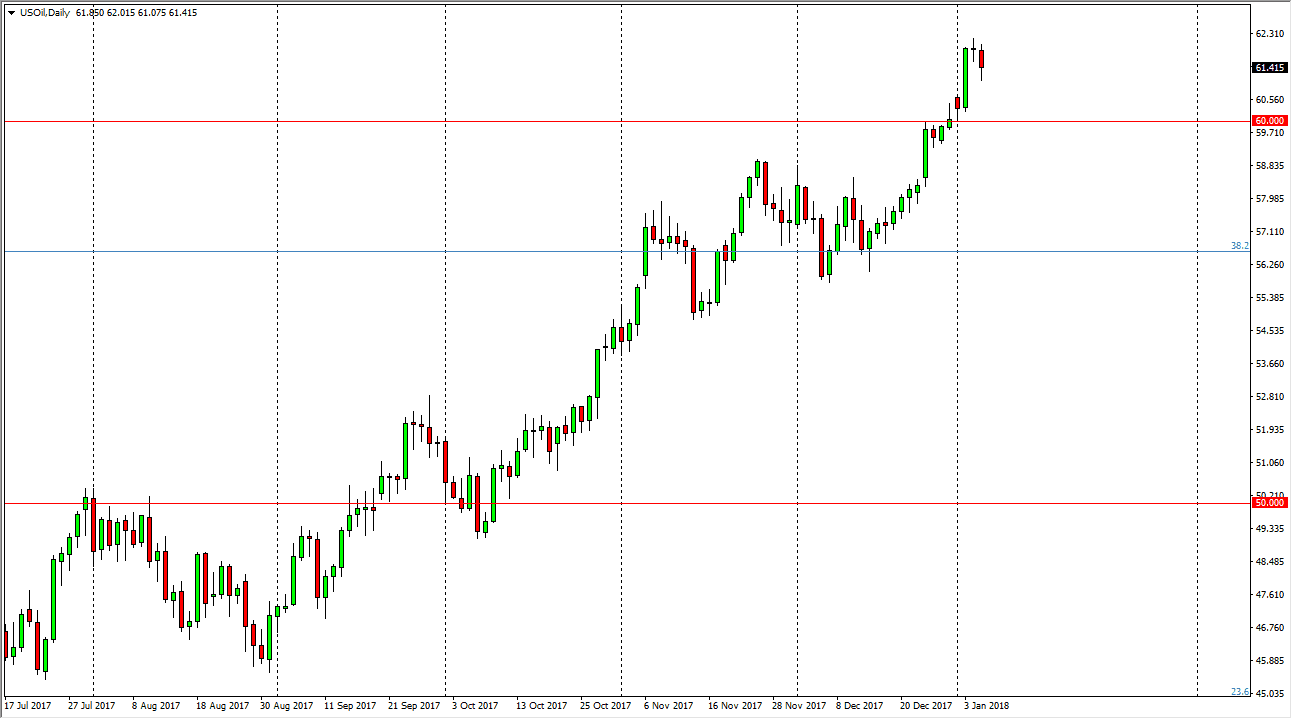

WTI Crude Oil

The WTI Crude Oil market fell significantly during the trading session on Friday, but turned around and bounced a bit to show signs of life. After the recent breakout above the $60 level, I think this pullback is probably necessary to find more buyers, and I think that the buyers are going to continue to push to the upside. It’s not until we break down below the $59 level that I’m willing to sell this market. That’s not to say that it will be noisy, of course it will be but there are a lot of competing factors right now that will make this market choppy. OPEC and Russia are cutting back production of course helps the price, but at the same time were starting to see Cheryl producers in North America crank up their production. So, I believe that we will get choppy but slightly positive momentum over the next several sessions.

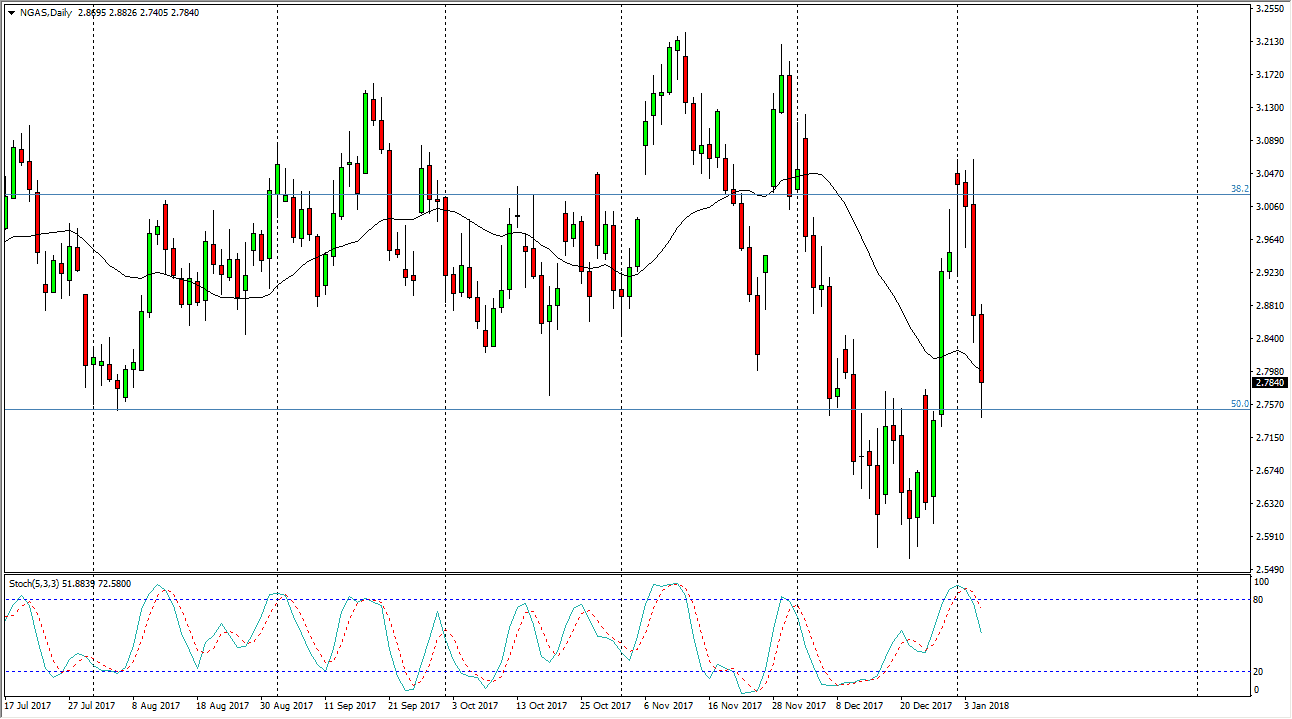

Natural Gas

Natural gas markets fell significantly during the trading session on Friday, reaching towards the $2.75 handle. Because of this, the market did find buyers as it is an area where you would expect a lot of noise, based upon previous price action. However, if we break down below the lows of the session, the market probably goes down to the $2.60 level. I think at this point we will probably see rallies from this area, but those rallies should show signs of exhaustion that we can take advantage of and start shorting again as natural gas markets have not been able to hang on the gains in what is traditionally the most bullish time of the year. That of course is a very negative sign, and I think it shows just how dire the situation is.