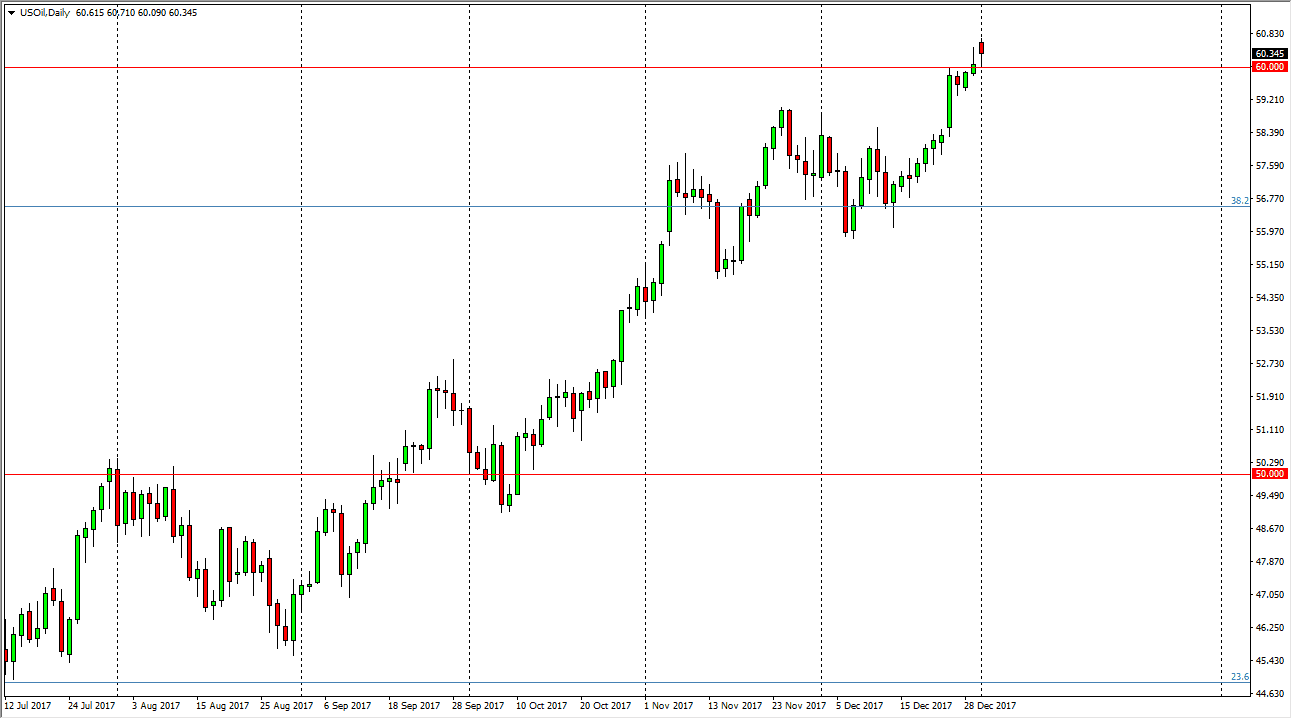

WTI Crude Oil

The WTI Crude Oil market initially gapped higher at the open during the trading session on Tuesday, but then pulled back significantly towards the $60 handle. By doing so, the market looks likely to continue to go much higher, as we have formed a bit of a hammer. The hammer of course is a bullish sign, so it looks likely that we will continue to reach towards the $62.50 level. That’s an area that has been important more than once, when looking at the longer-term charts. I believe that if we were to break down below the $59 level, that would be a very negative sign but right now that doesn’t look very likely to happen. Riots in the streets of Tehran continue to cause concerns as well as a soccer US dollar. Because of this, it looks as if the least in the short term, oil should rally.

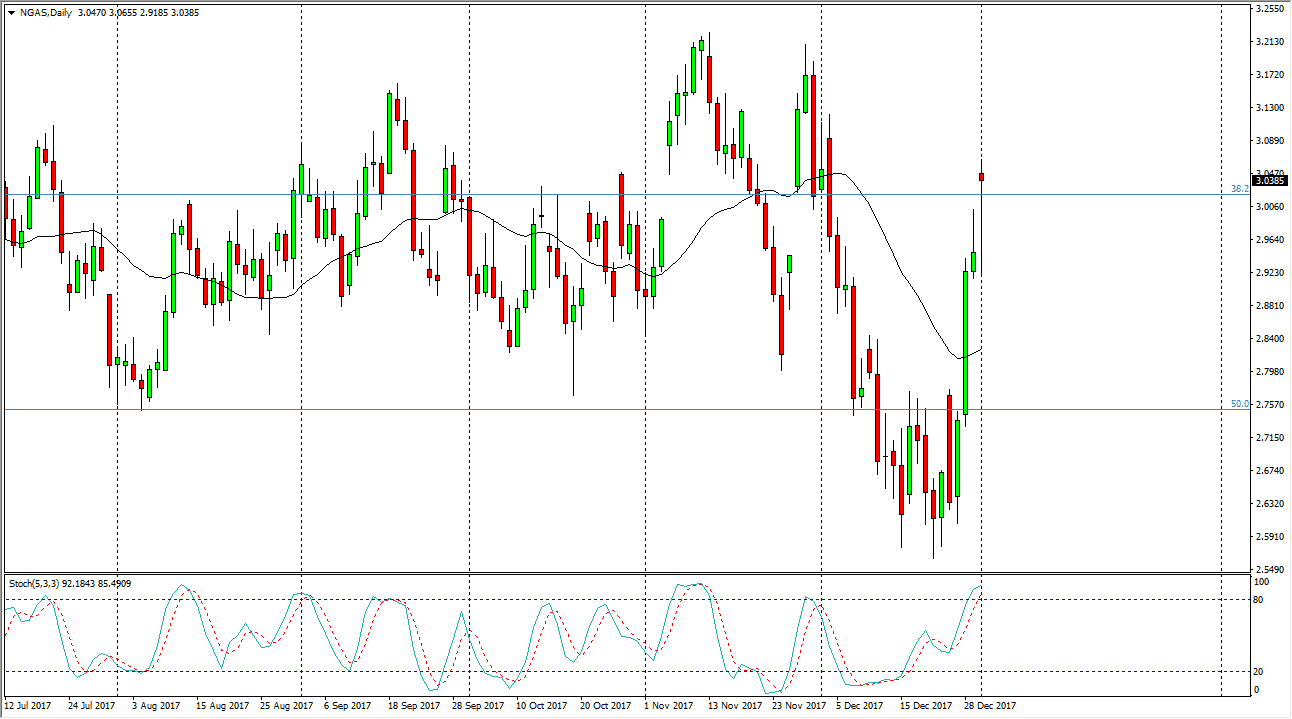

Natural Gas

Natural Gas gapped higher at the open on Tuesday, but then fell to fill that gap. By doing so, we found plenty of buyers underneath, and then ended up forming a bit of a hammer. The hammer of course is a bullish sign, and I think if we can break above the top of that the market will probably go looking towards the $3.10 level, or perhaps even the $3.20 level. The markets continue to be very volatile, but we are extraordinarily overbought, so I think that the markets will eventually give us an opportunity to start shorting. On signs of exhaustion, I plan to do just that. However, I think that the markets not been able to hang on the gains for significant amount of time should give us an opportunity to short eventually. I’m standing out-of-the-way currently.