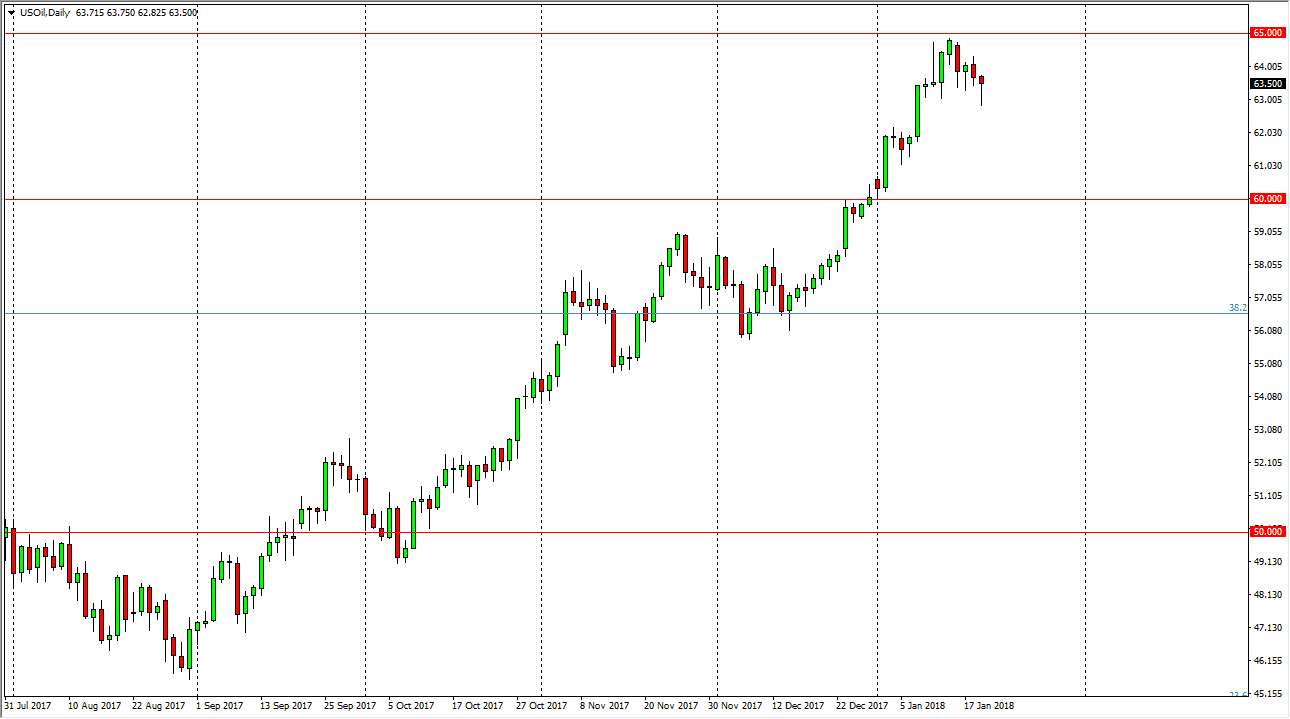

WTI Crude Oil

The WTI Crude Oil market fell a bit during the session on Friday, but found enough support at the $63 level to turn around and form a hammer for the daily candle. That’s a very bullish sign, and I think it shows that we are trying to reach towards the $65 level yet again, and perhaps trying to build up enough momentum. If we can break above the $65 level, we can go much higher. However, I think it will continue to be very volatile, but with an upward bias. If we break down below the $63 level, then we probably look for support again at the $62 level, possibly even the $60 level. If the US dollar falls, that could offer a bit more in the way of bullish pressure in this market as well.

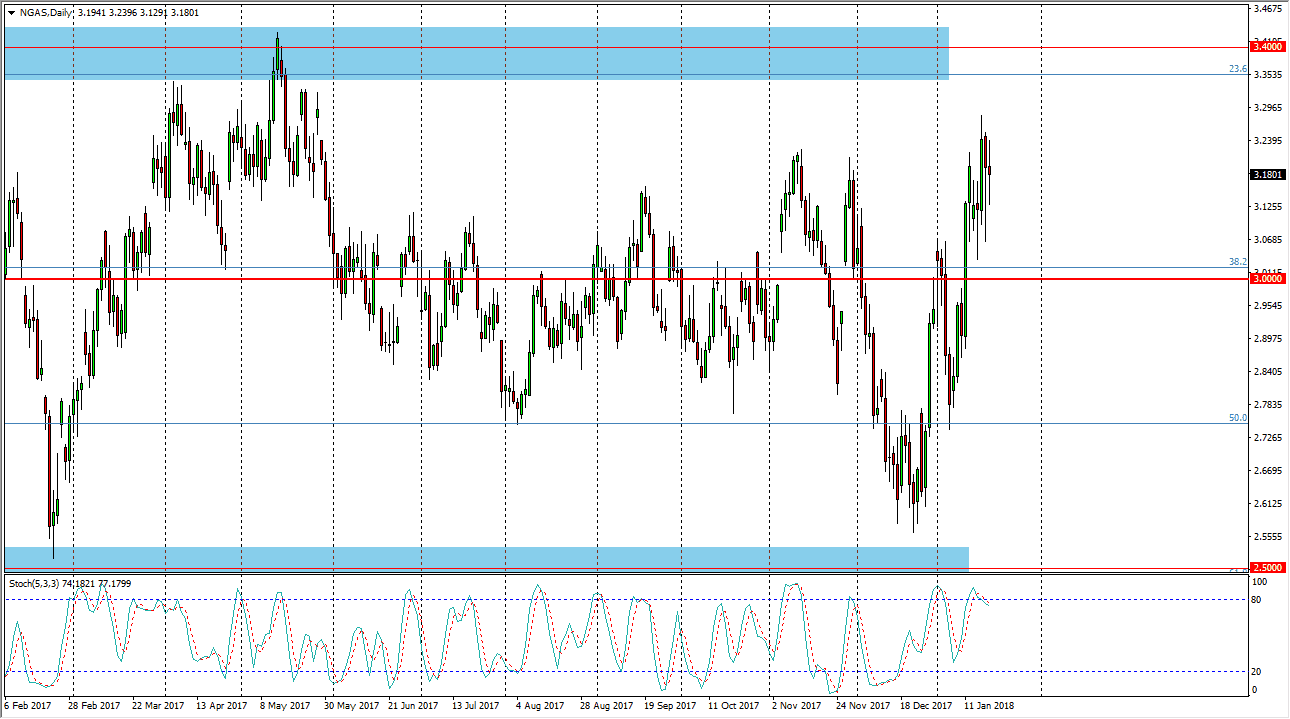

Natural Gas

Natural gas markets went back and forth during the trading session on Friday, ultimately in the forming a neutral candle. I believe that the neutral candle signifies that we are running out of steam, and the stochastic oscillator has not only reach the overbought condition, but it has already crossed over. That tells me that the market is more than likely ready to roll over, and it makes sense structurally as there has been a massive amount of resistance and noise just above. I believe that the resistance extends to the $3.40 level, and we are starting to see temperatures rise in the United States next week, which will bring down some of the demand, but more importantly: allowed drillers to start extracting natural gas from the ground again. Ultimately, most of the bullish case for natural gas is a short-term phenomenon, so I think it’s only a matter of time before we roll over.