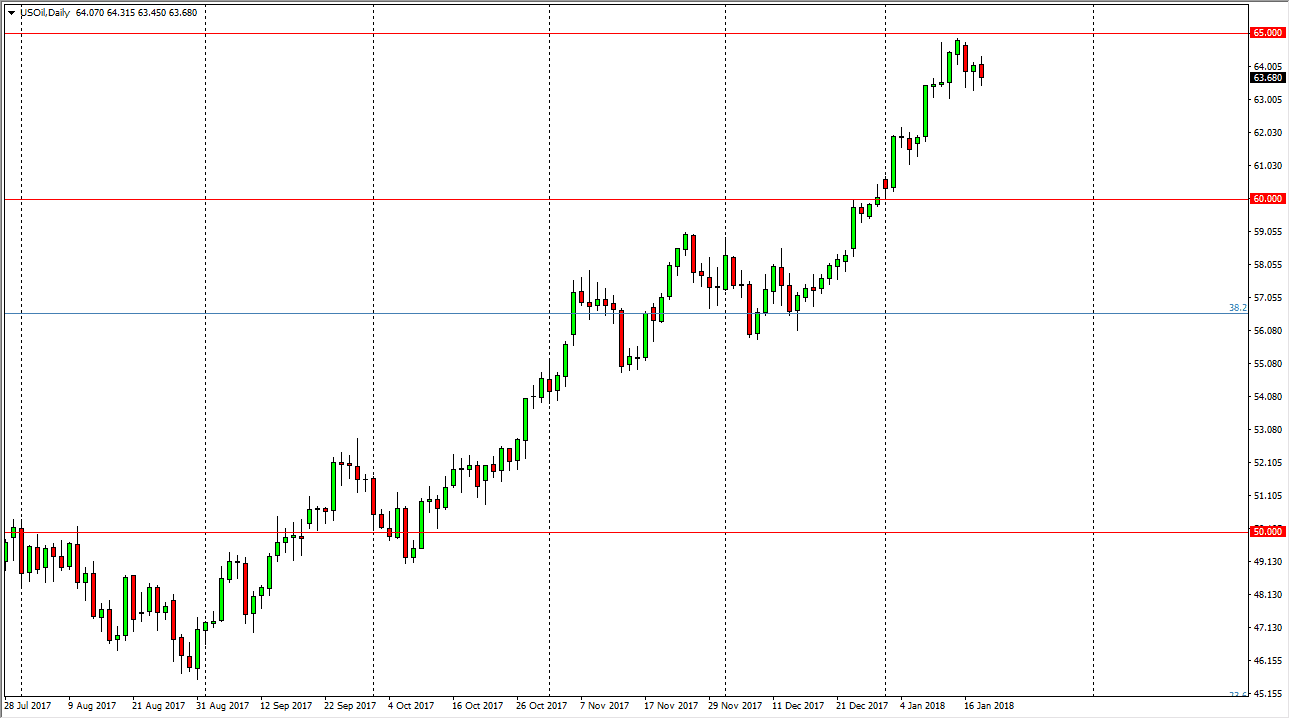

WTI Crude Oil

The WTI Crude Oil market was slightly negative during the session on Thursday, but I still believe that there is a significant amount of support underneath which will continue to push this market to break above the $65 level. The oil production of Venezuela is falling apart as the country drifts into crisis, so it’s likely that we will continue to go higher based upon the falling supply. I think that a break above the $65 level should send this market higher, perhaps to the $67.50 level. In the meantime, if we were to break down below the $63 level, the market could go down to the $60 level next. I expect a lot of volatility, but this market should continue to be noisy to say the least. The US dollar falling of course has helped as well.

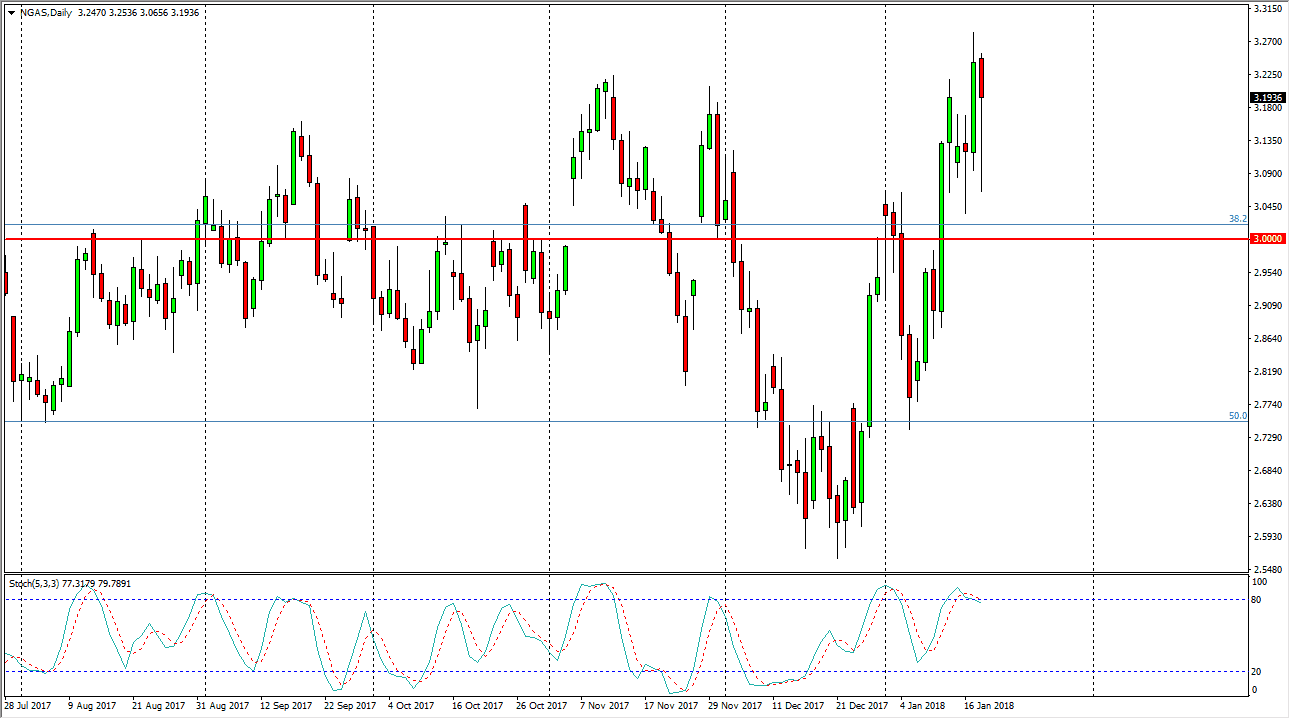

Natural Gas

The natural gas markets fell significantly during the day on Thursday, reaching down to the $3.05 level. Ultimately, I think that we are going to continue to go much lower, but it’s obvious that we have some fighting to do. There is extensive resistance to the $3.40 level, and of course natural gas is oversupply longer term. Recently though, the cold temperatures in the United States have not only increased demand for natural gas, but have made it impossible for many fracking companies to get the energy out of the ground. Sooner or later, and quite frankly in the next few days, we are going to see slightly warmer temperatures. Because of this, it’s likely that the market will eventually turn around, and we are essentially at the peak season of natural gas pricing. It’s only a matter of time before we get a reason to short. Right now though, I don’t see it. Be patient, opportunity should present itself.